The property market is recovering according to Zoopla, with an increase in the number of buyers and sellers resulting in more sales this month.

It reported that house prices were down 0.5 percent year-on-year, although it said this was higher than the recent low of -1.4 percent it recorded in October 2023.

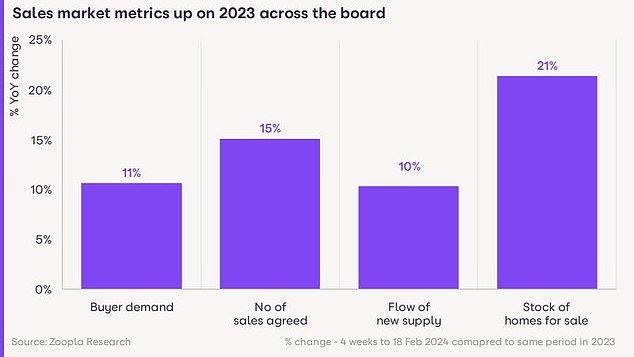

Zoopla said there are currently 11 percent more buyers on the market than a year ago, while the number of agreed sales increased 15 percent year-on-year.

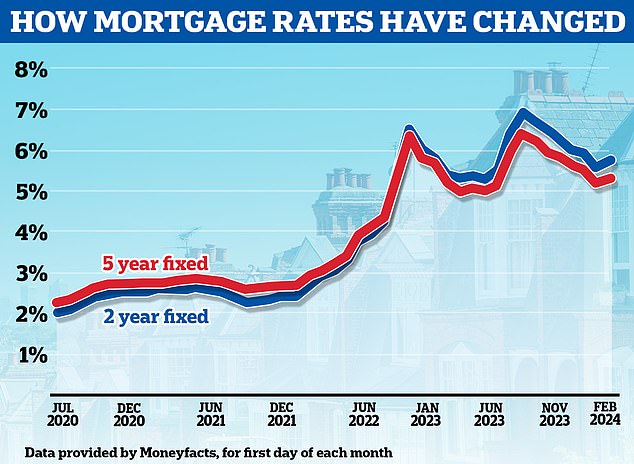

This follows falling sales volumes in 2023, when many people put moving plans on hold amid a volatile mortgage market where average two-year fixed rates hit highs of 6.86 per cent.

Warming up? Zoopla reported that buyer demand is 11% higher than a year ago, while the number of agreed sales increases 15% year-on-year

HMRC figures suggest transactions fell by 20 per cent over the year.

According to Zoopla, the first two months of 2024 have shown evidence of increased buyer confidence and “realistic” prices from sellers.

Additionally, he said there were 21 percent more homes on the market than a year ago.

However, although activity is picking up in the market, he does not expect prices to rise this year.

Currently, the average real estate agent closes six new sales a month, up from 5.2 a year ago.

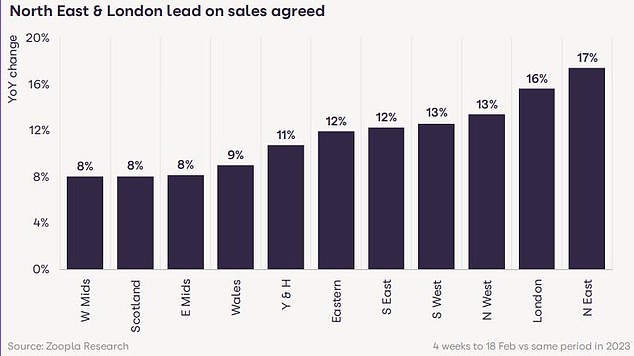

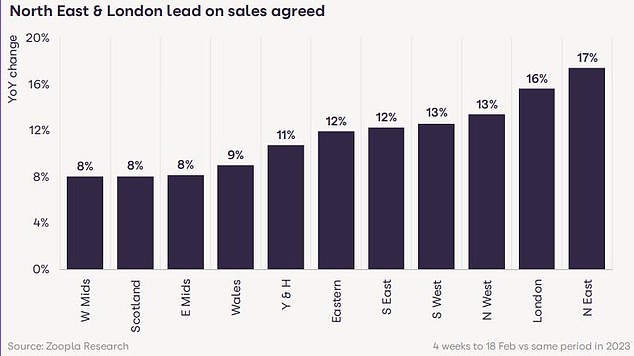

Zoopla reported that the North East of England and London led the sales rebound with volumes increasing by 17 per cent and 16 per cent respectively.

