The Global Alliance of Investment Trusts is on a roll, to the delight of shareholders. In terms of dividends and capital returns, it is paying off.

This month it will pay shareholders its first quarterly dividend of the new year. At 6.62p a year, it is not an eye-popping figure, but it is above what was paid 12 months ago (6.18p).

And investors can be assured that the trust’s record annual dividend growth will extend to 58 years next March, when the year’s final dividend is paid. The shares now trade just below £12.

This is because, along with rivals City of London, Bankers and Caledonia, Alliance has the longest track record among the investment trust sector of consecutive years of dividend increases.

It is one that has had “dividend hero” status conferred on it by the Association of Investment Companies, something the trust does not want to lose.

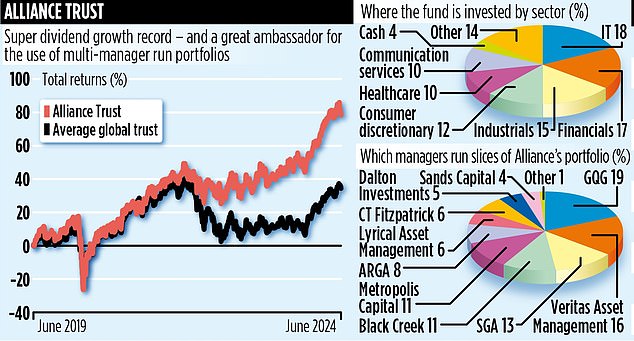

As for stock gains, Alliance isn’t doing anything wrong either. These have been 13 and 18 percent over the past six months and year respectively.

“Yes, the fund is having a good time,” says Craig Baker, one of three individuals at Willis Towers Watson (WTW) who pull the fund’s investment strings. “Our selection has been good.”

The fund, capitalized at £3.4 billion, differs from most other global funds in the way assets are managed. Instead of employing an investment group, the trust’s board uses WTW to divide the fund’s assets among what it considers to be the best-in-class managers.

The result is ten fund managers, selected from around the world, managing 11 portions of the trust’s assets.

With the exception of a basket of about 40 emerging-market stocks monitored by Florida-based GQG, each slice comprises no more than 20 stocks. Among the main fund groups it uses are Black Creek, GQG (manager of two portfolios), Lyrical, SGA and Veritas.

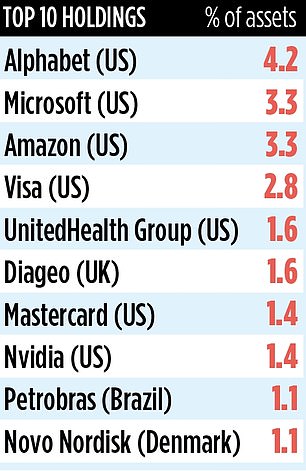

Picks from these top-tier fund managers produce a combined portfolio of 215 global stocks. Top holdings include some of the big American tech companies (such as Alphabet, Microsoft, Amazon and Nvidia), although Baker insists there is more to the trust than these favorable stocks.

Managers, he says, are always looking for future winners, such as Japanese machinery parts maker Misumi and Brazilian energy company Electrobas.

WTW’s role goes beyond selecting the best managers. Constantly monitor the performance of the chosen managers and transfer money between them so that no one controls too large a portion.

They will also sometimes fire investment firms if they feel they are no longer in their best interest, and bring in fresh eyes.

The latest change came earlier this year, when it replaced Jupiter with ARGA, as a result of the Jupiter manager that WTW used in the trust (Ben Whitmore) deciding to set up his own investment business.

“Whitmore remains a good manager and we may return to him when his boutique investment house is up and running,” Baker says.

“But we know ARGA Investment Management and its founder very well and are excited to have their expertise.”

The trust has its own website (alliancetrust.co.uk) and has taken to the airwaves to promote its suitability as a long-term investment (motto: “Find your comfort zone”).

It’s a sign, some say, of the trust the trust’s board has in WTW.

Alliance’s ongoing expenses are low at 0.62 percent. The stock market identification code is B11V7W9 and the symbol is ATST.