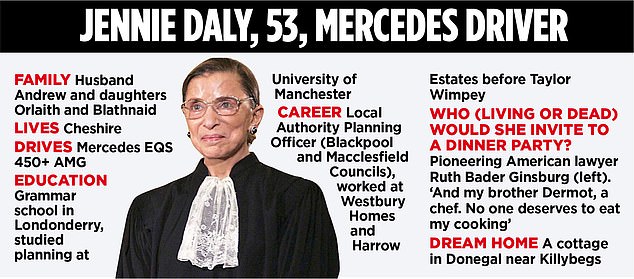

Woman first: Taylor Wimpey boss Jennie Daly

Jennie Daly, CEO of Taylor Wimpey, knows how divisive housing can be. She was born in Derry in 1970, when a wave of political violence was sweeping Northern Ireland. “Housing was a huge social and community problem,” she says. “There was a high level of underinvestment and, as a result, many conflicts.”

After the Second World War, Northern Ireland suffered a shortage of social housing and there were protests against anti-Catholic housing discrimination.

“I’m the youngest of four siblings,” she says. ‘Before I was born, my parents lived in a third-floor apartment with a water tap on the ground floor.

‘For a time, one of my brothers had to go live with my grandmother in the countryside. No one wants to choose a child for whom there is no place. That led me to understand the importance of housing to me.’

It certainly offers a stark insight into the housing divisions in the UK today: between young and old, North and South, rich and poor.

The Government is very aware that this is a critical point. Housing Secretary Michael Gove warned last week that if young people cannot buy their own homes they could abandon democracy.

Prime Minister Rishi Sunak last week revealed a plan to boost housing construction in urban areas to meet demand for new homes without alienating county voters.

Daly, 53, points to “a deficit of four and a half million homes in the UK” and argues that we need a national housing plan.

Local plans, he says, are “partial in their adoption” and decision-making at that level is “very challenging.”

It argues that a national plan is essential so that issues such as transport links, flood risks, employment and the economy can be considered in a wider context when deciding where to build.

She acknowledges that it is “a challenge to offer services in a way that the existing community does not feel that their services are under pressure.”

He adds: ‘With planning there is a danger that we feel it is too big to deal with. But we can’t just say it’s too difficult.’

He notes that stamp duty is “certainly an area” where Chancellor Jeremy Hunt could act.

Property purchases under £250,000 are not subject to stamp duty, but 5 per cent is charged on homes costing between £250,001 and £925,000. After that it increases from 10 per cent to a maximum rate of 12 per cent on values over £1.5 million.

First-time buyers pay no stamp duty on properties valued at £425,000 or less.

Daly says “there are real arguments” for reducing stamp duty for lower value homes and “there are definitely arguments on the downsizing side”.

Cutting the tax even further for first-time buyers – and for seniors who want to sell properties that are too big for them after their children leave home – would free up the market.

“We have overcrowding at the low end of the market and underoccupancy at the high end,” Daly says. ‘So it would be a smart move.

‘Removals boost the economy. We have to look at the dampening effect that stamp duty has.

‘Mobility is of fundamental importance for a healthy economy. When that becomes more difficult because there is a tax such as stamp duty or the lack of availability of housing, then the economic options of the individual and the economy begin to be limited.

“If there is a lack of adequate and appropriately sized housing, households will stop forming, birth rates will fall, mobility will come to a standstill and the real estate market will atrophy.”

Do you think there has been a fundamental change in the real estate market in recent years? Will this generation of young people ever enjoy the kind of housing security and wealth that their parents and grandparents enjoyed?

It doesn’t go that far, but it suggests that the notion of housing scale – where people trade up for bigger and better properties – is no longer valid.

“The idea of a young person buying a one-bedroom apartment and holding it for a few years is probably no longer true.”

She says first-time buyers today are generally older and have probably already set up a household with a partner and children.

“They want a bigger house and are more likely to stay there for a long time,” Daly says. “My generation thought of housing as a ladder to climb, but that concept is changing.”

As for his strategy at Taylor Wimpey, rather than radical change, he focuses on operational excellence and customer service. That means efficiency, discipline, cost control and delivery on time and on budget.

“We talk a lot about keeping things as simple as possible, about discipline,” he says. ‘We come to today’s market with a really strong balance sheet and a top-notch, experienced team. I inherited a business in a very good place. I’ve focused on the practical aspects.’

Whether by coincidence or not, this is an approach she shares with other bosses, including Margherita Della Valle at Vodafone.

Home construction, however, remains a man’s world. Daly is Taylor Wimpey’s first female chief executive in more than a century of history.

Her awareness of the social aspect of housing is a change from the crude greed displayed by some male bosses like Jeff Fairburn, former CEO of Persimmon. He disgraced the entire sector with his £75m bonus.

“When there is a negative story, it reflects on all homebuilders,” he says.

Daly receives a basic salary of £750,000 plus £75,000 pension contributions, plus a performance-linked bonus of up to £1.1 million and shares worth up to £1.5 million.

She has been involved in cleaning up some scandals, particularly the leasing issue, where thousands of people who bought homes from Taylor Wimpey – and properties from other companies – were caught with ground rent charges doubling every ten years.

These spiraling bills made it difficult to sell or remortgage. Following an investigation by the Competition and Markets Authority, Taylor Wimpey agreed to free homebuyers from the trap.

“We accepted that it was not appropriate,” he says. ‘We put in a provision of £130 million and I spent several years going to the landlords to renegotiate those leases.

‘There is a long queue of cases, but it is progressing. “He deserved an apology and we are sincerely sorry.”

Taylor Wimpey was also involved in the cladding scandal that followed the Grenfell Tower tragedy. The company has set aside hundreds of millions of pounds to pay for the removal of dangerous cladding.

Daly points to a crisis looming over the British housing stock. Despite the Luftwaffe’s best efforts, 40 per cent of housing in the UK is pre-war.

“We have the oldest reserves in the world and some are really energy inefficient,” he says. “This aging housing stock is not fit for the future.”

I asked Daly if he ever lived in a house built by his company.

“I joined Taylor Wimpey ten years ago and have been in my current home, with my family, for 17 years,” he says.

—So no, I’ve never had one. Maybe my next step. Some of them are really beautiful.’

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.