- Paul Waterman survived shareholder vote in April after pressure from Gatemore

- Gatemore now says he will seek the president’s impeachment if action is not taken

Gatemore Capital Management has again called for the dismissal of Elementis boss Paul Waterman, warning that the group’s chairman could be subject to dismissal if action is not taken.

Waterman survived a shareholder vote in early May with the backing of 88 percent of voting investors after Gatemore called for “urgent change” following so-called “self-inflicted management failures” and frustration over the stock price behavior of the chemical company.

But in an open letter published Tuesday, Liad Meidar, managing partner of Gatemore, warned that if Waterman is not removed, he could try to unite shareholders in an effort to oust chairman John O’Higgins.

Chemicals company Elementis makes ingredients for deodorants and skin creams

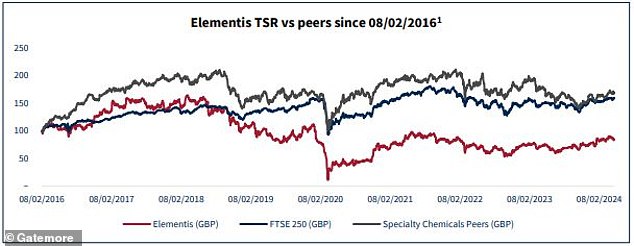

Gatemore’s frustrations with the FTSE 250 Elementis stem from disappointing share price performance compared to its peers and the broader index.

elementis stock have underperformed peers and the FTSE 250 by 86 and 76 percentage points respectively since Waterman became chief executive in 2026, according to Gatemore figures.

This despite having been supported by three acquisition proposals during that period, all of which were rejected by the group.

Meidar said: ‘(The group’s) fundamental strengths, coupled with its persistently weak share price, result in the perception that Elementis has lost its direction.

“We believe that many of Elementis’ current problems are self-inflicted and demonstrate a continued lack of judgment on the part of the company’s senior management team, particularly the CEO.”

Specifically, Gatemore has highlighted what it calls “poor capital allocation” and “poor judgment” about M&A activity.

The fund manager, who owns more than 4 million Elementis shares, believes the company has spent too much and not delivered enough in this regard.

In addition, it highlights a “disappointing” financial performance with declining profit margins and earnings per share “despite multiple cost reduction initiatives.”

Elementis, which has also previously been attacked by campaigner Franklin Mutual Advisers, has sought to rectify its performance with a series of operational restructuring and cost-cutting measures designed to save $30 million annually by next year.

But Meidar said these “proposed self-help measures reflect questionable timing, a lack of ambition in pace and, ultimately, a lack of commitment to value creation.”

Gatemore wants Elementis to “accelerate and confirm details” of the cost savings program and carry out a strategic portfolio review to refocus the business and make it more attractive to a strategic buyer.

Meidar again called on O’Higgins to fire Waterman and warned that investor anger could soon turn against him if he does not take action.

He said: ‘It is up to you, as Chairman of the Board, to take the lead in ensuring that the Board fulfills its fiduciary duties, responds to shareholder concerns, and works to foster the sustained creation of equity value for all shareholders.

‘With the benefit of our discussions with Elementis shareholders, we are confident of widespread support for our proposed approach and recommended actions.

‘This consensus underscores the critical need for urgent changes within the organization.

“In the absence of decisive action taken by the board of directors in the near term, shareholders could be forced to take proactive actions through available governance mechanisms.”

Elementis shares have underperformed peers and the FTSE 250 index