Table of Contents

The crisis affecting Asda has deepened amid a summer slump at the privately-owned supermarket.

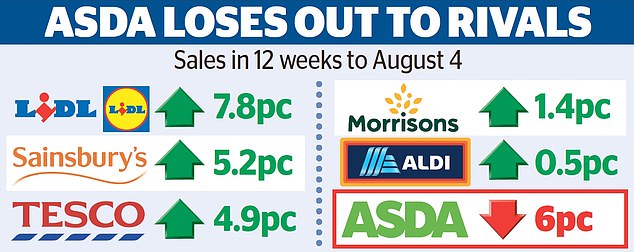

In a grim update, research group Kantar said Asda’s sales fell to £4.26bn in the 12 weeks to August 4, down 6 per cent on the same period in 2023.

The grim figures exposed the scale of the supermarket chain’s decline just days after its chairman, Lord Stuart Rose, said he was “embarrassed” by its results.

Difficulties: Sales at Asda fell to £4.26bn in the 12 weeks to August 4, down 6% on the same period a year earlier.

In contrast, sales rose sharply at rival supermarkets Tesco, Sainsbury’s and Lidl. Sales are still rising at Aldi, although not as fast, while Morrisons and Waitrose also appear to be in recovery mode.

Asda, once Britain’s second-biggest supermarket, has been in crisis since the Issa brothers, Mohsin and Zuber, joined private equity giant TDR Capital to buy it in a £6.8bn debt-fuelled deal in 2021.

Asda has seen its share of the UK grocery market fall from 14.1 per cent at the time of the takeover to 12.6 per cent, the lowest level since Kantar began keeping records in 2011 and down from 17.2 per cent a decade ago.

Asda has suffered as shoppers flock to rivals Aldi and Lidl, as well as Tesco and Sainsbury’s.

Speaking over the weekend, Rose revealed his frustration at Asda’s poor performance.

“I’m going to be totally honest with you. I’ve been in this industry for a long time and I feel a bit embarrassed,” he told The Telegraph.

Rose also called on co-owner Mohsin Issa to step back from day-to-day operations as the business “now needs a different animal” to take over.

Debt-driven: The Issa brothers, Mohsin (right) and Zuber, bought Asda in a debt-fuelled deal for £6.8bn in 2021 – now chairman Lord Stuart Rose (left) says he was ’embarrassed’

Mohsin Issa has been temporarily in charge since shortly after the acquisition in 2021, while the search for a permanent CEO continues.

An Asda spokesman said yesterday: “We recognise the areas that need improvement and have reset our short-term priorities to focus on improving the customer experience.”

Last week, the Leeds-based supermarket began a £50m programme to refurbish 171 stores and said it would add staff at checkouts and make sure stores are cleaner.

Shore Capital analyst Clive Black said: “Store standards just haven’t been good enough, shelves have been empty, tills have been understaffed, supply hasn’t really progressed consistently in what is a really competitive market.”

He said Rose’s words suggested a new boss would soon be on the way.

Morrisons, which is also privately owned after being bought by Clayton Dubilier & Rice for £7bn in October 2021, has also seen its market share fall.

It currently owns 8.6 percent, up from 8.7 percent last year.

But in a boost for new boss Rami Baitiéh, sales rose 1.4 percent in the 12 weeks to August 4.

There were hopes earlier this year that Asda was on track for a recovery after recording a small return to profit in 2023.

But the latest figures suggest that this was a false dawn.

Earlier this summer, Zuber Issa sold his shares in Asda to TDR, a London-based buyout firm. Mohsin Issa still owns 22.5 percent.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.