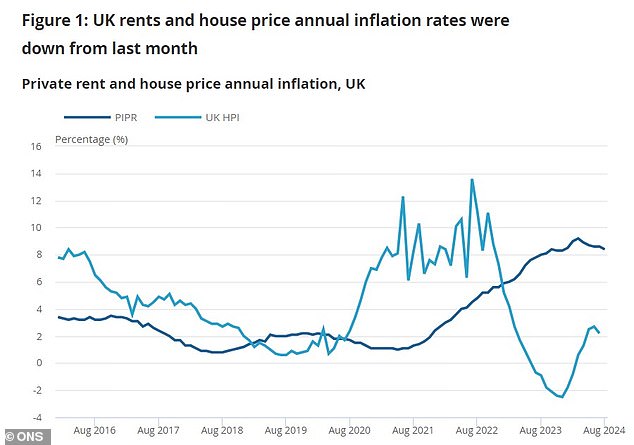

Average property prices continued to rise in the year to August but the pace of growth cooled, new data from the Office for National Statistics revealed.

Meanwhile, private rents have continued to rise at a “near-record pace.”

Average property prices rose 2.2 per cent to £290,000 in the period, down from 2.7 per cent growth in the 12 months to June.

This means the typical home has added £8,000 in value since January 2024, and is now £5,000 away from the all-time high recorded in June 2022.

Changes: Average property prices continued to rise in the year to August, but the pace of growth has cooled, the ONS said

Amid lower mortgage rates, average house prices rose 1.6 per cent in England to £306,000, 2 per cent to £218,000 in Wales and 6 per cent to £199,000 in Scotland.

In Northern Ireland, the average house price between April and June was £185,000, up 6.4 percent from a year ago, according to the ONS.

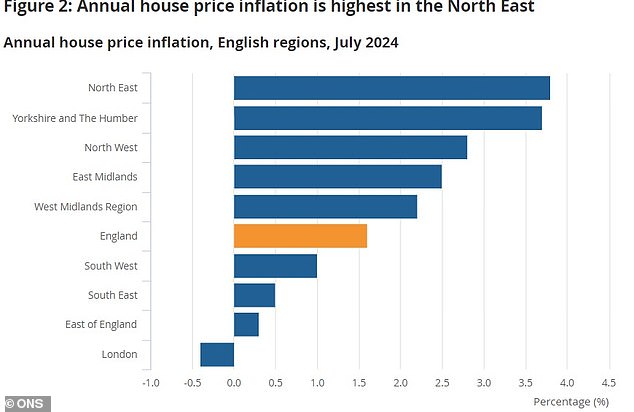

In London, average property prices fell by 0.4 percent.

The North East was the English region with the highest house price inflation over the 12 months to July, at 3.8 per cent.

Among all property types, terraced houses saw the biggest increase over the period, rising 2.2 per cent to an average of £296,000, according to HM Land Registry.

In contrast, average prices for flats and maisonettes rose just 0.4 per cent to £252,000.

Data: Annual inflation rates for rents and house prices in the UK, according to the ONS

Andrew Montlake, managing director of Coreco, told Newspage:“Not long ago some were predicting double-digit price declines in the residential real estate market.

“That simply hasn’t happened and it was never going to happen.

‘Prices have held up and as mortgage rates continue to fall, increased demand is likely to push prices higher in the later stages of 2024.

“Yes, there are potential bumps in the road, most notably the autumn budget, but another rate cut is likely before the end of the year, although this is unlikely to happen this week given that inflation remains at its current level. Falling mortgage rates are certainly boosting demand on the ground.”

Richard Harrison, head of mortgages at Atom Bank, said: ‘There is clear momentum in the housing market at the moment.

‘The first base rate cut in four years has helped spur activity and some competition among lenders, luring back potential buyers who might have put off their deals.

‘Lower mortgage rates certainly play a role here, and while another base rate cut seems unlikely this week, markets appear to be expecting another cut before the end of the year, meaning more good news for potential buyers.’

Average interest rates on two- and five-year fixed-rate loans have fallen for two consecutive months, according to data from Moneyfacts.

David Hollingworth, associate director at L&C Mortgages, said: “The level of competition between lenders remains intense and they have continued to adjust pricing periodically to try and keep up with their peers.”

Nick Leeming, chairman of Jackson-Stops, said: “Buyer confidence will always be influenced, to varying degrees, by the wider economic outlook.

‘It is essential that the Government introduces policies to address the imbalance between supply and demand, but at a rational pace.

“The market needs consistency and certainty, not impulsive reactions and short-term solutions.”

Changes: Annual house price inflation was highest in the North East, the ONS said

Rental costs are rising

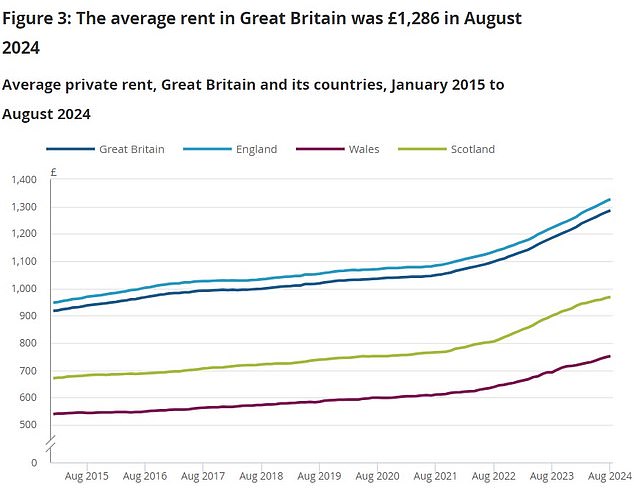

In August, the average private rent was £1,286 a month, up £100 or 8.4 per cent from the previous year, the ONS says.

The 8.4 percent increase was lower than the 8.6 percent increase recorded in the year to July and the record annual increase of 9.2 percent recorded in March 2024.

The average monthly rental cost in England reached £1,327 in August, up £104 on the previous year.

In Wales, the average monthly rental cost was £752 in August, up 8.5 per cent or £59 from the previous year.

Meanwhile, in Scotland, the average monthly rent for residents was £969 in August, up 7.6 per cent or £68 from a year earlier.

Expensive: In August, the average private rent was £1,286 a month, the ONS said

Ben Twomey, chief executive of Generation Rent, said: ‘Prices in shops may have stopped rising so rapidly, but we renters are still seeing our biggest costs rise faster than our income.

“This is nothing new for tenants, who have long been feeling this pressure as our landlords take more and more of our wages.”

The report came as separate ONS figures on Wednesday showed inflation was unchanged at 2.2 percent last month, marking the second consecutive month it has remained above its 2 percent target level.

Some experts say the figures reinforce expectations that the Bank of England will keep its key interest rate on hold at 5 percent on Thursday.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.