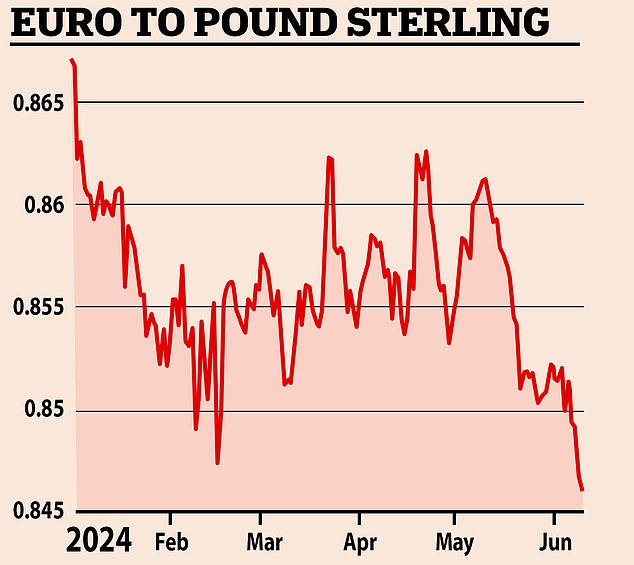

The euro fell sharply to its lowest level against the pound in almost two years overnight, hit by political uncertainty following the European Parliament elections.

One euro was worth 84.53 pence at one point, after Eurosceptic nationalist parties made the biggest gains in Sunday’s elections, and after Emmanuel Macron called a shock legislative election after being defeated in the vote by the extreme right.

It is the lowest since August 2022 and a boon for British tourists traveling to Europe this summer who will get more for their money in the eurozone.

The fall came after the French president suffered a humiliating defeat to Marine Le Pen’s National Rally party, which took home a projected 31.5% of the vote.

Far-right parties too achieved a series of high-profile victories elsewhere in the bloc, finishing first in France, Italy and Austria, and according to preliminary results, Germany and the Netherlands come in second place.

The euro fell sharply overnight after French President Emmanuel Macron called early legislative elections, in a high-risk move that could lead to Marine Le Pen’s party (pictured) taking power in the legislature. French.

The fall of the euro is a boon for British tourists traveling to Europe this summer, who will get more for their money in the eurozone.

One euro was worth 84.53 pence overnight – its lowest level since August 2022

When the results came in, the euro also hit a one-month low against the dollar (down 0.44% at $1.0753) and is now down more than 2.5% against the dollar this year.

French bond prices also fell following Macron’s decision to call early elections.

Yields hit their highest level in two weeks, around 3.17%, while Paris blue-chip shares fell 2%, driven by heavy losses at entities such as lenders such as BNP Paribas and Societe Generale. The European benchmark STOXX 600 also fell 0.7%.

The euro fight means a boost for British tourists planning to travel to the eurozone this summer.

Every year, millions of people leave the UK’s shores for the beaches of the Mediterranean or the sights of Europe’s historic cities.

Following the sharp fall of the euro against the pound, British tourists will see their money rise even further this year in countries such as Spain and Italy, which offer more affordable destinations for Brits compared to a holiday at home.

With an uncertain political future for Europe, experts have suggested the euro could remain turbulent.

The centrist, liberal and socialist parties were set to retain a majority after the election, but Eurosceptic nationalists made the biggest gains, raising questions about the ability of the major powers to drive policy in the bloc.

In a risky bid to restore authority, Macron called parliamentary elections (the first round will be held on June 30) following the results.

If the far-right National Rally party wins a majority, Macron would be left without a voice in internal affairs.

“This is probably bad news for the markets,” said Berenberg chief economist Holger Schmieding. “It introduces an unexpected element of uncertainty.”

Kathleen Brooks, head of research at trading platform .

“The question for traders in the euro and European stock markets is how radical Marine Le Pen and Jordan Bardella will be if they do well in the French parliamentary elections?” she said, referring to two far-right leaders in France.

The gap between German and Italian debt, which investors see as a measure of risk appetite in the broader region, also widened to 137 basis points.

“Obviously, the early elections are a new source of uncertainty, which should have some negative impact on economic and market confidence, at least in France,” said Jan von Gerich, chief market analyst at Nordea.

But he noted that EU election results do not always translate into national results, due to different voting systems and because EU elections tend to attract a larger protest vote.

Peter Cardillo, chief market economist at Spartan Capital Securities in New York, said it would take a big rise by the far right for the euro to weaken substantially.

Last week, the European Central Bank made its first rate cut in five years and the currency has lost almost 2.5% against the dollar this year, driven mainly by the relative prospects for interest rate cuts in the euro zone. euro and the United States.

In France, where concerns have grown over the country’s high debt levels, the implications of renewed political uncertainty for the economy could also be in the spotlight.

Standard & Poor’s last month cut France’s sovereign debt rating, delivering a stinging rebuke to the government’s handling of the strained budget days before EU elections.

The fall came after the French president (pictured) suffered a humiliating defeat to Marine Le Pen’s National Rally party, which took home 31.5% of the projected vote.

More than 360 million Europeans in 27 countries had the right to vote to elect the 720-seat legislature.

The next parliament and commission will have to deal with Russia’s continuing war in Ukraine, global trade tensions marked by US-China rivalry, a climate emergency and the prospect of a disruptive new Donald Trump presidency.

After the results, the president of the European Commission, Ursula von der Leyen, promised to “build a bastion against the extremes of the left and right.”

His center-right European People’s Party (EPP) took first place.

As the EPP’s main candidate, von der Leyen wants a second term at the head of the commission.

EU leaders will begin deciding whether to name her or another option from June 17, ahead of a summit on June 27-28.

Macron, for his part, called national legislative elections for June 30, a month before the Paris Olympics.

“I cannot act as if nothing has happened,” he said in a national address. The French people, he said, must now make “the best decision for themselves and for future generations.”

Macron himself will complete the remainder of his current (and final) presidential term, which ends in 2027, at which point Le Pen has ambitions to succeed him.

The French drama electrified an already charged day as votes were cast and counted and attention focused on how well the far right fared in each country.

In Germany, the EU’s largest economy, the scandal-plagued and fiercely anti-immigrant AfD party delivered discouraging news to Chancellor Olaf Scholz by beating his Social Democrats by 16 to 14 percent.

The AfD, considered too extremist for Le Pen, who broke an alliance with him just before the election, was kept in power by the opposition CDU-CSU bloc, which won 29.5 percent, while the Greens won 12 percent.

Members of Germany’s far-right AfD party applaud after the first exit polls were announced.

Far-right parties in the Netherlands and Belgium also gained ground, but fell short of the voting intentions credited to them before the elections.

In Austria, the far-right Freedom Party led the count in exit polls, the first time the group has led a national vote in the Alpine country.

In Italy, Prime Minister Giorgia Meloni’s ruling post-fascist Brothers of Italy did better than expected, coming out on top with 28 percent. Her result made her one of the few major European leaders to emerge stronger from the polls.

In Hungary, near-final results showed Prime Minister Viktor Orban’s far-right Fidesz party heading for what could be its worst result in his 14 years of rule, still a substantial 44 percent but well below the 52 percent mark. percent that it obtained in 2019.