After a difficult two years, UK smaller business director Neil Hermon is convinced “things can only get better”.

Echoing the words of D:Ream’s 1997 Labor election anthem, he believes an improving economic climate in the UK is great news for the companies the investment fund he runs has in its portfolio.

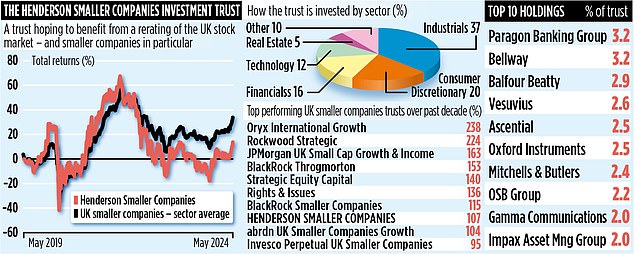

The £642m fund in question is Henderson’s smaller listed companies.

“The majority of the holdings in the trust are UK-oriented businesses,” Hermon says.

“So a stronger national economy is good for them, for consumers and, hopefully, for our shareholders.”

Certainly, all the economic figures now look more positive. Last week, the Office for National Statistics said that in the year to April, annual inflation fell to 2.3 per cent.

The International Monetary Fund also raised its growth forecast for the UK economy this year from 0.5 per cent to 0.7 per cent.

He also said there was scope for the Bank of England to cut interest rates between now and the end of the year – two or three cuts of 0.25 percentage points.

The fund currently has just under 100 holdings and focuses exclusively on the UK stock market.

The market capitalization of the largest companies it has stakes in is around £1.5bn, meaning it owns businesses that are part of the FTSE250 index.

“We like to race our winners,” Hermon says. ‘The only risk controls we apply are that no individual holding can represent more than four per cent of the trust assets. Furthermore, if a company is so successful that it joins the FTSE100 index, we will get rid of it.’

The latest position to be forced back was that of kitchen supplier Howden Joinery Group when it became a member of the FTSE100 late last year.

Economics aside, Hermon also believes many smaller UK companies remain undervalued, despite the top end of the stock market (the FTSE100 index) hitting new all-time highs.

“I can show you over 50 charts that prove smaller UK companies are cheap in stock market terms,” he says.

‘Private equity firms and international companies have been buying companies in the UK because they believe they offer good value for money. What I can’t tell you is when the shares of smaller UK companies will appreciate higher.’

The trust’s performance figures have improved in recent months. Over the past year, the fund generated a total return of 12.3 percent, compared with respective losses of 5.6 and 28.2 percent in the year to May 24, 2023 and May 24, 2022 An attractive feature of the trust is its income. .

The trust now has 20 consecutive years of annual dividend growth under its belt and this is likely to become 21 when the final dividend for the current financial year is announced in August.

Among smaller company trusts, only Athelney (21), BlackRock Smaller Companies (21) and Global Smaller Companies (53) have longer records of dividend growth.

“It’s an important part of the overall performance we get,” Hermon says. The income, paid semiannually, is equivalent to a dividend of just under three percent.

Janus Henderson, the fund management group behind the trust, has £1.2bn of assets in smaller UK companies.

Recent additions to the portfolio include healthcare company hVivo and engineering company Keller.

The trust’s ongoing charges are 0.91 per cent (source: Hargreaves Lansdown) and its stock market identification code is 0906506. Its market symbol is HSL. Hermon is supported by MP Indriatti van Hien.