Table of Contents

Nowadays it is difficult to find someone outside the public sector who can still provide a final salary pension.

Try asking your wider group of friends. I found one, and even he is being transferred from the “defined benefit” pension to the much more common “defined contribution” pension.

Like the rest of us, you will now be required to put money into a fund, along with employer contributions, and wait for it to grow to a size that covers your entire retirement.

The final salary pension already accrued will greatly facilitate this task.

Final salary pensions were highly valued for many reasons. First, I knew the retirement salary I would receive, as the name suggests. Second, those incomes would increase with inflation.

Main attraction: The best you can get is a final salary pension fund with guaranteed retirement income, but hardly any private sector employers still offer this.

An annuity can be a ‘light final salary’

Imagine if such a pension product were available today and for everyone. Well, there is. But he is not loved. In fact, he is not very well liked. I am referring, of course, to annuities.

You give money to an insurance company and they will pay you an agreed-upon rent each month or year. At a 6.5 per cent annuity rate, you would pay £100,000 and receive £6,500 a year.

You can add inflation protection, so income increases with inflation. But it will start at a much lower level.

Like a final salary pension, you know what you will receive in retirement and you know it will increase with inflation.

However, annuities’ pariah status is still alive and well. I realized this in a recent roundtable where I was talking about early retirement. My fellow panelist delivered a brutal send-off about the evils of annuities, which was met with many nods from the audience.

History explains why. Before 2015, most of us were forced to buy an annuity with our pensions. Hence the celebrations when compulsion was removed for everyone, allowing us to go out and ‘buy Lamborghinis’ if we wanted (a dry comment from the pensions minister of the time, Steve Webb, now This is Money’s retirement columnist).

We didn’t and we haven’t. But we had the option.

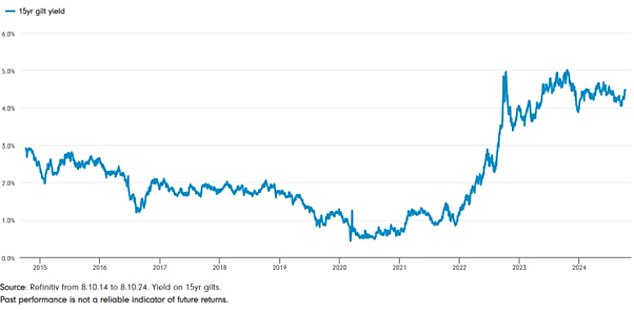

Meanwhile, anti-annuity sentiment accelerated. Annuity rates, already low at the time, fell even further. This is because the price of annuities is determined by the government’s cost of borrowing. As this declined throughout the 2010s, so did the income that could be purchased with an annuity.

Up again Annuity rates are driven by bond yields (the UK government’s measure of the cost of borrowing) and 15-year bond yields have risen substantially.

The Renaissance of Annuities

But fast forward to today and a lot is changing in annuities.

This started when interest rates rose and took off when Liz Truss’ mini-budget for 2022 caused government borrowing rates and therefore annuity rates to skyrocket.

The purchasing power of £100,000 for a 65-year-old, without protection against inflation, rose from an annual income of around £5,000 to around £7,500.

Some astute buyers took a bargain and bought certain income that could exceed the uncertain returns of the stock market – a unique opportunity.

Industry figures point to a revival in the popularity of annuities as rates have improved.

Sales rose 39 per cent in the last financial year, according to figures recently published by the Financial Conduct Authority.

Rates may be about to rise further due to movements in gold prices. The crucial 15-year bond yield, which influences the price of annuities, has risen from just over 4 percent three weeks ago to around 4.5 percent.

The chart above shows the longest 15-year history of gold performance.

Annuities vs. Reduction of Income

Perhaps the fall budget will further guide the debate about the merits of annuities.

An alternative to purchasing an annuity is to stay invested and earn income from your investments.

This can be done through regular income payments or through lump sums.

If all goes well, you will earn a decent income without diminishing the fund and, in the event of your death, you will be able to pass it on to your beneficiaries free of inheritance tax.

However, if you die after age 75, those who inherit it will pay income tax on the withdrawals.

And by keeping the fund intact, without selling it for an annuity, you can draw on it for emergencies, such as private healthcare, etc.

But the inheritance exemption that exists on pensions is said to be one of the Treasury’s objectives in the autumn budget.

If pensions were moved into the inheritance tax net, it would remove one of the advantages of staying invested, at least for the wealthiest investors.

It must be taken into account that today only 4 percent of inheritances are subject to inheritance tax. The figure is expected to rise sharply, but would rise faster if pensions were caught in the net.

Such a move would face fierce opposition, so we’ll have to wait and see what Rachel Reeves does on October 30.

Even if the change is made, the reduction in income will maintain its main attraction given the flexibility it offers.

Annuities, however, may play a larger role in retirement planning, as the “a little of both” approach is gaining popularity.

The vast number of annuity options is not always understood. You can buy an annuity for a fixed period instead of for life, for example.

It may also include an income for your spouse after your death. You will earn better income if you declare certain health problems. And buying later, perhaps at age 70 or 80, will lead to a much higher income: a £100,000 inflation-linked annuity at age 65 buys £5,161 a year, or £7,595 at age 75, according to data from the retirement specialist HUB Financial. Solutions.

For some – particularly those who worry too much about the ups and downs of investing – a hybrid route may be attractive. For example, you could cover all basic expenses with an annuity while keeping a portion invested to pay for discretionary expenses.

Annuity appeal: If Rachel Reeves drags pension funds into the inheritance tax net in the Budget, then buying annuities may look more attractive

How You Could Play the Retirement Income Game

The options are numerous and can be overwhelming. The help of a financial advisor is crucial.

One of the most common mistakes is being attracted to a blanket rate, as evidenced by FCA data.

It showed that 80 percent of annuity sales were level policies.

Buyers were opting for higher incomes today but leaving themselves vulnerable to future inflation, something an advisor might warn against.

I, for one, hope to keep most of my pension invested. My goal will be to achieve a sustainable income rate, hopefully no more than 4 percent, and I will consider an inflation-linked annuity for later in retirement.

Such a plan seems very different from simply retiring on my friend’s final salary, but at least I will have created my own degree of final salary security.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.