However, Zoopla claims that this is not simply a “new year” phenomenon and that sales market momentum has been growing over the past five months.

After a quiet 2023, its experts believe the market is on track to achieve 10 percent more sales this year, which will reach a total of 1.1 million.

Richard Donnell, CEO of Zoopla, said: ‘The housing market has proven very resilient to higher mortgage rates and cost of living pressures.

‘More sales and more sellers show growing confidence among households and evidence that mortgage rates of 4 to 5 per cent are no barrier to improving market conditions.

“While sales are expected to increase, we do not expect house price growth to accelerate further in 2024.”

What is happening with house prices?

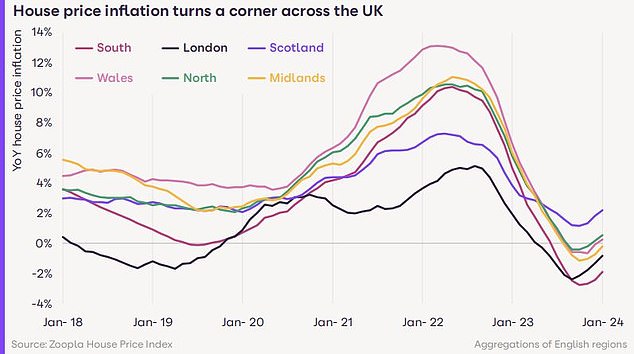

Zoopla says it continues to see a slowdown in the pace of price declines.

House prices are currently down just 0.5 percent year-on-year, down from a recent low of -1.4 percent in October 2023.

The average house price is 1.5 per cent below the peak of £268,000 in October 2022, it said.

