Spirit Airlines has announced a revamp of its fare options, marking a significant departure from its usual one-way fare offerings.

The ultra-low-cost carrier said it would begin selling a variety of premium tickets that come with perks such as larger seats, priority check-in, snacks and Wi-Fi.

Spirit will also sell tickets that include a checked bag, a key benefit that customers previously paid extra for.

The airline, known for its rock-bottom fares but for charging travelers a host of extra fees, will introduce the new fares starting in August.

This comes as the struggling airline seeks to boost revenue amid pressure from larger rivals that are increasingly leveraging its premium offerings.

Spirit Airlines has announced a suite of new fare options, marking a major departure from its usual no-frills offerings.

The Florida-based airline will offer four categories of service, it announced Tuesday.

However, he did not give details on the price breakdown of each tariff.

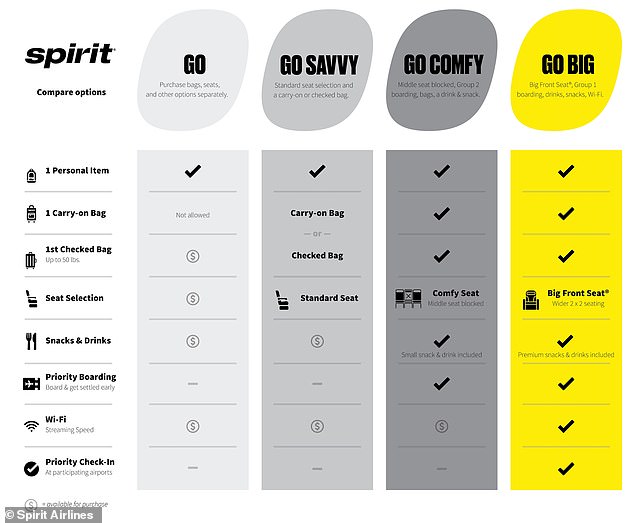

Customers will be able to book the new fares, called ‘Go Big’, ‘Go Comfy’, ‘Go Savvy’ and ‘Go’, starting August 16.

The ‘Go Big’ option includes a ‘Big Front Seat’, snacks and drinks, a carry-on bag, a checked bag, among other benefits.

The large front seat offers increased comfort with wider seats, extra legroom, extra seat padding and no center seat, the company said in a news release.

This fare will be advertised as a traditional business class product and is designed to compete with what is offered by higher-end airlines such as American Airlines, Delta Air Lines and United Airlines.

‘Go Comfy’ offers a guaranteed blocked middle seat, one carry-on and one checked bag and ‘Go Savvy’ includes the choice of one carry-on or one checked bag and standard seat selection during booking.

The ‘Go’ fare will offer a personal item on board and allow customers to purchase checked bags, seat selection, Wi-Fi, snacks and beverages.

This fare will offer “the greatest affordability for those who want to keep it simple,” the airline said, staying true to Spirit’s economy model.

The company said it aims to have all new offerings on flights by August 27.

“We’re ushering in a new era in Spirit’s history and taking low-cost travel to new heights with enhanced options unlike anything we’ve offered before,” said Ted Christie, Spirit’s president and CEO.

“We listen to our guests and are excited to offer them what they want: options for a superior experience that are affordable and provide unparalleled value.”

The airline announced earlier this year that it would waive fees for changing or cancelling a flight.

Previously, those fees ranged from $69 to $119, depending on how close to the flight the change was made.

The Florida-based airline will offer four new service categories, it announced Tuesday.

A ‘big front seat’ is one of the benefits offered by the ‘Go Big’ fare option

As part of the changes, Spirit also announced it was revamping its boarding process and introducing priority check-in for select customers at some airports beginning next month.

Spirit’s new fares are more like what you’d find on a major network airline than one of the country’s big budget carriers.

“That’s intentional,” Christie said. The boy with the pointsHe said these are the fare packages travelers expect to buy today.

“We’re reacting to what the market is telling us about what’s important. Spirit is moving as quickly as possible to deliver those products to its people.”

Spirit isn’t the only low-cost airline making major changes.

Southwest Airlines, which is also under pressure to boost revenue, announced earlier this year that it plans to offer “premium” seats with more legroom, and Frontier Airlines also began offering blocked middle seats at the front of the plane for a higher price in March.

Jungho Suh, assistant professor of management at George Washington University’s Graduate School of Business, told… Washington Post Spirit’s decision makes strategic sense, but it comes with risks.

“It’s risky to dilute their brand identity, which is geared toward budget travelers,” he said.

The airline is under pressure to boost revenue amid investor fears it could file for Chapter 11 bankruptcy following a failed merger with JetBlue earlier this year.