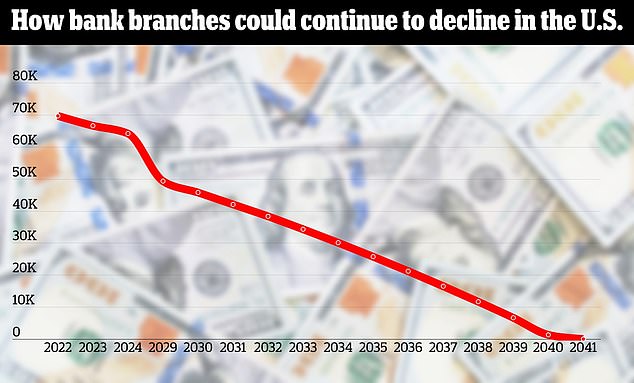

The last physical bank branch could close within a matter of years, a new study reveals.

The last physical bank could close as early as 2041, according to a study New report from Self Financial.

This date was reached by studying the net closing rate across the country, which has averaged 1,646 each year since 2018.

Dailymail.com has reported on the alarming rate of closures, revealing the locations of weekly closures reported to the Office of the Comptroller of the Currency. Scroll down for the full list of our 2024 coverage.

In the first half of 2024 alone, major banks closed 539 local branches, leaving more and more Americans without access to basic financial services.

Physical bank branches could disappear in the United States by 2041, according to a new report

Even though most Americans now choose to do most of their banking online, customers still prefer to use physical branches for certain services.

It is also difficult for some older customers to use services such as mobile banking.

Nearly two-thirds of Americans still use a physical branch to make cash deposits, while more than half use them to speak to an advisor in person, the report found.

Thirty-nine percent of respondents told Self Financial that they had more confidence in banks with physical branches than those without.

Despite this, the report found that since 2012 there have been more branch closures than openings, leaving Americans with a net loss of these vital services.

Between 2012 and 2022, the latest year for which Federal Deposit Insurance Corporation data are available, the number of bank branches fell from 82,461 to 69,590.

Not only that, but the trend has rapidly gained momentum since the pandemic, as more and more services were forced to use online services.

Not only this, but the bank’s overall costs increased significantly, such as rent for physical branch buildings, electricity costs and increased staff salaries.

The consequences of this can be seen in the dramatic closure of 2,442 branches between 2021 and 2022 alone.

Lockdowns mean more and more people must rely on increasingly scarce in-person services.

The number of banks has decreased nationwide every year since 2012

Nearly two-thirds of Americans still use a physical branch for certain services

In 2022, each branch in the country had to serve 4,715 people, the highest figure since 1995.

California has been the hardest hit state, with a net loss of 1,114 branches over the past decade, and could be the first to lose physical bank branches, the report said.

Dailymail.com analysis found that California has also been the hardest hit so far in 2024, as 72 national banks closed in the first half of the year.

The Golden State was closely followed by Florida, which lost 1,091 banks in the past decade, and Illinois, which lost 858.