Table of Contents

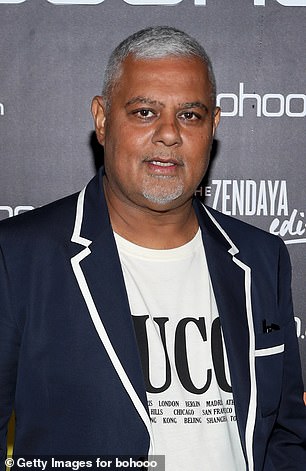

Mike Ashley has demanded Boohoo co-founder Mahmud Kamani step aside as tensions grow between two of retail’s most prominent figures.

The troubled fashion group revealed yesterday that Kamani has resigned from his role as executive chairman to become executive vice president.

But the move, which saw Boohoo member Tim Morris promoted to president, failed to quell Ashley’s anger. His Frasers Group is Boohoo’s largest shareholder and has been pushing for change.

Boohoo said Mahmud Kamani (right) has resigned as chief executive to become executive vice-chairman, but Mike Ashley (left) is demanding he resign.

Morris said he would focus on “delivering maximum value and protecting the interests of all shareholders.” He pointed to £39.3 million in new funding as a sign that a revival can be achieved.

And Kamani, who founded the Manchester retailer in 2006, will give up his salary for a year. It has also promised not to try to buy Boohoo or any of its assets.

But Frasers said the reorganization made little difference. A spokesman said: “His title may have changed, but his grip has not. Mr Kamani must go.

He added: “Shareholders have lost money and there is justified disappointment and distrust in the current leadership, particularly Mr Kamani.”

Frasers is pushing for Ashley and turnaround expert Mike Lennon, a close ally of the tycoon, to take positions on Boohoo’s board.

Shareholders will vote on the proposal on December 20. Frasers, controlled by Sports Direct tycoon Ashley, owns 28 per cent of Boohoo, while Kamani owns 12.6 per cent.

A ruthless takeover specialist, Ashley has grown his retail empire from a shop in Maidenhead, Berkshire, to an estate that includes Game, Jack Wills and Agent Provocateur.

He tried to install himself as chief executive, but Boohoo named a whistleblower, Dan Finley, this month. Boohoo has urged investors to reject Ashley’s claims, saying he is promoting a “commercial self-interest”.

“The board has a credible plan to unlock and maximize value for all shareholders,” Boohoo said last week.

A ‘make or break’ review has set the stage for a breakup of the company. It has cast doubt on the future of brands such as Oasis and Coast, which could be spun off or sold.

Russ Mould, investment director at AJ Bell, said: “Kamani is unlikely to give in to Frasers’ demands and go away without a fight.” He helped build the business into one of the country’s biggest forces in fast fashion.

“Although Boohoo has lost its way, it is incomprehensible that Kamani would allow someone else to step in and rebuild the business in a different way. It would be an admission of failure.

Maximizing its appeal to young fashion shoppers, Boohoo lifted its shares to a high in 2020 during lockdowns, when it was valued at more than £5bn.

But the trade has been affected by fierce competition from rivals such as Shein.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.