A Tampa couple was devastated to learn their insurance company denied their flood claim because their living room is classified as a basement.

Food water flooded Jaime Giangrande-Holcom’s family home and ruined everything in the living room when Hurricane Helene hit the Sunshine State in September.

The extensive damage prompted her and her husband to file a claim through the National Flood Insurance Program (NFIP).

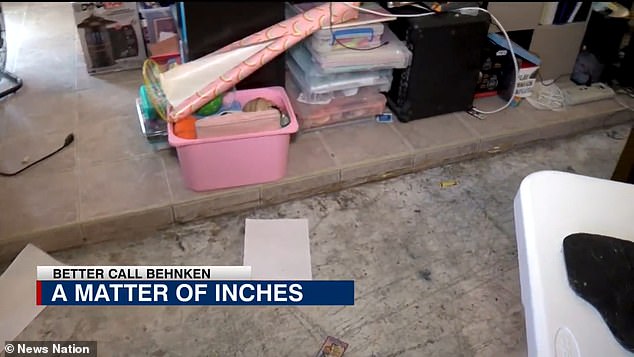

However, an insurance adjuster said the three-and-a-half-inch ‘step’ from the entrance to the living room means the area is technically classified as a “basement” and therefore not included in their coverage.

‘It’s ridiculous. “Even coming out and saying the word ‘basement’ in the state of Florida is comical,” Jaime said. WFLA.

Jaime Giangrande-Holcom (pictured) said an insurance adjuster denied his flood claim after Hurricane Helene.

The adjuster said the three and a half inch ‘step’ from the entrance to the living room means it is classified as a basement and is not covered by insurance.

‘I grew up in New York and I know what a basement is like. He lived in basements. This is not a basement.

The storm, which reached Category 4, killed more than 200 people in several states and early estimates show economic losses could exceed $50 billion.

Jaime and her husband had paid $3,800 for flood insurance this year through the National Flood Insurance Program (NFIP), administered by the Federal Emergency Management Agency (FEMA).

The NFIP defines a basement as any area of a building with a floor that is below grade on all sides, according to its website.

Rooms that are not completely below ground level, such as sunken living rooms, are considered basements because the lowest floor is underground on all sides.

However, Jaime hopes that measurements of his house will show that the living room is not below grade and therefore is not a basement.

‘As for measurements, it’s four and a half inches that go up to our house, and it’s three and a half inches that go down to our “basement,”‘ he said.

Floodwaters from Hurricane Helene devastated Jaime and her husband’s home in Tampa, ruining everything in their living room.

The National Flood Insurance Program said sunken living rooms like Jamie’s are considered “basements” because the lowest floor is below grade.

A FEMA spokesperson told the local media outlet that it is important for homeowners to understand what their policy does and does not cover.

“The National Flood Insurance Program considers a sunken living room to be a basement when it has a floor below grade (subgrade) on all sides,” the spokesperson said.

“In this situation, the three-and-a-half-inch stepped (sunken) area of the reference home is considered a basement and, as a result, there would be limited coverage in this area.”

Recent natural disasters have exposed how few Americans have flood insurance, and experts are now warning of the potentially devastating impact this can have.

Flood insurance is not included in homeowners insurance and must be purchased separately.

In some areas, including parts of Florida, flood insurance is required on government-backed mortgages for homes classified as high risk by FEMA.

However, insurers are increasingly raising prices and withdrawing entirely from states like Florida as the cost of covering rising natural disasters rises.