Table of Contents

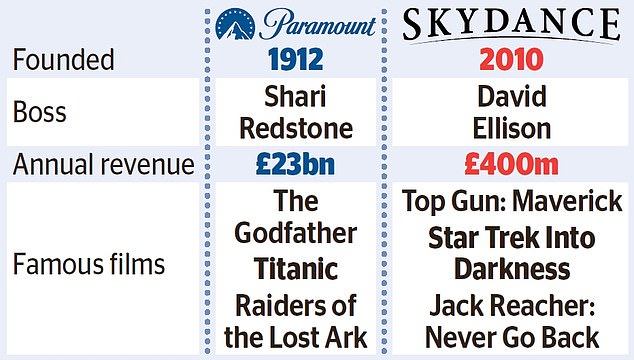

Paramount Global, one of Hollywood’s oldest companies, has agreed to merge with independent film studio Skydance Media, marking the “end of an era” for the movie giant.

Paramount chairwoman Shari Redstone, 70, is selling her family’s majority stake in the newly formed company’s business, which is estimated to be worth £22bn.

Paramount, whose hits include Titanic and The Godfather, has been part of the Redstone empire for the past three decades.

It worked on Top Gun: Maverick with Skydance.

Paramount, founded in 1912, was purchased in 1994 by Shari’s late father, Sumner, who built a global media empire out of his father’s drive-in chain, National Amusements.

Tie-in: Paramount worked on the 2022 blockbuster Top Gun: Maverick, starring Tom Cruise (pictured), with Skydance

In addition to the film studios, Paramount owns television networks such as CBS, as well as Comedy Central, Nickelodeon and MTV.

Skydance Media is an independent film studio founded in 2010 by billionaire David Ellison, son of Larry Ellison, one of the richest men in the world with a fortune of £124 billion, who founded the software company Oracle.

Skydance is backed by US private equity groups including RedBird Capital, which abandoned a joint bid with the UAE government to buy the Telegraph newspaper group in April.

As part of the deal, Skydance will pay £1.9bn to buy National Amusements, which controls Paramount.

It will also invest around £6.2bn in the newly formed company, including £1.2bn to help pay down debt.

Ellison, 41, will become chairman and CEO of the new Paramount.

He said: “This is a defining and transformative moment for our industry and for the storytellers, content creators and financial stakeholders who invest in Paramount’s legacy.”

The deal caps a tumultuous period for the company since merger talks began in late 2023.

In April, former Paramount boss Bob Bakish resigned following allegations of tensions with Redstone.

Adding insult to injury, Redstone last month called off advanced talks with Skydance, saying the two sides had been unable to reach mutually acceptable terms.

But last week, Skydance and Paramount appeared to do an about-face: Redstone was reportedly eager to close a deal, seeing it as the best option for her family and the company’s legacy.

In addition to Skydance, Redstone has also held talks with Japanese technology company Sony and private equity group Apollo about possible partnerships.

Redstone said: ‘Given the changes in the industry, we want to strengthen Paramount for the future while ensuring that content remains king.

Our hope is that the Skydance transaction will enable Paramount’s continued success in this rapidly changing environment.”

Redstone inherited the business in a succession-style battle after his father died in 2020.

She had initially been nominated as his successor, but spent years arguing with her father to get the job after they fell out.

They managed to resolve their bitter dispute before he died. Analysts believe the new owners will breathe life into the company, which has struggled in recent years due to streaming services, declining TV viewing figures and a debt spiral of around £11bn.

This has put pressure on stocks, which have fallen by around 77 percent over the past five years.

Paolo Pescatore, media analyst at PP Foresight, said the merger was “the end of an era” for the group, but also an opportunity.

He added: “A new owner means a necessary change of thinking and approach.”

AJ Bell analyst Russ Mould said: “Investors will be hoping Skydance can bring some new shine to the wider Paramount group.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you