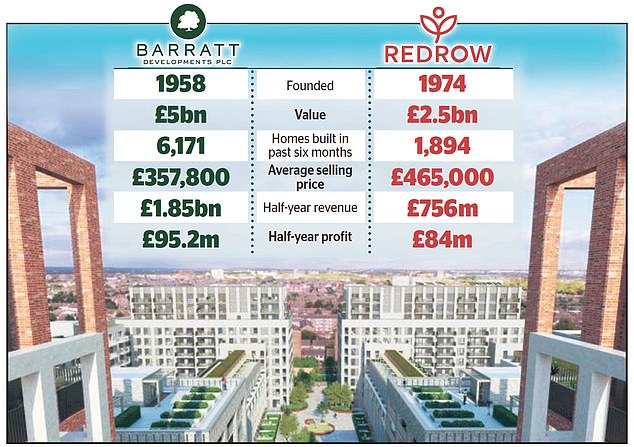

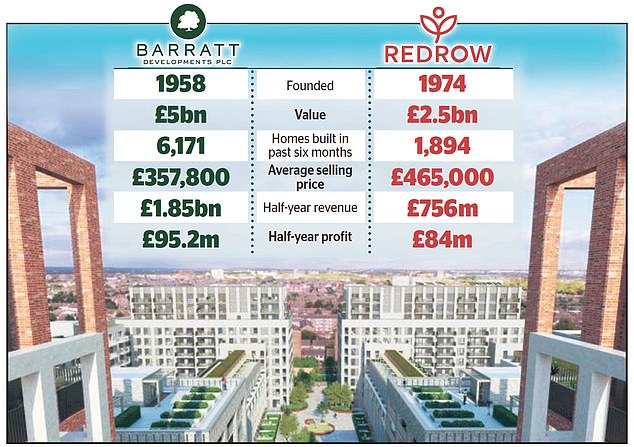

- Britain’s biggest housebuilder agreed to buy Redrow in February

- CMA is concerned the deal could cause house prices to rise

<!–

<!–

<!– <!–

<!–

<!–

<!–

Britain’s competition watchdog has opened an investigation into Barratt Developments’ £2.5bn acquisition of FTSE 250 housebuilding rival Redrow.

The Competition and Markets Authority said on Friday it was investigating whether the acquisition could result in a “substantial lessening of competition” within the UK’s goods and services markets.

Barratt claimed the deal would help tackle the UK’s huge housing deficit, but critics at the time raised concerns that it could lead to higher prices as a result of weaker competition.

Higher card prices? CMA to investigate Barratt and Redrow housebuilding deal

The CMA’s latest intervention comes just weeks after the watchdog warned that Britain’s biggest housebuilders, including Barratt and Redrow, could be colluding in building projects to keep prices high.

The CMA has opened an initial comment period for interested parties, which will end on April 2, after which it will launch a formal investigation.

There are already concerns that the concentration of major players in the housebuilding market means it is not performing well. Critics say the deal could make things worse.

It follows a tougher trading period for the housebuilding industry, which has seen demand hit by lower affordability and availability of mortgages, as well as higher costs.

Barratt saw its adjusted pre-tax profit fall almost 70 per cent to £157.1 million in the six months to December 31, with revenue falling 33.5 per cent.

Redrow’s profits more than halved to £84m, forcing the group to cut its dividend to 5p a share, while revenue fell by £275m to £756m.

baratt stock fell 0.7 percent to 473.8 pence in early trading on Friday, while Redrow shares They were down 0.3 percent at 661 pence.

Both say the deal could help alleviate Britain’s housing deficit, but critics say it will further worsen market concentration.