Table of Contents

- Eurozone inflation slowed from 2.6 to 2.2 percent in August, Eurostat says

- Markets now expect the ECB to cut interest rates again in September

The European Central Bank looks set to cut interest rates again at its next meeting after eurozone inflation fell to a three-year low in August.

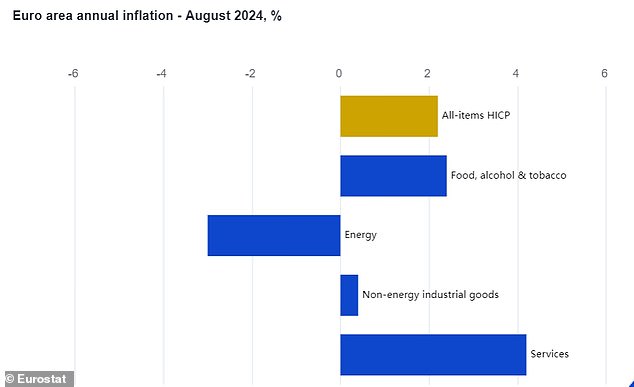

Eurozone inflation slowed to 2.2 percent from 2.6 percent this month, data from Eurostat officials showed, thanks to a 3 percent drop in energy prices that helped offset increases elsewhere.

The bloc faces an inflation problem similar to Britain’s: while goods inflation is declining, core and services inflation remains too high.

UK inflation rose in the latest set of ONS figures, while interest rate forecasts remain divided over when the Bank of England will cut rates again.

Investors are betting that the ECB will cut interest rates by another 25 basis points in September

Core inflation in the eurozone eased to 2.8 percent from 2.9 percent during the month, while services inflation rose to 4.2 percent from 4 percent as wage inflation remained stubbornly high.

Bert Colijn, senior eurozone economist at ING, partly attributed the rise to inflation in the French services sector, which “rose after the Olympic Games in August.”

He added: ‘For the ECB, the modest progress in core and wage inflation now and expectations for next year seem sufficient to cut it by 25 (basis points) in September.

“But this remains a slow and gradual process of releasing the brakes on the economy, as the ECB remains concerned about upside risks to the inflation outlook.”

Eurozone services inflation accelerated from 4 to 4.2 percent in August

The ECB became the first major central bank to begin easing monetary policy earlier this year, beating the Bank of England and the US Federal Reserve in cutting the eurozone’s key rate by 25 basis points to 3.75 percent.

Markets now expect the ECB to follow up with another 25 basis point cut to 3.5 percent next month, but there is less certainty about how the bank will approach monetary policy in the rest of the year.

Michael Field, European market strategist at Morningstar, said that while core inflation “remains substantially higher” than the ECB’s target, “it is at least moving in the right direction.”

He added: “With inflation appearing to have stabilised at the necessary level and unemployment stable, the ECB should reaffirm its course of action.”

“This sets us up very well for future rate cuts this year.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.