Table of Contents

House prices rose for a fifth consecutive month in June, according to the latest figures from the Office for National Statistics.

The average house price rose by 2.7 per cent, with the typical home selling for around £288,000.

In cash terms, this means the average house price is up £8,000 compared to 12 months earlier.

ONS figures are published with a delay compared with other house price indices, but are considered more accurate because they are based on completed sales.

On the rise: Average prices are increasing annually across all regions of the UK.

Between May and June alone, the average house price rose by 0.5%, with property values in Northern Ireland and Yorkshire and the Humber leading the rise.

Marc von Grundherr, director of estate agents Benham and Reeves, said: ‘Five consecutive months of positive monthly house price growth demonstrates that the UK housing market is recovering from the period of stagnation caused by higher mortgage rates.

‘Buyers are acting with greater confidence and this confidence will only grow further now that interest rates are starting to fall, so we expect to see a very strong end to the year, both in terms of buyer activity levels and the resulting boost to property values.’

Lower mortgage rates push up home prices

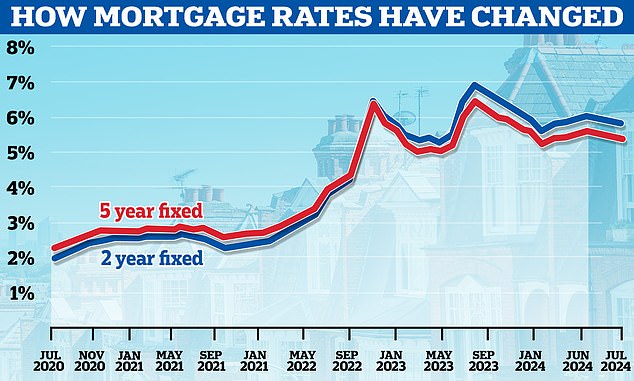

Falling mortgage rates are believed to be the main factor helping to boost home prices.

The Bank of England cut the base rate from 5.25 per cent to 5 per cent earlier this month and this triggered a wave of cuts in mortgage rates with several lenders now offering five-year fixed-rate deals below 4 per cent.

However, today’s house price figures came alongside news that inflation has again exceeded the Bank of England’s inflation target, at 2.2 percent.

This means that the average price of goods and services is now 2.2 percent higher than last year.

Mortgage Rates Are Coming Down: Lower mortgage rates are encouraging more potential buyers to act

However, this was a smaller increase than expected and economists and commentators were quick to point out that it should have little influence on the direction of interest rates.

Peter Stimson, product director at MPowered Mortgages, said: “Although inflation has risen, it is unlikely to have an impact on mortgage rates as this is already priced in.”

Where are house prices rising the most?

House prices across all UK regions have increased compared to 12 months ago.

In the 12 months to June, prices in Northern Ireland rose by 6.4 per cent on average, while in Scotland house prices rose by 4.3 per cent.

Meanwhile, England and Wales have seen more modest house price growth, at 2.4 per cent and 1.8 per cent year-on-year respectively.

However, the monthly picture reveals differences. In Northern Ireland, house prices rose by 3.6 percent over the past month, while in Yorkshire and the Humber, prices rose by 2.7 percent.

However, average house values in the East Midlands fell by 0.5 per cent and in the south-west of England prices fell by 1 per cent between May and June.

Property type also influences house prices. For example, terraced houses have increased by 4% in the last 12 months, from £269,998 to £280,895.

However, the average price of an apartment or duplex has only increased by 0.5 percent during that time.

Jonathan Hopper, chief executive of buying agency Garrington Property Finders, said: ‘National averages tend to mask some of the disparities created when there are increasing numbers of interested, but highly price-sensitive, buyers.

‘Price increases are currently strongest in areas considered to offer very strong value, but less affordable areas are still seeing only modest price growth.

“Even in traditionally prime areas, only the best properties achieve full asking price.”

How accurate is ONS house price data?

The ONS house price data is broadly in line with what we are seeing in the Nationwide and Halifax house price figures, based on their mortgage data.

Halifax said house prices rose 2.3 per cent year-on-year, the highest level reached so far in 2024.

Nationwide said house prices rose 2.1 per cent in the 12 months to July – the biggest annual increase it has recorded in the past 18 months.

A radical change: the Bank of England cut the base interest rate from 5.25% to 5% on August 1

However, the ONS data lags behind other house price data sets as it is based on sales prices from the Land Registry.

This means that prices paid in the month before the general election and well before this month’s cut in the Bank of England’s base rate are shown.

Buying agent Jonathan Hopper suggests there may be further increases in house prices in the coming months given there has been an uptick in buying interest.

He said: ‘The ONS data is more than a little sepia-tinted and does not reflect the subsequent upturn in buyer sentiment.

‘Buyer enquiries have increased and the market has become more active, even if the summer holidays mean it is still operating at a much slower speed than its maximum.

‘It is crucial that borrowing costs have started to fall following the Bank of England’s decision a fortnight ago.

‘Thousands of potential buyers who have put off their moving plans for months, or even years, are now asking themselves ‘if not now, when?’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.