The new car market has surpassed the one million sales mark at half-year for the first time in five years.

A 1.1 percent rise in registrations in June has lifted sales for the 2024 half-year to 1,006,763, figures from the Society of Motor Vehicle Manufacturers and Traders show.

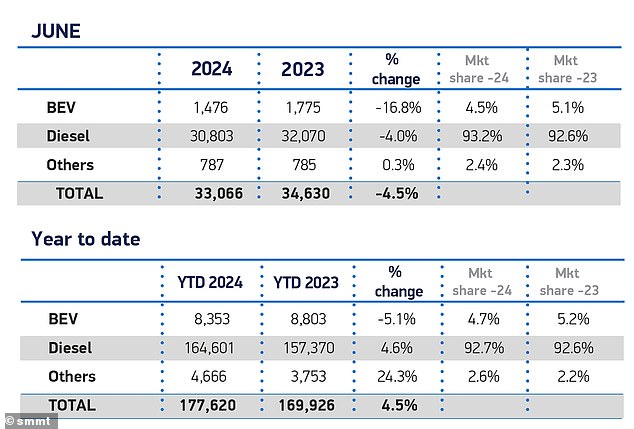

Last month’s increase was driven by the adoption of electric vehicles and sales in the fleet sector.

However, Private retail demand has fallen across the board, with the industry now calling for the next government to “revitalise the market” by unveiling EV incentives on polling day.

The new car market has surpassed the million sales mark at half-year for the first time in five years

New car registrations reached 179,263 units in June, bringing the half-year total above the one million mark for the first time since the pandemic began.

New car registrations reached 179,263 units in June, bringing the total for the first half of the year above one million for the first time since the pandemic began.

This represents an increase of 6 percent compared to the first half of 2023.

The biggest driving force has been the 14.2 percent increase in fleet sector growth, with significant adoption of electric vehicles.

June saw a 30 percent increase in plug-in hybrid vehicle (PHEV) volumes, to reach a market share of 9.3 percent, and almost equivalent growth in hybrid electric vehicle (HEV) volumes, of 27.2 percent.

Hybrid electric vehicles (HEVs) now account for 14.9 percent of the market, while pure electric vehicles (battery electric or BEVs) now account for 19 percent of all new vehicle registrations, their highest monthly share this year.

This 7.4 percent increase in electric vehicle registrations is a positive sign as the UK market accelerates the transition to electric vehicles.

Pure electric vehicles (battery electric or BEV) now account for 19 percent of all new vehicle registrations, their highest monthly share this year

June saw a 30 percent increase in plug-in hybrid vehicle (PHEV) volumes to a 9.3 percent market share, and almost equivalent growth in hybrid electric vehicle (HEV) volumes of 27.2 percent.

But as the UK elects a new government today, falling private sales are worrying the industry, casting doubt on the UK’s shift to electric power.

The transition is currently in the hands of the fleet sector, as uptake of private drivers continues to slow.

Take-up of private EVs has fallen by 10.8 percent year-to-date, with fewer than one in five new EVs reaching private buyers.

The same is true for private sales in general: retail buyers account for less than two in five new cars (just 37.7 percent).

This represents a 15.3 percent drop in the number of individual drivers buying new cars, the ninth consecutive monthly decline.

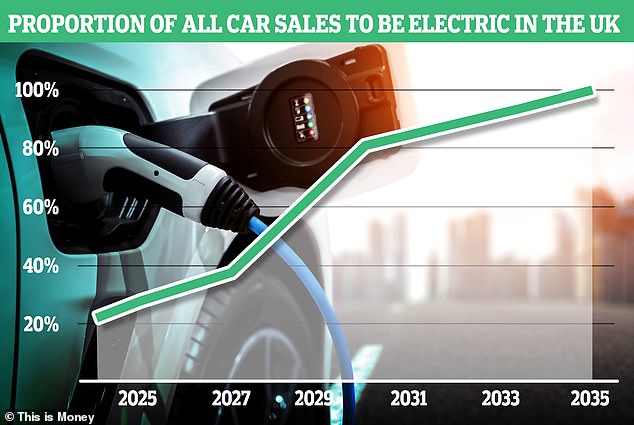

Electric future: ZEV mandate will force automakers to sell an increasing volume of electric vehicles between now and 2035

Automakers are under new pressure to meet zero-emission vehicle (ZEV) mandate targets. Brands must sell increasing numbers of zero-emission electric vehicles each year until new gasoline and diesel vehicles are banned in 2035.

The SMMT recently revealed that the UK is failing to meet its targets and that carmakers will miss a key government target for electric vehicle sales this year.

The market share of pure electric vehicles this year is expected to be only 19.8%, lower than the 22% stipulated by zero-emission vehicle regulations.

While electric vehicles now account for 16.6 percent of the new car market so far this year, up slightly from 16.1 percent in the same period last year, this adoption is still below government-mandated levels.

With Labour expected to win today’s general election, the industry is calling for greater support for private buyers on the road to net-zero emissions.

Labour has confirmed it will bring forward the deadline from 2035 to 2030, while the Conservatives have pushed it back to 2035.

Mike Hawes, SMMT chief executive, said: “With the right policies in place, the next government can reinvigorate the market and deliver a faster and fairer transition to net-zero emissions.”

“Private demand continues to lag behind the fleet, making it clear that reinvigorating the private EV market is an urgent issue that must be addressed immediately,” said Sue Robinson, CEO of the National Franchise Dealers Association (NFDA).

Richard Peberdy, KPMG’s UK automotive director, said: ‘The industry is looking to the election result and what it means for automotive policy.

‘Increasing sales of new electric vehicles is imperative for UK carmakers, who now have a mandate to ensure that an increasing percentage of the cars they make are electric each year.

‘More and more industry players are talking about how best to achieve this, including by providing greater incentives for consumers to purchase new electric vehicles.’

According to the SMMT, restoring tax incentives by halving VAT on electric vehicles for three years would put 300,000 more private electric vehicles on the road, ensuring that half of all vehicles on the road are zero-emission by 2035, reducing CO2 emissions from road transport by 175 million tonnes by that date.

Reintroducing tax incentives by halving VAT on electric vehicles for three years would put an additional 300,000 private electric vehicles on the road, according to the SMMT.

The SMMT also wants the decision to make electric vehicles pay vehicle excise duty (road tax) from 1 April 2025 to be reversed, and VAT on public charging to be reduced to 5 per cent (in line with domestic charging).

Mike Hawes, SMMT chief executive, said: “With With the right policies in place, the next government can revitalize the market and achieve a faster and fairer transition to zero emissions.

Sue Robinson, executive director of the National Franchise Dealers Association (NFDA), agreed, saying: “Private demand continues to lag behind fleet demand, making it clear that reinvigorating the private EV market is an urgent issue that must be addressed immediately.”

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.