Table of Contents

Pensions and Isas are the most powerful tools for building a savings pot – and each increases the potential of your savings in a different way.

But choosing the best option is not easy; there is no outright winner, and what is best for you depends on your own circumstances.

The stakes are also high. Choose the right vehicle and you can increase your retirement income by thousands of euros, according to new figures from investment platform Interactive Investor.

Pensions and Isas are the most powerful tools for building a savings pot – and each increases the potential of your savings in a different way

Why choose a pension?

The big advantage of saving for a pension is that you benefit from contributions from the government – and, if you work, also from your employer.

Pension savings are tax-free, so if a basic rate taxpayer wants to save £100, they only need to deposit £80 and the government will top this up with £20. If a higher rate taxpayer wants to save £100, they will have to contribute £60.

When your money grows within a pension, all growth, dividends and income earned are tax-free.

You can also get an increase if your employer contributes to your pension, or if you can take a salary sacrifice, which means your contributions are exempt from National Insurance.

You can also pay much more into pension than Isas. The annual limit was £40,000. This rose to £60,000 for the April 2023 to 2024 tax year – while the annual Isa limit is £20,000.

> How pensions work: your essential guide to retirement savings

Pensions are also a tax-efficient way to pass money on to future generations. If you die before the age of 75, your beneficiaries will inherit your pension pot free of inheritance tax.

If you are older, they pay tax at their own income tax rate when they go to withdraw money from it.

However, pensions are not without limitations. The most obvious is that you cannot withdraw money from your private pension until you are 55.

This will increase to 57 years in 2028 and there is a possibility that the minimum age will change again.

You also pay tax when you withdraw money from a pension. While 25 percent of what you take out is tax-free, the rest is taxed at your usual rate.

Why choose an Isa?

An Isa is a wrapper that protects your savings or investments against tax on interest, profits and dividends.

A shares Isa protects against tax attack on your returns and allows profits to grow free of capital gains tax and dividends to be treated as income or reinvested free of dividend tax.

An Isa does not offer the same tax benefits as a pension, but withdrawals are not taxed. So you can use an investing Isa pot to generate tax-free income.

Most Isas allow you to access your money at any time. However, there are exceptions. Money in a Junior Isa cannot be withdrawn until the owner is 18.

Lifetime Isas can only be used when you buy your first home, or after the age of 60. Lifetime Isas benefit from a government bonus of up to £1,000 per year for every £4,000 you save for your first home or retirement.

However, other types of Isa do not benefit from tax-free cash incentives from the government – or from employers.

The big advantage over a pension is that you don’t pay tax on money you withdraw from an Isa.

> How to choose the best (and cheapest) shares Isa

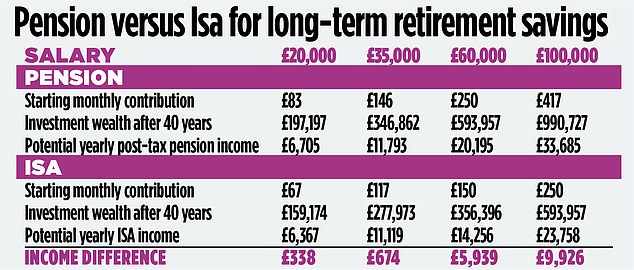

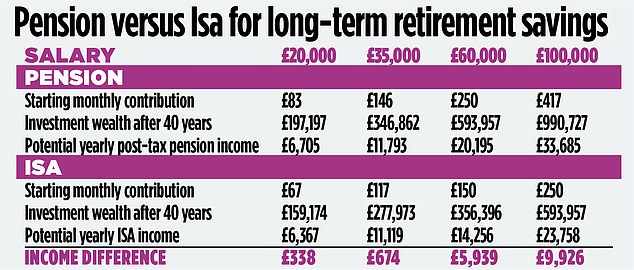

Source: Interactive Investor. Assumptions: 5% investment growth net of fees, income tax payable at the basic rate on all pension income at retirement, 25% of withdrawals are tax free, pension income based on a 4% withdrawal rate, excluding impact of employer contributions, 5% of income earned paid into pension or Isa and pension contributions, includes tax relief.

Pension versus Isa: how they stack up

Investment platform Interactive Investor looked at the benefits of a pension versus an Isa over 40 years and the pot that could be built up and the income that could be withdrawn.

The figures compared a theoretical saver investing 5 percent of his monthly income, with the money going into a pension and benefiting from tax relief that increased premiums.

Assuming an average annual investment growth after fees of 5 percent over a period of forty years, the ultimate potential size of the pot and the annual after-tax income from it were examined.

A basic rate taxpayer who has built up a pension over 40 years could have an annual income almost £700 higher than if they saved in an Isa, according to Interactive Investor. A taxpayer on a higher rate could end up with £6,000 more in annual income.

That’s because with a pension, not only do you get tax relief as soon as you make contributions, but that tax benefit also benefits from the effects of compounding, meaning it will compound over time.

Alice Guy, head of pensions and savings at Interactive Investor, says: ‘Even if you pay income tax later, you still have more left over because that extra tax increase has become much bigger than the tax you ultimately pay.

‘In addition, you can take 25 percent tax-free (in one go or smaller payments) from your pension pot, which means that most people pay slightly more tax in total on Isa investments.’

But those who put money into a pension are giving up potential access to their pot until age 55 currently, or until age 57 in the future.

Because both have advantages and disadvantages, most savers are usually best off with a combination of both pensions and Isas.

DIY INVESTMENT PLATFORMS

A.J. Bell

A.J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

eToro

eToro

Investing in shares: community of more than 30 million

Trade 212

Trade 212

Free stock trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.