Table of Contents

The collapse of Harland & Wolff into administration is a major blow to Belfast and to British shipbuilding.

The prospects of any kind of bailout by the government, or any other entity, will have been damaged by the revelation that £25m of funding was allegedly misappropriated by previous management. Investors in the AIM-listed company will have been left out of pocket.

PwC has been called in to assess the financial manoeuvres. The auditing firm knows all about how money is being lost following its well-known mistake with Chinese property giant Evergrande.

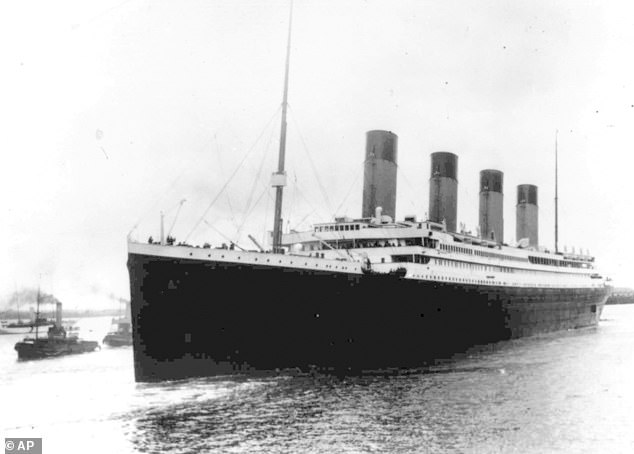

Doomed: Harland & Wolff is best known for building the Titanic in Belfast, before it sank on its maiden voyage in 1912.

Despite Harland & Wolff’s historical resonance, it must not be allowed to sink like the Titanic.

At stake is the contract to assemble the fleet solid support ships for the Royal Navy’s aircraft carrier force, which could end up in Spain if consortium partner Navantia joins.

A Labour government unnecessarily committed to taking Britain’s railways back into public ownership and expanding the country’s defence capabilities should provide the funding or loan guarantees needed to ensure survival.

Their fiscal masochism is a danger to jobs, Northern Ireland’s prosperity and the national interest.

It is encouraging that a number of potential buyers for the operating companies have emerged. It is axiomatic that naval contracts should only be sold to UK companies.

Babcock, which runs much of Britain’s naval fleet, is the obvious candidate even if public money has to be used as lubricant.

Britain’s steel and shipbuilding industries are key to national security amid geopolitical turmoil on the high seas and in the heart of Europe.

The Starmer government needs to shape up, and quickly.

Big spenders

There is no shortage of advice for Rachel Reeves ahead of the budget on October 30.

The exaggerated rhetoric about black holes must be dropped. Borrowing and debt are too high and the Conservatives have left unfinished business.

But given the scale of the crises since 2008, the UK’s debt-to-national-income ratio is not disastrous at 99% of GDP, but could be considerably lower if the distortions caused by the Bank of England’s bond purchases are removed.

The debt-to-GDP ratio is lower than that of most of Britain’s G7 competitors, and a fraction of the 250% it was at the end of World War II.

The Office for Budget Responsibility’s long-term debt projections released last week are based on biased assumptions about climate change and productivity.

Economists’ letters to newspapers can usually be dismissed. The latest missive from former cabinet secretary Gus O’Donnell and others to the FT has merit: it warns the Chancellor of the Exchequer against cutting back on limited public investment.

If you want to increase productivity, you must prioritize infrastructure.

Reeves got off to a bad start when he gutted road plans for the Stonehenge tunnel, the A27 and the revival of the railways in his rushed “fix the foundations” plan in July.

The NHS needs investment in equipment and AI, not bigger budgets. Large infrastructures like HS2 can be made to work if they are managed properly.

There is an urgent need for new nuclear power, including small modular reactors (SMRs), if Ed Miliband’s lukewarm support is to be overcome.

It is all well and good to leverage pension fund investments to invest in infrastructure, climate change and information technology.

The productivity imbalance between the South East and the rest of the country will only be addressed by the Government’s commitment to projects such as the trans-Pennine rail links. The National Wealth Fund will be helpful, but it is woefully inadequate to the task.

Film noir

The Magnificent Seven’s assault on entertainment and sport has destabilised Hollywood’s content providers.

Warner Bros Discovery has been hit hard, losing out to Amazon in the auction for the National Basketball Association’s streaming rights, and managing less than 5 percent of the summer season’s box office sales. A blockbuster was needed to lift morale and a weakened stock price.

With the release of Beetlejuice, Beetlejuice has finally arrived. The sequel to Tim Burton’s 1988 hit achieved record sales of £110m in the US after its release in September.

It is estimated to raise £191m as it goes global. It is not a radical turnaround for a company that lost 25% of its share market value this year, but it is proof that investment in creativity works.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.