The most popular age at which people want to retire is 62, but most adults believe they will work longer or, in some cases, never be able to stop.

People who expect to have to work longer think it will take them an average of seven more years to afford retirement, and about a quarter say that will never happen, according to a new study.

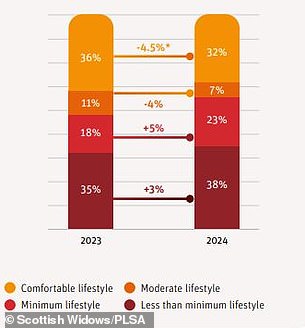

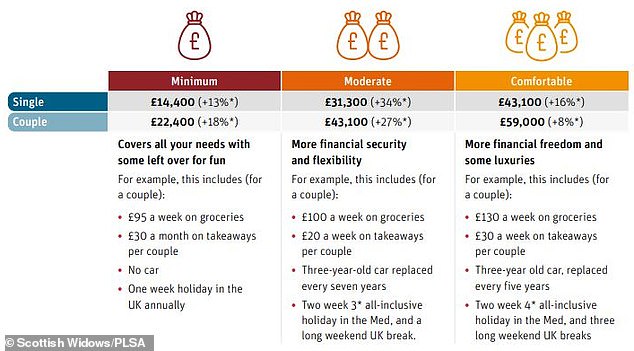

The report also shows that more adults are likely to fall short of the minimum income standard in retirement (£14,400 for a single person and £22,400 for a couple) than at this time last year.

Retirement planning: The most popular age to stop working is 62, but 54% of adults believe they will have to work longer than they would prefer

According to the Scottish Widows study, an additional 1.2 million people are unable to afford even the most basic retirement lifestyle.

Influential industry standards are used that look at what individuals and couples need for a minimum, moderate or comfortable retirement – find details of each level below.

He Study of the Association of Pensions and Life Savings It assumes you qualify for a full state pension, which rose to £11,500 a year in April, but the figures do not include income tax, housing costs (if you rent or are still paying a mortgage) or care fees.

The rise in the percentage of people expected to experience the poorest pensions, from 35 percent to 38 percent over the past year, is due to the rising cost of living.

The firm says rents rose 15 percent between 2022 and 2023, while wages rose 6.2 percent and state pensions increased 8.5 percent.

Scottish Widows found that 54 per cent of people believe they will have to work longer than they would like, with the preferred cut-off point typically being 62.

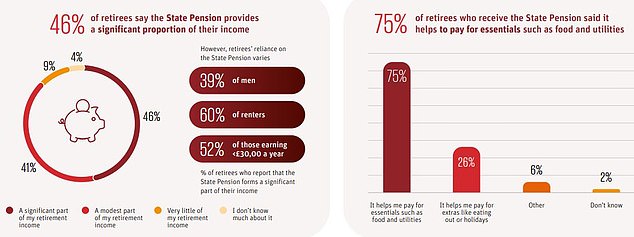

It also showed that 25 percent of future retirees expect the state pension to provide a significant portion of their retirement income.

Rising costs mean fewer people are on track to have a better lifestyle in retirement

Among people who are already retired, 75 percent say the state pension helps them cover essential bills.

The state pension age is currently 66 and will rise to 67 between 2026 and 2028.

It provides a guaranteed income for life, which many people no longer get from their workplace plans as private sector employers phase out final salary pensions.

Outside the public sector, employers have opted for more austere defined contribution pensions, in which individuals also bear the investment risk of the savings they must live on in old age.

Scottish Widows surveyed more than 5,000 adults, weighted to be representative of the UK population, during the spring.

“People are starting to think about how their private pension fund might interact with their state pension entitlement to plan for their retirement,” says Pete Glancy, director of pension policy at the firm.

‘But there is still a real reliance on state pensions, and while some will be able to use their private pension pot to get the flexibility they seek in terms of retirement age, others are only just beginning to realise that they could end up working for much longer.’

He added: “Now is the right time for the new Government to take a holistic view of people’s financial resilience across their lives, paying particular attention to those whose retirement outcomes are projected to be much lower.

The state pension, currently £11,500 at full rate, helps many retirees meet their basic needs (Source: Scottish Widows)

Are you worried about saving enough for your retirement?

Pete Glancy of Scottish Widows offers the following advice.

Imagine your future: Considering what you want your lifestyle to be like and what your financial priorities will be is very important as this will help you think about how much you need to have saved.

Our retirement report found that 57 percent of people want to spend more time on activities, while 37 percent will support their children and grandchildren in retirement.

Think about money: Half of people between the ages of 50 and 60 have done little or no research into how much they might need to save for retirement.

This covers everything from the cost of care and bills, to food and housing.

If you don’t know where to start, the PLSA has published a set of living standards for retirees showing what life in retirement might be like at different income levels.

Now it’s time to calculate how your current savings compare to the lifestyle you want to enjoy.

PLSA Retirement Living Standards: What lifestyle is available at different income levels?

Are you not on the right track? Don’t panic. There are things you can do to boost your retirement savings, no matter what stage of the savings process you’re in.

If you have a workplace pension, talk to your employer about your contributions and how to increase your savings levels or if they offer salary swapping.

If you are self-employed and can save for your personal pension, consider your options. It is also a good idea to take advantage of times such as pay rises or bonuses to increase your contributions.

> How to get the most out of your work pensionnorth – also see the tips below

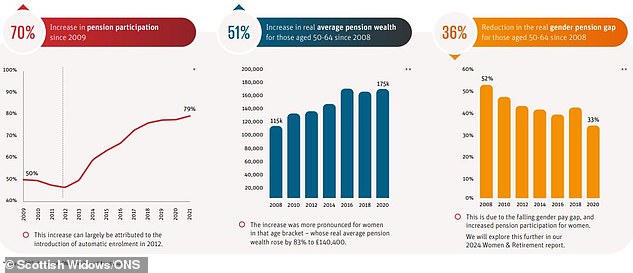

How have pensions changed since Scottish Widows began conducting its annual survey two decades ago?

Are you thinking about working longer? More than half of people expect to work seven years longer than they thought, and only 26 per cent expect to retire at or before the current state pension age of 66.

Delaying your retirement can give you more time to make contributions, leave that money invested, and give it the potential to grow until you decide to withdraw money from it.

This could mean retiring gradually or finding a job that allows you to continue into a later stage of life.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.