Looking ahead: Michael Summersgill is the quintessential northerner

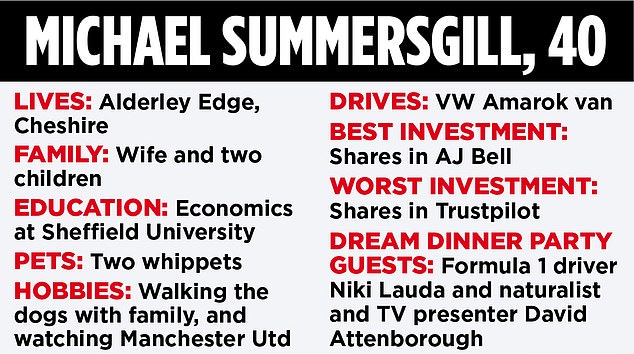

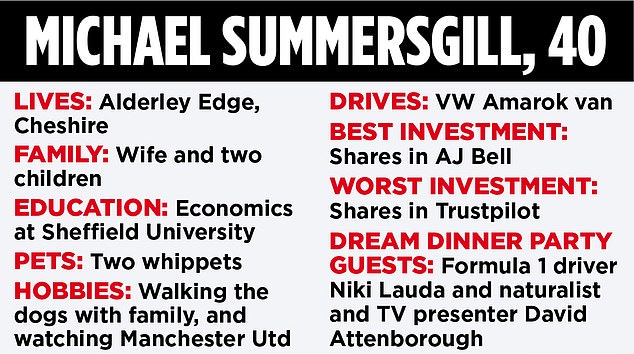

Michael Summersgill is the quintessential Northerner. He was born in Warrington, Cheshire, went to university in Sheffield and now lives in the village of Alderley Edge, home to footballers’ wives and all forms of northern bling.

He even has two whippets, but no pigeons or ferrets. In typical taciturn Northern style, he refuses to give the names of his puppies, presumably to protect their privacy.

“My mother even bought me a flat cap when I got them,” he says with a grin.

Most of the top investment jobs are in the city, but Summersgill, true to his roots, runs British investment platform and stock exchange giant AJ Bell from Salford Quays, the former site of Manchester Docks. His concession to the capital visits a few times a month.

Andy Bell founded the estate agent in Manchester in the mid-1990s and Summersgill likes it very much. It has the advantage of being close to Old Trafford where Red Devils fans can watch Manchester Utd at their home ground. Summersgill, 40, who took over in 2022, has been a season ticket holder since childhood.

But it’s not just about football. Manchester, he says, is an ideal base for a company that focuses largely on British customers, arguing that its attractiveness means it has no problem finding talented people outside the city. But in a nod to the Square Mile’s status, the company still has a significant presence there. And Summersgill wants to boost the city’s moribund stock market, setting out his plan to revive public interest in investment.

‘I would suggest three things to boost UK investment. One: simplify Isas to make them less complicated. Two: abolish stamp duty on shares. And third, provide more support to help people make investment decisions.

‘If you do that it will create a fundamentally different environment for retail investors in Britain. And it doesn’t cost a fortune.’

The first target, he says, is clouded by the UK’s Isa, which was unveiled by Chancellor Jeremy Hunt in his Budget last month. The new product will allow savers to add £5,000 to their annual benefit if they invest it in UK companies. It’s part of the government’s attempt to boost London’s stock market, but Summersgill says it doesn’t go far enough.

He argues that the problem with the UK stock market is not that there are not enough retail investors. He says: ‘If you look at the data, 10 percent of the shares are owned by private individuals. That has been stable since the turn of the century. It is the assets of pension and insurance companies that have fallen sharply.’

He fears that while the target of the UK Isa is ‘the right one’, it will make little difference to the total invested in the UK stock market. He notes that there are only 800,000 savers ‘maxing out’ their Isas, adding: ‘The best-case scenario is that you get an extra £4 billion invested every year. That’s a rounding error for the FTSE 100.’

