<!–

<!–

<!– <!–

<!–

<!–

<!–

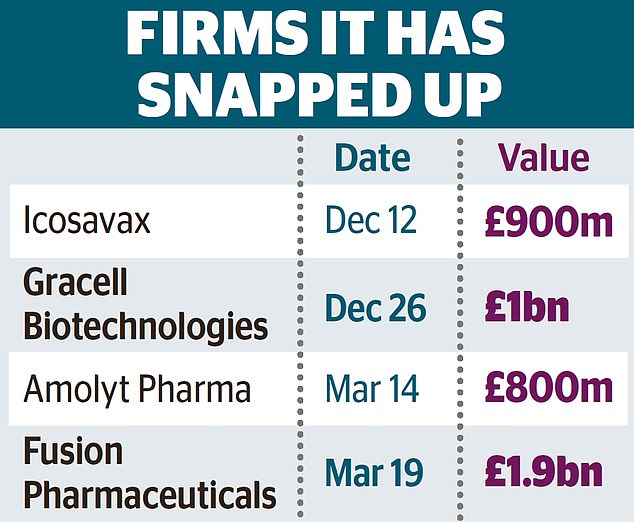

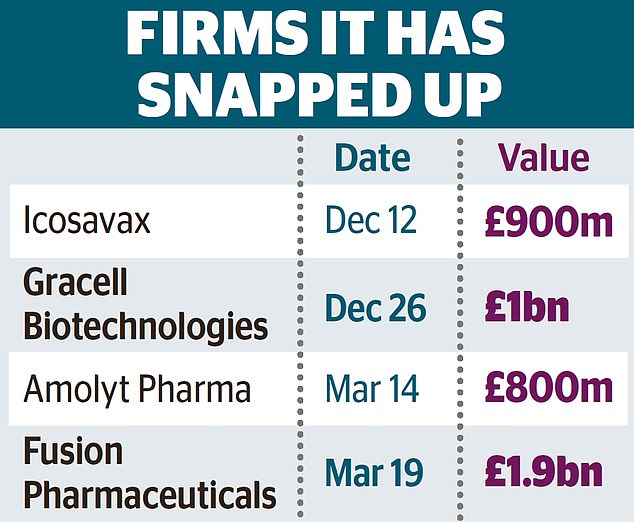

AstraZeneca continued its buying spree with a £2bn bid for cancer treatment specialist Fusion Pharmaceuticals.

The deal to purchase the Canadian company is the latest in the pharmaceutical maker’s mergers and acquisitions to expand its pipeline.

AstraZeneca has bought several smaller companies since December, including rare disease company Amolyt Pharma for £800m earlier this month.

Late last year, the pharmaceutical giant struck a deal to buy Chinese cancer therapy company Gracell for £1bn, weeks after buying respiratory vaccine developer Icosavax for £900m sterling.

The Fusion deal announced yesterday is part of AstraZeneca’s strategy to develop cancer treatments to replace chemotherapy and radiotherapy.

Long-time boss: Astrazeneca, led by Pascal Soriot (photo), has bought several small companies since December, including Amolyt Pharma, specializing in rare diseases.

Fusion will become a wholly owned subsidiary of AstraZeneca, with operations continuing in Canada and the United States.

Susan Galbraith, executive vice president of oncology at AstraZeneca, said: “Today, between 30 and 50% of cancer patients receive radiotherapy at some point during their treatment, and the acquisition of Fusion reinforces our ambition to transform this aspect of care.

She said the tie-up could accelerate “a potential new treatment for prostate cancer.” Susannah Streeter, head of finance and markets at Hargreaves Lansdown, said the latest in a series of small acquisitions showed AstraZeneca was “not afraid to make multiple bets on potential first-class candidates”.

“AstraZeneca is at the forefront of new methods of treating cancer,” she added.

Danni Hewson, head of financial analysis at AJ Bell, said: “Pharmaceutical companies have learned the lesson of patent breaches: they cannot rely on blockbuster treatments forever.

“They need to keep the pipeline level, acting as a conveyor belt for something else to come along just as an existing treatment loses patent protection and profits fall victim to generic copycats.”

“Medicine is constantly evolving and today’s patient is acutely aware of the next big development that could make their treatment more effective and less invasive.”

AstraZeneca announced earlier this month that it would inject £650 million into Britain’s world-leading pharmaceutical industry.

The FTSE 100 group will invest £450 million in the research, development and manufacturing of new vaccines at its factory in Speke, Liverpool.

The company, which developed a Covid vaccine with Oxford University, will also spend £200 million expanding in Cambridge.

The investment suggests chief executive Pascal Soriot’s confidence in Britain has been restored after he last year called the UK a “very unattractive” country in which to do business.

He pointed to Astra’s decision to build a factory in Ireland rather than the UK as evidence that Britain was becoming less attractive.

But the long-serving boss said last month: “The current life sciences environment in the UK is different to what it was almost a year ago. »

Soriot, 64, is credited with turning around the fortunes of the London-listed pharmaceutical manufacturer. Since he took the reins in 2012, the company’s shares have more than tripled.

He oversaw the development of the company’s Covid vaccine which helped lift lockdowns during the pandemic.

The company more than doubled its annual profits last year, thanks to bumper sales of its cancer treatments.

Profits rose to £5.5 billion in 2023, up from £1.9 billion the previous year, as sales rose 3% to £36.3 billion.

The group said its revenue and profits in 2024 would be boosted by its blockbuster oncology drugs.

AstraZeneca’s performance increased Soriot’s salary. He landed his biggest salary deal last year, earning £16.9 million – the fifth year in a row he has taken home more than £15 million.

This brought his total income to £135 million during his 12-year tenure.