Table of Contents

I was just charged 67 per cent tax on the interest on my savings when I did my self-assessment tax.

I am an employee and earn over £100,000, so I am in the unfortunate position of having my personal allowance removed and having to pay 60 per cent tax on any pay rise I get.

Although I should be getting £500 of tax-free interest, I somehow ended up paying an even higher tax rate on my interest.

Tax sting: Toby Tallon, tax partner at Evelyn Partners, explains how the personal savings allowance for higher earners works

Last year my salary plus private healthcare medical benefit amounted to £103,597.

Somehow, despite all my income being paid through employment, my online self-assessment calculated that I still owed £1,398.

But when I added the £2,025 of savings interest I had received, my tax bill rose to £2,414.

That was around £1,016 extra in tax, which by my calculations is a tax rate of 50.2 per cent on the full £2,025 interest amount.

But it’s even worse than that, as the personal savings allowance means I should get £500 of interest tax-free, so I’ll only pay tax on £1,525 of interest.

This tax bill means I have paid 67 percent of the taxable interest. What the hell is happening here?

Toby Tallon, Tax Partner at Evelyn Partners, responds: The personal savings allowance is £1,000 if you are a basic rate taxpayer, £500 if you are a higher rate taxpayer and zero if you are an additional rate taxpayer.

Although the £500 personal savings allowance is often described as “tax free” for higher rate taxpayers, strictly speaking it is a “personal savings allowance” where a 0 per cent tax charge is applied on the first £500 savings interest. .

Unfortunately, this means you have to include your entire interest in your adjusted net income, which raises it by £500 and means your personal allowance is restricted by it.

Effectively, this means that for those earning between £100,000 and £125,140 – the band at which the personal allowance is removed – the personal savings allowance is not completely tax-free.

If you earn more than £125,140, the personal savings allowance is removed entirely.

How people end up paying taxes on tax-free savings

Going into details, the restricted personal allowance is calculated using the following formula:

£12,570 – ((adjusted net income – £100,000)/2).

In your case, your personal allowance is limited to £9,759 when interest is taken into account.

The £2,025 interest has reduced your personal allowance by £1 for every £2 earned, reducing it by £1,012.

His personal allowance would have been £10,771 if he had not earned the interest.

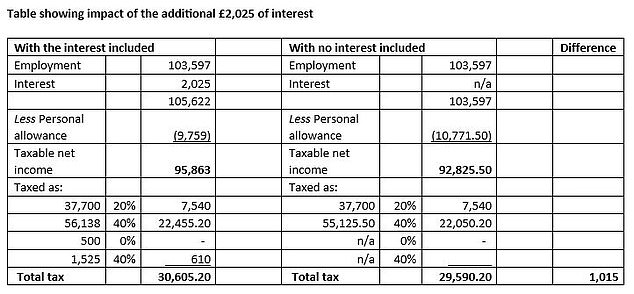

To help illustrate this, we have included a table below that calculates the total tax payable with and without interest income.

The result of receiving the interest income is a total additional tax of £1,015, which is in fact around a marginal tax rate of 50 per cent, which is the level you calculated before deducting the personal savings allowance from your interest.

This is made up of £610 on the interest itself (40 per cent x (£2,025 – £500)) but also £405 of the additional restriction on your personal allowance (40 per cent x (£10,771 – £9,759)).

So in essence you are right that there is a marginal tax rate that is higher than the usual top 40 per cent rate, and 67 per cent in the specific example you described (based on £1,015/(£2,025 – £500)). – but this is due to the 0 per cent tax charge on the first £500 of savings income, rather than being exempt, resulting in the total amount of £2,025 of interest restricting your personal allowance.

Source: Evelyn Partners

How can you reduce your tax bill?

If your income is likely to be similar in the future and you want to avoid a repeat of this scenario, you could consider making pension contributions, relief grants or making use of Isas.

1) Pension contributions

These are deducted from your adjusted net income, so making a pension contribution can restore some or all of your lost personal allowance.

Greater direct tax relief on pension contributions is also achieved by increasing the basic tax band (20 per cent taxable amount).

If your employment income and interest income were exactly the same in the current tax year ending 5 April 2024 and if you had sufficient annual pension allowance, you could make a net pension contribution of £4,500 to reduce your net income adjusted by £5,622. necessary to fully restore your personal allowance (the £4,500 is ‘increased’ to £5,625, to take account of the basic rate of tax).

This would also expand its basic rate band by £5,625. This can make pension contributions for someone in your situation very tax efficient, provided appropriate advice is taken about their wider financial circumstances.

You would have to make the corresponding pension payment before April 5, 2024, so time would be of the essence.

2) Gift aid

Donations to a charity also reduce your adjusted net income. The tax relief is granted in a similar way to pension contributions, increasing the basic tax rate.

As long as the donation qualifies for donation assistance, the base rate bracket will be increased by the “gross donation,” which is the amount you actually donated, plus 25 percent. For example, if you donated £100 through gift aid, your basic rate band would increase by £125.

Additionally, unlike pension contributions, it is possible to “carry over” donated aid contributions made after the end of the tax year to the previous tax year, as long as important conditions are met (include them on your tax return the first time you present, and file your tax return by the January 31 deadline).

3) Isas

If you haven’t used your annual Isa allowances, you could put up to £20,000 a year into an Isa and enjoy the benefits of tax-free status on any interest or dividend income or capital gains from returns on that Isa (keep in mind that stocks and shares can put your capital at risk).

Hopefully these government-approved tax saving tips can restore your confidence in the tax system and your bank balance.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.