- The typical driver now pays £612 a year for car insurance, according to the ABI

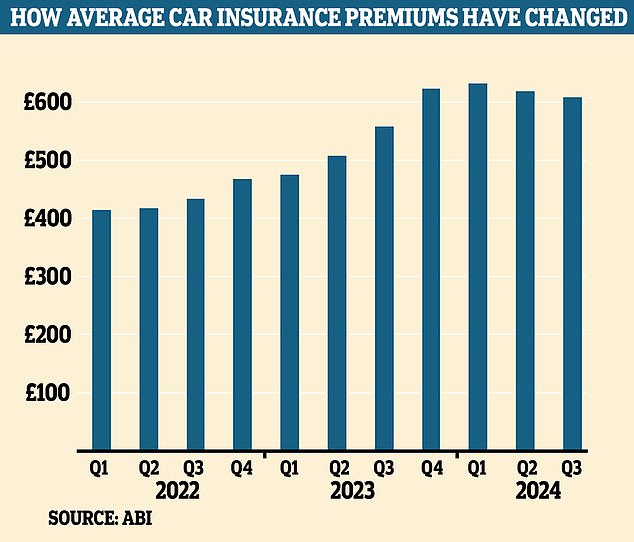

Car insurance premiums fell 2 per cent between July and September 2024, with the average driver now paying £612 a year for cover.

The latest drop in premiums follows another 2 per cent drop between April and June 2024, according to trade body the Association of British Insurers.

But it will be a small relief for drivers, who still pay more than 40 per cent more for car cover than two years ago – the typical premium was £436 in summer 2022.

The ABI said that despite the recent drop in prices, premiums remained high due to high claims costs and general price inflation for insurers and repairers.

It all adds up: The high cost of auto insurance adds to the pain felt by overall rising bills

In total, insurers paid out £2.9 billion in motor insurance claims in the third quarter of 2024, up 14 per cent on the £2.5 billion paid in the same period last year .

While the average claim paid remained stable from Q2 2024 to Q3 2024 at a value of £4,800, it was 8 per cent higher than Q3 2023.

Repair costs totaled £2 billion for the quarter, up 26 percent from the third quarter of 2023.

The average claim for vehicle theft decreased in Q3 2024 by 7 per cent compared to Q3 2023 to £12,200, but vehicle theft increased by 17 per cent to £3,000.

The ABI said car insurers paid out £1.13 in claims in 2023 for every £1 collected in premiums, according to EY consultants.

But critics say the premium increases challenge the fact that the biggest cost auto insurance premiums pay for — bodily injury claims — is falling.

The above figure of £1.13 does not include the money insurers make from investments, which can be substantial.

ABI general insurance policy director Mervyn Skeet said: ‘While our latest figures show the second consecutive quarterly drop in average motor insurance premiums, we know the industry continues to face significant cost pressures and the price of cover remains a burden on household finances.

“We remain determined to do everything we can to support motorists.”

Last month, the Government demanded answers about the rising cost of car insurance.

A Labor Party review is questioning insurers about those most affected by rising costs, including ethnic minorities, people on lower incomes and young and elderly drivers.

A working group looking at the issue includes industry groups and consumer advocates such as the Association of British Insurers (ABI), Citizens Advice, Which? and Compare the Market as well as insurance regulators.