- Eurozone consumer price inflation remained stable month-on-month in April at 2.4%

- Markets currently expect a 25 basis point cut at the ECB’s June meeting

- The Bank of England could continue with a base rate cut in August, according to forecasts

The European Central Bank appears on track to become the first among its global peers to start cutting interest rates after consumer price inflation held steady in April.

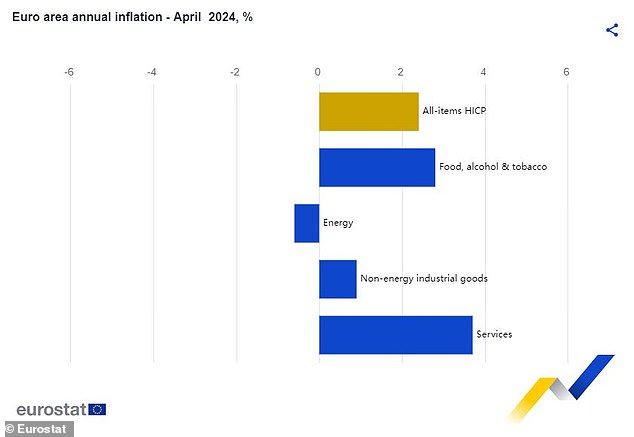

The eurozone CPI was 2.4 percent in April according to Eurostat data, the same as in March and in line with forecasts. This puts the ECB on track to cut interest rates at its June meeting.

The closely watched core and services inflation metrics also declined from the previous month, from 2.9 to 2.7 percent and 4 to 3.7 percent, respectively.

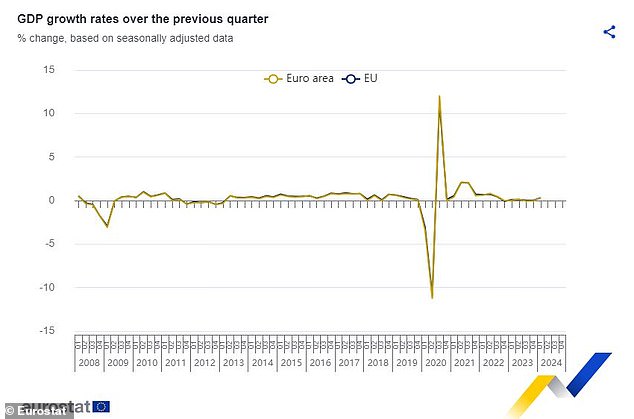

Meanwhile, separate data on Tuesday showed the 20-nation bloc had shown its best economic performance since the third quarter of 2022, when the energy crisis began.

Leading: President Christine Lagarde is expected to lead the European Central Bank toward the first interest rate cut among global peers when it meets in June.

Michael Field, European market strategist at Morningstar, said some may have been “disappointed” to see the CPI holding steady month-on-month after a long period of monthly declines, but described the result as “a decent result.”

He added: ‘Inflation is within striking distance of the ECB’s 2 percent target level and, unlike in the United States, where concerns of a resurgence in inflation and an overheating economy are more pronounced, the outlook in Europe It’s completely different.

‘The continued decline in core inflation is another positive sign. Hawks had previously worried that services inflation could pick up again in Europe, driven by tight labor markets, but fortunately the data says otherwise.’

Markets are currently expecting a 25 basis point cut at the ECB’s June meeting, taking its main refinancing rate from a post-global financial crisis high of 4.5 percent to 4.25 percent.

The Bank of England is expected to implement the first of two base rate cuts for 2024 in August.

The US Federal Reserve is the furthest laggard of the trio, with markets currently predicting it will wait until September.

Eurozone CPI held firm at 2.4% in April as both core and services inflation declined

Policymakers at the ECB, which expects headline inflation of 2.3 percent by 2024, have recently encouraged expectations of a cut in June, albeit with the caveat that key economic data is still ongoing.

Spanish central bank president and ECB head Pablo Hernández de Cos said on Tuesday that the eurozone should start cutting rates this summer, as expected.

He wrote in the Bank of Spain’s annual report: “The ECB’s governing council considers that if these inflation prospects are maintained, it would be appropriate to begin reducing the current level of monetary policy tightening in June.”

However, the ECB will be cautious in the face of surprisingly strong GDP data, which showed the eurozone achieved 0.3 percent growth in the first quarter of 2024.

The eurozone economy has stagnated since the start of the energy crisis in 2022, but is now showing signs of life amid more stable energy supplies, better wage growth and a rebound in household consumption.

Positive signs: Eurozone economy showed its best growth since the third quarter of 2022 in the first three months of this year, according to the latest data

ING senior eurozone economist Bert Colijn said there are also concerns about the impact on CPI of rising energy prices and improving domestic demand.

He added: “Still, we think the economic environment is benign enough for a rate cut in June and we expect the ECB to rely on data after that.”

‘The ECB depends on the data. Yes, they mention it a lot, but for the next rate decisions, they really will be.

‘Today’s inflation data is a warning that the ECB will likely be careful with rate cuts and may take its time to normalize them.

‘With an economy showing signs of recovery and unemployment at historic lows, the ECB can afford to do so.

‘Still, the eurozone is not the United States and demand does not carry as much risk for the ECB as it does for the Federal Reserve, despite today’s encouraging first quarter GDP release. We still expect a first cut in June, but the Bank will remain extremely cautious.’