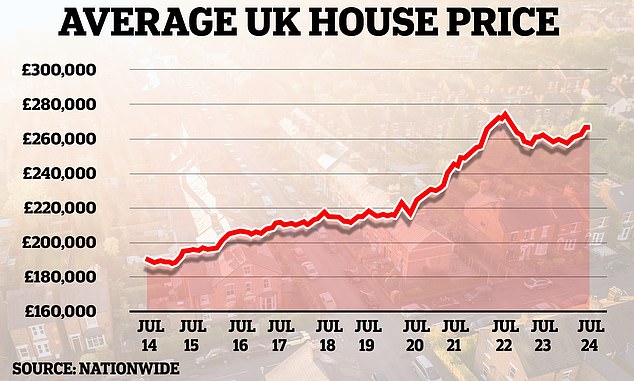

House prices recorded the fastest pace of annual growth since December 2022, according to the Nationwide Building Society.

Britain’s largest mutual fund said average house prices rose 0.3 percent between June and July.

House prices have risen by 2.1 per cent annually and a typical home is now worth £266,334 – the biggest annual increase recorded in the past 18 months.

On the rise: House prices rose 0.3 percent month-on-month in July, according to Nationwide, after accounting for seasonal effects

However, average prices are still around 2.8 percent below the record highs recorded in summer 2022.

Nationwide uses a seasonal adjustment to smooth out the typically busiest and slowest months in the housing market, and without that adjustment the average rose just 0.1 percent between June and July.

Robert Gardner, chief economist at Nationwide, says the housing market is still in a state of flux as people continue to adjust to higher mortgage rates.

He said: ‘Housing market activity has remained relatively stable in recent months, with the number of mortgages approved for home purchases at around 60,000 per month.

‘While this is still around 10 percent below the level prevailing before the pandemic struck, it remains a respectable pace given the higher interest rate environment.

‘For example, for borrowers with a 25 per cent deposit, the rate on a five-year fixed-rate deal has hovered around 4.6 per cent in recent months, more than double the average of 1.9 per cent recorded in 2019.

‘As a result, mortgage affordability remains difficult for many potential buyers. In fact, for a median earner buying a typical first-time property, the monthly mortgage payment equates to around 37 per cent of take-home pay – well above the 28 per cent pre-COVID and the long-term average of around 30 per cent.’

What’s next for home prices?

Knight Frank forecasts house prices will continue to rise for the rest of the year.

Tom Bill, head of UK residential research at the estate agent, said: ‘Despite the uncertainty of a general election, house prices rose slightly this summer due to the typical seasonal pattern of buyers needing to relocate for study or work.

‘We expect transactions and demand to pick up further this autumn as a rate cut approaches and more mortgages fall below the psychological 4 per cent threshold, which should produce UK house price growth of 3 per cent in 2024.’

Nicky Stevenson, managing director of national property group Fine & Country, suggests we could see further price growth in the second half of the year.

“July’s house price surge could mark a turning point for the housing market, and if interest rates fall today, optimists will expect a housing boom in the second half of 2024,” Stevenson said.

Stevenson believes a rate cut by the Bank of England could be a potential game-changer for the housing market.

The Bank of England’s Monetary Policy Committee (MPC) will meet today to decide on the base interest rate. Markets are divided on whether to keep the interest rate at 5.25 percent or reduce it to 5 percent.

He added: “Lower interest rates generally translate into more affordable mortgages and we are already seeing lenders respond with more competitive offers ahead of the decision later today.”

‘With the combination of rising house prices, stabilised inflation and potentially lower interest rates, this could lead to a surge of activity in the coming months, with more properties coming onto the market and a potential boost in transactions.’

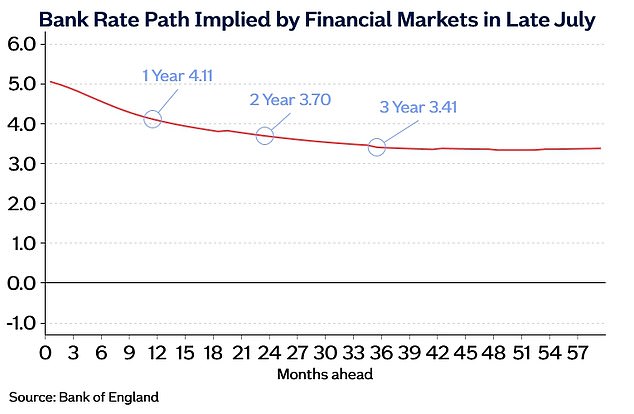

No drastic cuts expected: The base rate is not expected to return to the lows seen in 2021/22, meaning mortgage rates may not fall dramatically from where they are

However, Mr Gardner says future base rate cuts are already built into fixed-rate pricing and mean buyers won’t notice much of a difference when it comes to their mortgage rates even if the base rate is reduced.

“Investors expect bank rates to decline modestly over the next few years, which, if correct, will help lower borrowing costs,” Gardner said.

‘However, the impact is likely to be quite modest as the swap rates that underpin fixed-rate mortgage prices already incorporate expectations that interest rates will decline in the coming years.

‘Affordability is likely to improve only gradually through a combination of wage growth outpacing house price growth, which is expected to remain fairly stable, with some support from modestly lower borrowing costs.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.