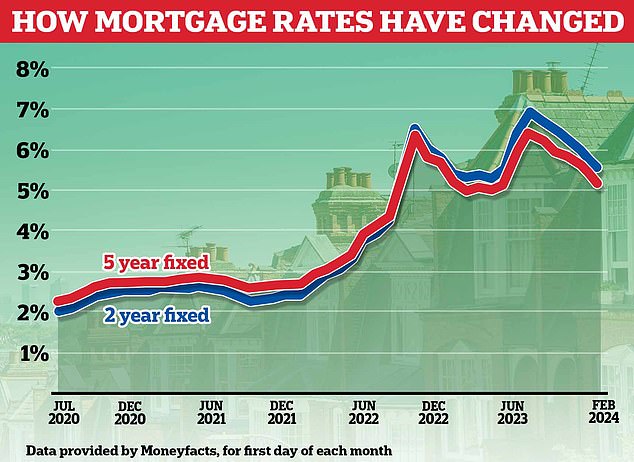

- The average two-year fixed rate fell 0.37 percentage points in January to 5.56%

- This was the biggest monthly drop since December 2022, says Moneyfacts

- But some lenders are raising rates again, so what should borrowers do?

Average fixed mortgage rates fell for the sixth consecutive month in January, according to the latest figures from financial researchers Moneyfacts.

The headline average two-year fixed rate fell 0.37 percentage points, from 5.93 percent to 5.56 percent during the month.

Meanwhile, the average five-year fixed-rate mortgage fell from 5.55 percent to 5.18 percent.

This represented the largest monthly drop since December 2022.

Mortgage lenders have been cutting rates since August, when the average two-year fixed rate hit a high of 6.85 percent and the average five-year fixed rate hit 6.37 percent.

Mortgage lenders have been cutting rates since August, when the average two-year fixed rate hit a high of 6.85 percent and the average five-year fixed rate hit 6.37 percent.

This means the average borrower fixing a £200,000 mortgage for two years with a 25-year repayment term could expect to pay £1,234 a month now, compared to £1,394 a month in August.

A mortgage price war broke out earlier this year with more than 50 mortgage lenders cutting their residential rates, some of them more than once.

However, cuts have largely stalled over the past two weeks, and some lenders have now raised their rates.

The two-year average increased from 5.56 percent to 5.59 percent and the five-year average increased from 5.18 percent to 5.23 percent.

Starting tomorrow, Nationwide Building Society said it will increase some of its fixed and tracking fees by up to 0.25 per cent.

But borrowers who get the cheapest deals can still get a rate of just under 4 percent when the fix is for five years or just over 4 percent when the fix is for two years.

The cheapest five-year fixed rate available to someone buying or remortgaging with at least a 40 per cent deposit or equity in their home is currently 3.93 per cent, with a fee of £999.

Someone buying with a 40 per cent deposit can fix it up for two years for as little as 4.2 per cent, again with a fee of £999.

The advice for anyone approaching a new mortgage is to act now rather than wait in the hope of getting lower rates.

Market expectations about interest rates are reflected in swap rates. Mortgage lenders value their fixed rates based on Sonia swap rates in particular.

Today, five-year swaps are at 3.88 percent and two-year swaps are at 4.41 percent.

Both were up compared to the start of the year, when five-year swaps were 3.4 percent and two-year swaps were 4.04 percent.

Rachel Springall, finance expert at Moneyfacts, said: “Those borrowers who have waited patiently in recent months to refinance, or are indeed preparing for when their mortgage contract expires, would do well to review rates, as lenders They are closely monitoring the volatile swap rate market, which tends to influence fixed rate pricing.

‘There have been high expectations that fixed rates will fall further, and whether now is the right time to refinance will depend on each individual’s circumstances.

“Lenders are constantly reviewing their ranges, and rates are likely to fluctuate in the coming weeks due to noise surrounding future rate expectations.”