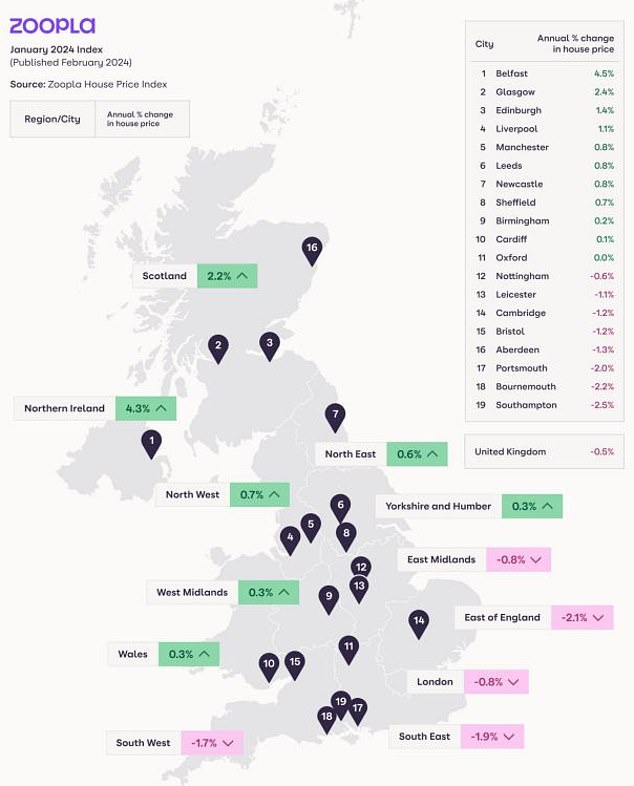

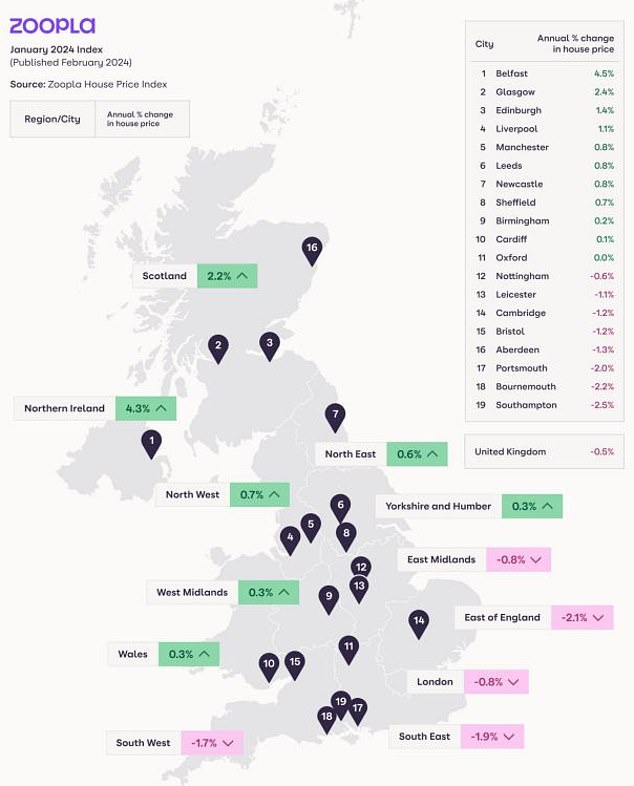

It revealed that price falls were slowing across all UK regions and countries.

Reversal: Average UK house prices are currently down 0.5% year-on-year according to Zoopla, compared to the recent low of -1.4% recorded in October 2023.

However, he added that rising mortgage rates and reduced household purchasing power have affected higher-priced markets more than more affordable locations.

For this reason, the southern regions of England, where house prices are typically highest, have recorded the largest annual price falls.

Five regions in the south of England are recording annual price falls of up to 2.1 per cent, led by the east of England.

Zoopla has singled out London as the only outlier in the south of England, showing signs of a recovering market.

This is despite house prices in the capital being down 0.8 per cent compared to last year and it being the most expensive property market, with an average price of £534,000, almost double the UK average.

Zoopla reported that the North East of England and London have led the sales rebound with sales volumes increasing by 17% and 16% respectively.

Zoopla experts believe weak house price growth over the past seven years has improved affordability in the capital and is opening up London to more potential buyers than before.

A rebound in buyer demand and a lack of homes for sale are reasons why house prices in the capital may recover faster than in the southern regions of England.

Meanwhile, home prices in the most affordable areas of the country are rising year after year.

The country that has increased the most is Northern Ireland, with a year-on-year increase of 4.3 percent, followed by Scotland, with a year-on-year increase of 2.2 percent.

Why is the real estate market heating up?

Falling mortgage rates have been a major catalyst in improving market confidence and increasing housing market activity levels in recent weeks.

Faster earnings growth and rising revenues are also starting to offset the impact of higher borrowing costs, albeit slowly.

The latest figures for 2023 from the ONS show regular pay rose by 6.1 per cent annually.

Mortgage rates have also fallen back to where they were a year ago. However, since early February, lenders have been raising rates as the cost of financing used to fund mortgages has risen modestly in recent weeks.

Falling mortgage rates have been a major catalyst in improving market confidence and increasing housing market activity levels in recent weeks.

Zoopla experts say mortgage rates could fall a little over the course of the year, but this depends on the timing of future base rate cuts, which may occur later in 2024.

For now, they predict rates are likely to stabilize at current levels and say buyers should expect mortgage rates of 4 to 5 percent through much of 2024.

Current prices, according to Zoopla analysts, are enough to support moderate increases in house prices this year and prevent prices from falling further in more expensive areas.

Zoopla’s Richard Donnell adds: ‘Our consistent view is that 5 per cent mortgage rates are the tipping point for the annual house price decline.

‘Mortgage rates above 6 percent for a sustained period would lead to price declines greater than double digits.

“Mortgage rates in the 4 to 5 percent range are consistent with flat-to-low single-digit price increases.”

Five southern England regions record annual price falls of up to 2.1%, led by the east of England

Nigel Bishop, of buying agency Recoco Property Search, adds: ‘We have seen first-hand that buyer confidence has returned to some extent, especially compared to this time last year.

‘This increase in market activity is largely due to the availability of more affordable mortgage products.

“Likewise, sellers have become more motivated to put their properties up for sale, which means buyers have a greater number of properties to choose from.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.