Australian borrowers are now being tempted by much lower fixed-rate mortgages amid predictions of big rate cuts in 2025.

Macquarie Bank on Thursday cut its two- and three-year fixed rates by 20 basis points to 5.39 per cent, now Australia’s lowest mortgage rate outside of a green loan.

Four- and five-year fixed rates were cut by an even more dramatic 40 basis points, also to 5.39 per cent, for borrowers with a 30 per cent mortgage deposit.

Macquarie’s fixed rates are lower than its most competitive variable rate of 6.14 per cent.

But its lowest fixed rates are not much lower than Australia’s lowest variable rate of 5.75 per cent offered by Abal Banking, a subsidiary of Arab Bank.

Major banks offer variable rates starting at a “six” and fixed rates starting at a “five,” flooding borrowers with tempting offers in recent months.

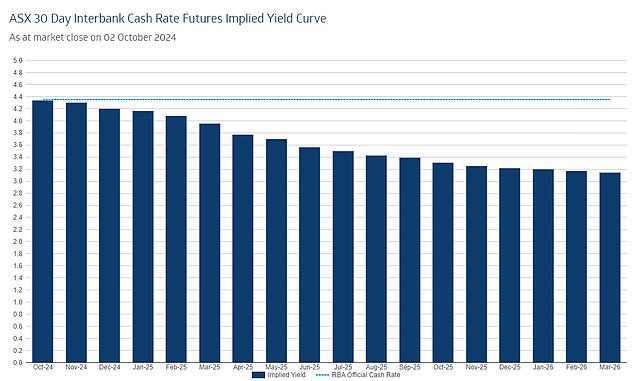

Financial markets expect the Reserve Bank to cut the cash rate four times next year from a 12-year high of 4.35 per cent.

But before opting for a lower fixed rate, borrowers should be aware that they could miss out on even better deals in 2025.

They also face huge break-up fees, in the tens of thousands of dollars, if they change their mind about fixing their mortgage rate while the RBA continues to cut rates.

Sally Tindall, head of data analytics at Canstar, said fixing a mortgage rate now was still a big gamble, considering banks were still likely to cut their fixed and variable rates.

Australian borrowers are now being tempted by lower fixed-rate mortgages amid predictions of big rate cuts in 2025 and 2026.

“For someone looking to pay as little interest as possible, it’s a gamble because we simply don’t know what the cash rate will be and what mortgage rates will be within the fixed rate term,” he told Daily Mail Australia.

‘Once you set it, you have to put up with that fixed rate.

“We can never be 100 percent sure.”

When the Reserve Bank cuts interest rates, those who have already fixed their mortgage face paying a cancellation fee of tens of thousands of dollars if they want to get out of the fixed loan.

“Often you may have to pay expensive break-up fees because the bank will lose money as a result of you breaching the contract and may charge you for any losses you may incur,” Ms Tindall said.

The 30-day interbank futures market expects rate cuts to begin in February next year, and has priced in four Reserve Bank rate cuts in 2025 that would reduce the cash rate to 3.35 percent for the first time since March 2023.

The Commonwealth Bank is even more optimistic: its head of Australian economics, Gareth Aird, forecasts five rate cuts by the end of 2025 that would reduce the interest rate to 3.1% for the first time since February 2023.

Sally Tindall, head of data analytics at Canstar, said fixing a mortgage rate now was still a big gamble, considering banks were likely to continue cutting their fixed and variable rates.

The generous rate cuts forecast for 2025 will not undo the RBA’s 13 rate hikes in 2022 and 2023, which were the most aggressive since the late 1980s.

But they would be the biggest relief in a year from June 2019 to March 2020, when rates were cut by 125 basis points during the bushfires and the onset of Covid.

“As we move closer to a cut in cash rates, we expect more fixed rates to fall,” Ms Tindall said.

“For the last three months, it has literally been raining fixed rate cuts.”

Fixed-rate mortgages accounted for less than 2 per cent of new and refinanced mortgages in July, Australian Bureau of Statistics data showed.

This was well below the all-time high of 46 per cent in July 2021, when the Reserve Bank cash rate was at a record low of 0.1 per cent and banks were offering fixed mortgage rates starting with a ‘ two’ or, in some cases, a ‘one’.

“At the moment the arrangement is completely under the noses of borrowers – the future is still very uncertain,” Ms Tindall said.

“People are choosing to stick with a variable interest rate because, in their view, the consequences of being wrong are less risky than setting a fixed interest rate only to see variable rates plummet and being left with a mortgage rate that doesn’t. competitive, especially when a mortgage is, for many families, the largest monthly expense.’

The 30-day interbank futures market expects rate cuts to begin in February next year, and has priced in four Reserve Bank rate cuts in 2025 that would reduce the interest rate to 3.35 per cent for the first time since March 2023.

Lower wholesale funding costs also mean banks can continue to cut their variable mortgage rates as the RBA eases monetary policy, with core inflation expected to fall within its target of 2 to 3 per cent by the end of 2025. .

Those considering fixing their mortgage rate should remember what happened in early 2008, when interest rates rose twice, to a 12-year high of 7.25 per cent, only for the RBA to cut them six times between September 2008 and April 2009.

This more than halved the cash rate to 3 per cent – plunging to levels not seen since the 1960s – as the RBA embarked on huge 100 basis point cuts in October, December and February.

Those who set their mortgage rate at 9 per cent got burned when the Reserve Bank cut rates to stimulate the economy during the global financial crisis.

“It was one of the many reasons why Australians are not great fixers: a lot of people fixed their rates just before the global financial crisis because they thought interest rates were going to start rising and they fixed what ended up being a kind of very high interest rate, fixed rate only for the global financial crisis to hit and the cash rate started to plummet,” Ms Tindall said.

However, floating rate borrowers should also be aware that major banks in 2020 did not fully pass on the RBA rate cuts.

But they can always negotiate a better deal even before the rate cuts begin.

“Many borrowers will decide to stay on a variable rate, but they know that variable rate is, by definition, negotiable, so if you want rate relief in 2024, pick up the phone at your bank and haggle with them,” he said . saying.