Table of Contents

BP’s new boss has watered down the oil giant’s green energy plans following pressure from investors.

In a major shift in strategy, Murray Auchincloss has frozen new offshore wind projects as it focuses on oil and gas.

It is a sharp reversal from the policies of disgraced former chief executive Bernard Looney, who had pushed for a rapid move away from fossil fuels.

This has weighed on BP’s share price and widened the gap with rival Shell, sparking speculation it could become a takeover target.

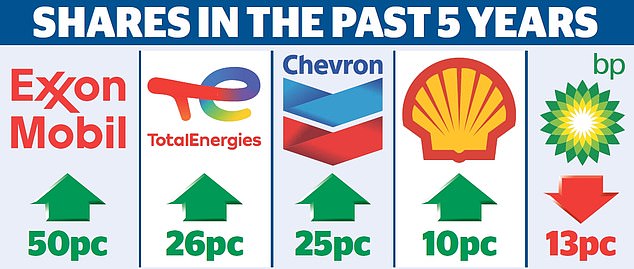

While BP shares have fallen more than 10 percent over the past five years, Shell is up 10 percent, while Chevron, Exxon Mobil and Total Energies have made even bigger gains.

Green blow: In a major shift in strategy, BP boss Murray Auchincloss (pictured) has frozen new offshore wind projects as he focuses on oil and gas

Auchincloss is stamping his authority on BP, having succeeded Looney last year.

Last month it unveiled a £1.6bn cost-cutting plan after profits fell short of expectations in the first quarter of this year.

It will now slow investment in big-budget, low-carbon projects that are not expected to generate cash for years.

Some workers on new renewable energy projects have been seconded to projects already underway, such as offshore wind projects in Britain and Germany.

And the FTSE 100 company will prioritise investment and acquisition of new oil and gas assets, considering projects in the Gulf of Mexico and onshore US shale basins where BP already has large operations.

BP will also consider investing in biofuels and some low-carbon businesses that can generate returns in the near term.

It is planning job cuts in renewable energy, although no specific targets have been set.

BP has imposed a company-wide hiring freeze, with only a few exceptions, including front-line and security staff.

Auchincloss, 53, took over the top job after Looney was forced to resign amid a scandal over undisclosed relationships with colleagues.

BP said: ‘We will act as a simpler, more focused and higher value company.

‘We set six priorities that underpin this, including: driving greater focus on activities that generate the most value, as well as delivering on BP’s next wave of efficiencies and growth projects.

“The actions we are taking are part of this objective, in service of our goal of increasing the value of BP.”

Russ Mould, investment director at AJ Bell, said Auchincloss had been under pressure to “take radical action with a diminished BP at risk of falling prey to a larger predator”.

“The motivation for taking the route of a slower energy transition could be to secure a better market valuation, more in line with US peers that have not made the same type of environmental commitments,” he said.

‘In doing so, Auchincloss is following the path forged by his Shell counterpart Wael Sawan. Such decisions may go down well with investors in the short term, but could lead to problems in the longer term.’

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Investment Ideas and Fund Trading

interactive inverter

interactive investor

Fixed fee investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free stock trading with no commissions per account

Affiliate links: If you purchase a product, This is Money may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you