Table of Contents

Mortgage rates are set to fall again tomorrow after three major banks announced they will cut home loan costs.

This morning, HSBC, NatWest and Barclays confirmed a wave of rate cuts that will benefit house-movers, first-time home buyers and mortgage refinancers.

NatWest, which was the first to announce cuts, said it would reduce mortgage rates by up to 0.19 percentage points on selected two- and five-year fixed-rate products.

Most notably, it is cutting its lowest rate for a five-year fixed loan from 3.89 per cent to 3.77 per cent, with a product fee of £1,495.

HSBC is also cutting rates on its five- and two-year fixed-rate bonds, although it will not reveal specific details until tomorrow.

>When will interest rates fall?

Price war: NatWest, HSBC and Barclays started the month with a wave of mortgage rate cuts as banks battle for customers

Meanwhile, Barclays announced a raft of rate cuts, including a sub-4 per cent fix aimed at people remortgaging and a 3.95 per cent offer for home buyers with a 25 per cent deposit.

Craig Fish, director of Lodestone Mortgages & Protection, told Newspage: ‘It’s only the first business day of the month but lenders are working flat out.

‘There are already good reductions from several lenders this morning, and more lenders are likely to join in.

‘As the nights get darker, this is a bright sign that the housing market is about to rebound in time for the fall.’

What will this mean for borrowers?

From tomorrow, NatWest’s lowest five-year fixed rate for someone buying with a 40 per cent deposit will be 3.77 per cent, with a product charge of £1,495.

On a £200,000 mortgage repaid over 25 years, that would equate to £1,033 a month.

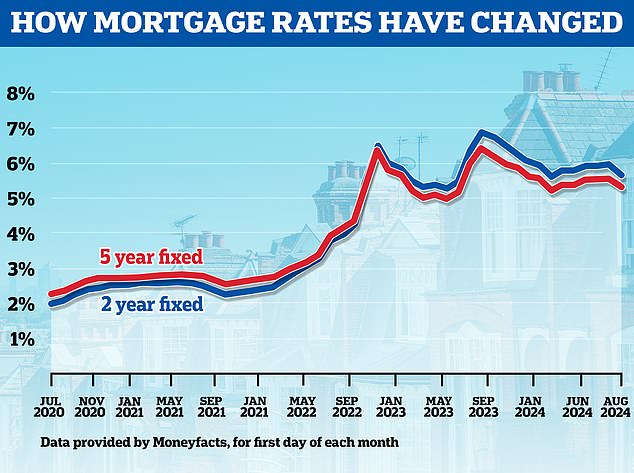

To put that into context, the average five-year fixed rate across the market is currently 5.2 per cent, according to rates watchdog Moneyfacts.

Someone getting the average interest rate on a £200,000 mortgage repaid over 25 years would pay £1,193 a month.

NatWest’s lowest two-year fixed rate for home buyers will drop to 4.14 per cent from tomorrow and comes with a £1,495 per product fee.

This market-leading rate is available to home-movers with a 40 per cent deposit and is well above the two-year fixed market average of 5.56 per cent.

Ranald Mitchell, director of Charwin Mortgages, believes NatWest’s latest wave of rate cuts will help revive the housing market.

“NatWest’s latest rate cut is another clear sign that mortgage lenders are doing everything they can to revive the housing market,” Mitchell said.

‘Lenders are competing fiercely to offer the most attractive deals and real momentum is now building.

‘This wave of rate cuts is a positive step towards finding that sweet spot where consumer confidence returns and the housing market gets back on track.

‘It’s an exciting time for potential buyers, affordability is improving and the window of opportunity is wide open.’

From tomorrow, NatWest and Barclays will also offer five-year fixed-rate mortgage refinancing deals below 4 per cent for those with larger amounts of capital.

NatWest’s lowest five-year fixed rate will be 3.92 per cent with a fee of £1,495, while Barclays will charge 3.93 per cent with a fee of £999.

Barclays is also offering a rate of 4.07 per cent to those who remortgage their home and have at least 25 per cent equity.

As for home buyers, those with a 15 per cent deposit will be able to get a rate of 4.45 per cent from tomorrow free of charge.

Rohit Kohli, director of The Mortgage Stop, told news agency Newspage: ‘The good news continues as Barclays makes further rate cuts, especially in the 85 per cent loan-to-value tranche.

‘The sentiment among lenders is clearly that these rate levels are here to stay for a while longer and, provided there are no inflation shocks next week, borrowers should act quickly.

‘These ongoing cuts are quickly turning the situation into a seller’s market and prices could begin to rise rapidly.’

What will happen to mortgage rates?

Mortgage rates have been falling in anticipation of interest rate cuts.

Since the beginning of July, the lowest five-year fixed mortgage rate has fallen from 4.28 percent to 3.77 percent.

Meanwhile, the lowest two-year fixed rate fell from 4.68 percent to 4.12 percent during that period.

Nicholas Mendes, mortgage technical manager at broker John Charcol, said: ‘Prior to today, competition between lenders had shown signs of easing slightly as they sought to manage their channels and strike a balance between winning business and maintaining service levels.

The Bank of England is likely to hold rates this month, although the Federal Reserve is expected to cut.

‘With inflation expected to remain slightly above its comfort level, the committee will likely take a wait-and-see approach, recognizing that the impact of the earlier tapering on inflation will not be immediate.

‘While rates are projected to fall later this year to around 4.75 percent, a more significant reduction to 4 percent may not occur until 2025.

‘Despite the likely hold this month, we can expect continued tightening and a narrowing of fixed rates between purchase and refinancing operations.

‘In addition, building societies and smaller lenders may reduce their rates as major lenders soften their competitive behaviour compared to recent weeks.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.