Table of Contents

Rumours have been circulating in the press and on social media that the council tax could be radically revised and replaced by a 0.5 per cent tax based on the value of the property.

Council tax is one area that Labour could, in theory, change. Labour’s manifesto financial promises included not raising social security, income tax or VAT, but left other taxes up in the air.

But given that this could mean a massive increase in bills for some, including older people living in high-value homes but on relatively low incomes, how likely is this to happen?

Would Labour risk a poll tax-style revolt by changing council tax? We look at what it would mean and whether it could happen.

Changes expected: A council tax shake-up could be on the way under a Labour government

How does the municipal tax work now?

When the current council tax was introduced in 1991, every property in England and Wales was valued and put into one of eight council tax bands.

Band A is for properties valued at less than £40,000 with owners paying the lowest level of council tax, while Band H is for properties valued at £320,000 or more, with owners paying the highest level.

The bands are still used today, despite the fact that the average price of housing has increased by around 400 percent, according to figures from the Property Registry.

Does Labour want to reform council tax?

The Labour Party has given mixed signals on council tax reform. Some of its leading MPs are in favour, others are not, and some have changed their minds.

Prime Minister Keir Starmer is a prime example of this. Starmer has previously described the Welsh Labour government’s plans for council tax reform as “a model for what the Labour Party can do across the UK”.

The Welsh Labour Party wants to reclassify Welsh properties for council tax, as well as set higher tax brackets. This would not happen until 2028 and requires the Welsh Labour Party to retain its lead after the 2026 Welsh elections.

However, Starmer also said that “council tax was too high for too many people” and that he did not want to “raise taxes” when interviewed by Sky News in June 2024.

Similarly, former shadow minister Jonathan Ashworth has gone on record saying Labour had no plans to alter council tax bands.

Chancellor Rachel Reeves is in favour of council tax reform, as is culture secretary Lisa Nandy.

What are the chances of Labour changing council tax?

At the moment, it is impossible to say. The government certainly has an incentive to raise funds, and Rachel Reeves claimed this week that the Conservatives had left a £22bn hole in the country’s finances.

Changing council tax would not substantially change this, as local authorities keep all the money paid to them by people living in their area.

But a general increase in council tax would take pressure off other areas of government spending and could be used to improve local services.

Council tax is also one of the taxes that Labour has left open to change, as it was not protected from change before the election.

How would Labour reform council tax?

There are several options for council tax reform. The one being talked about in the rumours is an idea championed by Labour MP and former chief executive of the Resolution Foundation think tank Torsten Bell, which would introduce a system based on house prices.

This would see council tax bands removed and instead households paying a percentage of the price of their home as council tax each year.

Depending on the tax level chosen, this means that council tax bills could fall for some homes, while they could rise for others.

There could be massive increases for properties in London and the home counties, but also in the South, South West and other more prosperous areas or those popular with second home owners.

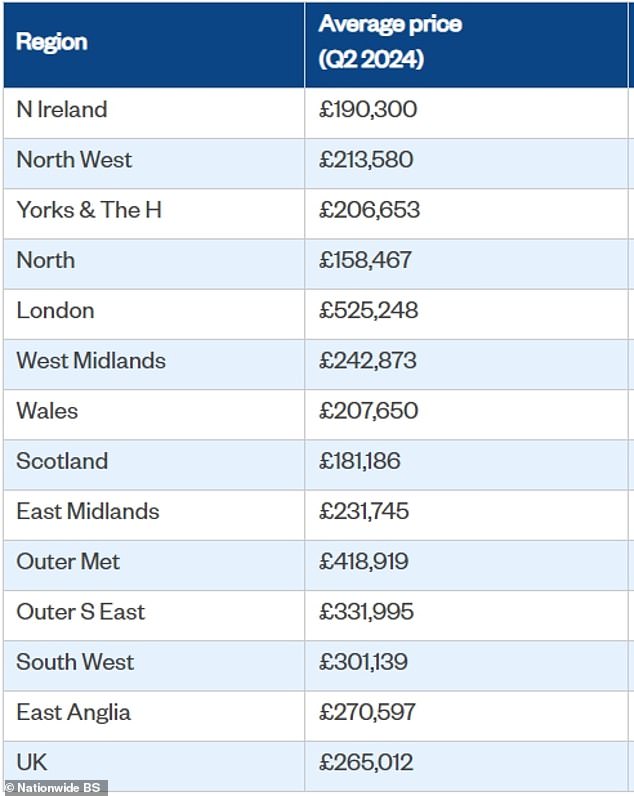

Big difference: UK house prices vary substantially, Nationwide index shows

According to the Office for National Statistics, the average UK home is currently worth £285,000 and the typical Band D home pays £2,065 in council tax a year.

This equates to an effective municipal tax rate of 0.73 percent per year based on value.

So a council tax level of 0.5 per cent would mean lower bills for some, but this changes dramatically depending on where you live.

For example, the average house price in London is £525,248, according to Nationwide Building Society, so in theory this would mean a bill of £2,626 for an average home there.

Overall, bills would potentially rise substantially in the south of England, but fall in the north of England, Wales and Northern Ireland.

An analysis by the Institute for Fiscal Studies think tank concluded that a proportional council tax would “reduce the housing wealth gap between high- and low-value property owners”.

But the IFS added that this would mean households would pay more in 124 local authority areas in England alone, increasing council tax bills by £1,230 a year for more than 4 million homes.

Another option for changing the council tax system is to keep the current one but update the bands with modern property prices.

But changing council tax would be a huge challenge, even if Labour wanted to do it. The process would involve consultation and the drafting of new legislation.

But the main challenge would come from homeowners, especially if council tax reform led to higher bills.

Although inflation has fallen to the Bank of England’s target of 2 percent, the cost of living remains high compared to pre-2021 levels.

Households struggling to cope with high energy, rent, mortgage and grocery bills may object if their council tax also rises.

Will Labour confirm or deny council tax changes?

Labour has been contacted for comment on whether it has any plans to alter the way council tax works.

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible ISA now accepting transfers

Transaction fee refund

Transaction fee refund

Get £200 back in trading commissions

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.