Summersgill is also concerned it will only add more complexity, confuse savers and put people off investing. Instead, he says the government should stimulate demand by abolishing the 0.5 percent stamp duty levied when an investor buys a UK-listed share.

“It’s a no-brainer,” claims Summersgill, adding that abolishing stamp duty could reduce costs for customers as platforms compete for business. “The benefit would certainly flow to the customers.”

Summersgill says the market can also be helped by supporting people to make investments, rather than focusing on general financial education. An example, he says, is if someone has money in a fund that tracks a stock index such as the FTSE 100, platforms should tell them if they can switch to a cheaper tracker. He says, “Most people want to minimize the time and energy it takes to take care of their finances, and that’s understandable.”

Summersgill himself graduated in 2005 with a degree in economics and became an accountant in training. He was soon offered two jobs, one at accounting giant PwC, another at a ‘funny company called AJ Bell’. Ultimately it was his sister, pension expert and ‘the brains of the family’, who made the decision. He says: ‘She told me she saw a lot of people transferring their pensions to AJ Bell and that I should come along to the interview.’

When he joined AJ Bell’s finance team in 2007, the company focused on self-invested personal pensions, which were among the first products it launched in the early 2000s. Isas and share trading accounts followed in 2011 and funds in 2017.

Shortly after arriving, Summersgill was thrown into the deep end as the sector was gripped by the 2008 financial crisis.

But, he says, AJ Bell managed to “grow enormously” during that period as people continued to seek help with their pension pots despite the unfolding chaos.

“If someone wants to put their retirement in a better place, it doesn’t matter whether major American investment banks fail or not,” he says.

His ascent was rapid. He became Chief Financial Officer in 2011, including the role of Chief Operating Officer from 2014, and then Deputy Chief Executive in 2021. During his tenure, AJ Bell has continued to grow. Summersgill helped lead the company to list its shares on the London Stock Exchange in December 2018.

The company has a turbulent image; The advertisements feature the catchy disco tune Ring My Bell from 1979 by Anita Ward, pictured in the inset. At the time of the IPO it was valued at £651 million. Today it is worth almost double that: £1.2 billion.

All this, he says, “set him up for success” when he took over from Andy Bell, who stepped down in 2022 after more than 27 years in charge. He says, “I can’t think of many people who have had a better preparation period.”

In harmony: AJ Bell’s ads feature Anita Ward’s 1979 disco tune Ring My Bell, pictured

While Andy Bell remains the company’s largest shareholder and acts as an adviser, Summersgill says his former boss ‘doesn’t want to be a backseat driver’. The founder also seems to have little reason to get involved. In its latest set of results in December, the company published record figures, with annual profits rising 50 percent to almost £88 million.

When I speak to him, Summersgill is focused on AJ Bell’s ‘busy season’ – the end of the old tax year and the start of the new tax year in Britain, which started yesterday.

As the deadline approaches, savers usually rush to make the most of their Isa allowance, allowing them to put £20,000 a year into these tax-efficient accounts.

Would including assets like cryptocurrency on AJ Bell’s platforms attract more investors?

He personally says he’s “not a fan of crypto,” adding that it’s “one of those dangerous things” that “blurs the line” between investing and gambling. But despite his skepticism, he says that if more crypto products are approved by regulators, it could become more mainstream and be considered a safe haven.

“Can crypto establish itself as digital gold?” he muses. ‘I understand how that could happen. We are a commercial company and will be guided by consumer demand and the judgments of regulators.’

Returning to the UK market, he says there has been a renewed focus on retail investors, with priority given to ‘hobbyists’, people who trade out of enthusiasm.

He compares these investors to ‘Sid’, the fictional focus of the 1986 advertising campaign that encouraged people to buy shares in British Gas when it was privatized by Margaret Thatcher. The name has recently returned after the government announced plans to transfer part of its stake in NatWest to small shareholders.

He says: ‘Sid is not dead, but those enthusiasts are just one group in the market. Many others are hungry for help and we must support them if we are to revive the UK stock market.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.