Table of Contents

The number of families, including two retired generations, could rise by a third to exceed one million in the next decade, new research reveals.

Family members who live longer will have to use their savings to cover their own needs in retirement, as well as help older or younger relatives.

According to a study by St James’s Place, around 55 per cent of future retirees expect to provide financial support to their family members, compared to 37 per cent of current retirees.

Providing financial support to family members is becoming an increasing priority for people, according to a survey of future and current retirees

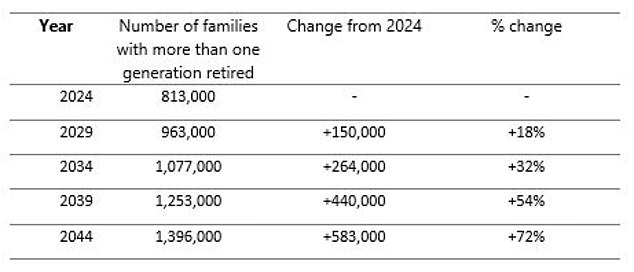

There are currently around 813,000 families with two generations of retirees, but this figure will increase by 18 percent to 963,000 in 2029, and by 32 percent to 1.08 million within 10 years.

The number is expected to reach 1.4 million by 2044, according to the company’s analysis of Office for National Statistics data on the size and age of the UK population.

The rise in families with more than one generation retired is happening faster than expected when St James’s Place carried out the same research five years ago.

So, it was estimated that by 2024 there would be 704,000 families in this situation.

There has been an increase compared to the forecasts it made in 2018, and over the next 20 years there will be many more families with more than one generation retired than initially expected, the company says.

Source: St James’s Place analysis based on ONS data

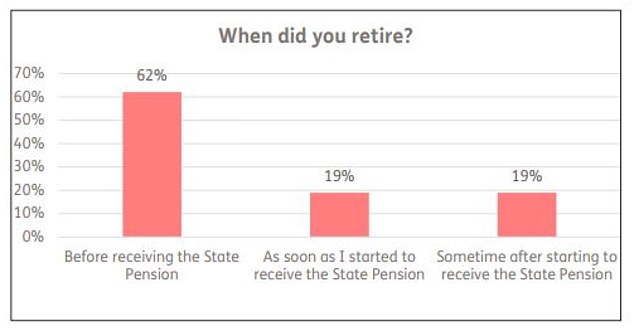

Meanwhile, separate research from Just Group shows that 62 per cent of people aged 55 and over who are now semi-retired or retired left the workforce before reaching state pension age, which is currently 66.

Around 34 percent of those who retired before the state pension age dipped into their pension savings between the ages of 55 and when they stopped working full-time, according to Just’s survey of 1,050 older people.

> What to do if you fear your pension is falling short: scroll down for a checklist

Source: Justo Group

St James’s Place says retirement income will need to be spread across generations as providing financial support for family members is becoming a greater priority for people.

About 22 percent of future retirees expect to help with daily living expenses, 16 percent with buying a home or paying a mortgage, and 14 percent with child care, vacation or education.

As for how they intend to fund this support, 14 percent said they would work in retirement, 12 percent would cut spending on essentials or delay retirement, 9 percent would use what they expected to leave as an inheritance, and 8 percent percent would turn to pensions or other sources of income sooner than planned.

STEVE WEBB ANSWERS YOUR QUESTIONS ABOUT PENSIONS

St James’s Place surveyed 4,000 UK adults, weighted to be nationally representative.

How much do you need for a comfortable retirement?

An influential industry report looking at what individuals or couples need for a minimal, moderate or comfortable retirement shows that costs have risen significantly across the board over the past year.

According to research by the Pension and Lifetime Saving Association, a couple now needs £59,000 a year to be comfortable in their old age.

A single person needs to save even more and achieve an income of £43,100 to cover meals out, holidays, trips to the theater and a car, as well as daily needs.

The PLSA figures assume you are entitled to a full state pension, which increased to £11,500 a year in April, but the figures do not include income tax, housing costs (if you rent or are still paying a mortgage) or care expenses.

“With people living longer, retirement becoming more of an individual’s responsibility and the economic landscape evolving, the way we need to think about planning for the future has fundamentally changed,” said Claire Trott, director of the retirement division of St. James’s Place.

‘The next generation of retirees cannot expect to follow the same path as those who are currently retired.

‘There is a lot of pressure on people’s finances at the moment, so generating enough funds for the future while supporting other generations may not be the priority and can be daunting.

‘On top of this, future retirees increasingly expect to financially support others once they retire, and retirement income needs to spread in multiple directions.

“Implementing the right plans at an early stage will provide greater opportunities to build wealth over time and leave as much as possible behind when you are gone, without making unnecessary sacrifices along the way.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.