Table of Contents

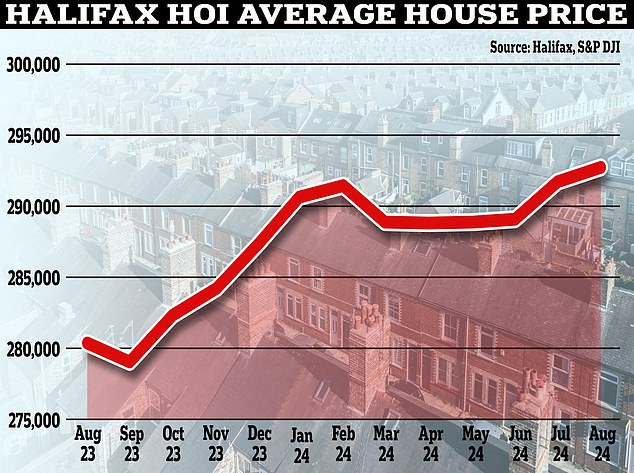

House prices rose in August, according to Halifax, posting the biggest annual increase in nearly two years.

The mortgage lender revealed that house prices rose 0.3 percent last month after a bumper 0.9 percent rise in July.

House prices rose 4.3 per cent year-on-year, the largest increase recorded by Halifax since November 2022.

The typical property now costs £292,505, which is the highest price since August 2022.

On the rise: House prices rose 0.3% in August, following a 0.9% increase in July, according to Halifax

Average house prices are now just £1,000 away from the all-time high reached in June 2022, when average property values hit £293,507.

Halifax mortgage director Amanda Bryden said falling mortgage rates had helped revive the housing market in recent months.

This week, mortgage rates returned to levels not seen since Liz Truss was Prime Minister.

Since the beginning of July of this year, the lowest five-year fixed mortgage rate has fallen from 4.28 percent to 3.77 percent, while the lowest two-year fixed rate has fallen from 4.68 percent to 4.12 percent.

Falling rates are already leading to more people taking out mortgages to buy property.

The number of mortgages approved has also risen to its highest level since the month in which the disastrous mini-budget was presented during Liz Truss’s 45-day tenure.

The Bank of England recorded 62,000 home purchase approvals in July, the highest total since the 65,100 recorded in September 2022.

Amanda Bryden, from Halifax, said: ‘The recent price increases build on a largely positive summer for the UK property market.

“Potential home buyers are feeling more confident thanks to the easing of interest rates. This optimism is reflected in the latest mortgage approval figures, which are at their highest level in almost two years.”

What will happen to housing prices?

Many real estate analysts expect home prices to continue to rise during the fall months.

Anthony Codling, head of European housing and building materials at investment bank RBC Capital Markets, said: ‘The easing of mortgage rates is boosting homebuyer confidence.

“We expect this positive momentum to continue through the remainder of 2024 and to see a strong fall sales season as mortgage rates continue to decline.”

While Halifax has recorded the biggest annual rise of any house price index so far, not all market commentators are getting carried away.

Tom Bill, UK director of residential research at property firm Knight Frank, believes many people refinancing their mortgages in the coming months will be in for a surprise and this will keep prices in check.

“The strength of the UK housing market is one of a number of indicators that contrast with the Government’s gloomy rhetoric about the state of the economy,” Bill said.

‘As inflation comes under control and mortgage rates decline, we expect demand and transaction activity to be stronger this fall than in the past two years.

‘People will continue to opt for less favourable mortgages compared to recent years, which will keep house price growth in check, but rates are expected to fall further over the next 12 months.’

Jonathan Hopper, chief executive of buying agency Garrington Property Finders, believes a glut of homes on the market will keep prices in check.

According to the Halifax House Price Index, the typical home now costs £292,505

He added: “Although interest rates are likely to fall further in the coming months, it is too early to say that we are looking at a full recovery.”

‘In recent weeks we have seen an increase in homes on the market, and this increase in supply has not yet been fully absorbed. In the coming months, price increases could moderate as the market rebalances.

‘With plenty of buyers with options to choose from and sellers eager to close a deal, buyers who do their homework and negotiate effectively can still score big discounts.’

Amanda Bryden from Halifax also shares this sentiment, although she expects prices to rise slightly.

“While this is good news for current homeowners, affordability remains a significant challenge for many potential buyers who are still adjusting to higher mortgage costs,” Bryden added.

‘However, with market activity picking up and the possibility of further interest rate cuts, we expect house prices to continue their modest growth for the remainder of this year.’

Where have house prices risen the most?

According to Halifax figures, there is still a disparity in house price growth across the country.

Jonathan Hopper, chief executive of buying agency Garrington Property Finders, believes a glut of homes on the market will keep prices in check.

For example, average prices in Northern Ireland have risen 9.8 per cent year-on-year, according to Halifax, while prices in the east of England have only increased 0.3 per cent.

In many of the most expensive areas of the country, prices have risen below the UK average.

In Greater London, where a typical home costs £536,000, prices have risen by just 1.5 per cent on average over the past 12 months.

Meanwhile, in the south-west and south-east of England prices rose by 2.3 per cent and 1.9 per cent respectively over the past year.

Other regions that have seen strong house price growth over the past year include Wales, where average values have risen by 5.5 per cent, the North West of England, where prices have risen by 4 per cent, and Yorkshire and the Humber, where the average home is worth 3.6 per cent more than a year ago.

Buying agent Hopper added: ‘Behind the momentum revealed by national averages, prices are rising fastest in areas where value is strongest.

‘In the more expensive areas of London and the south-east we continue to see prices falling.

‘That’s why Halifax data shows average prices in Wales are rising almost four times faster than those in London, while prices in the north-west of England are outstripping those in the capital by almost three to one.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.