Table of Contents

Terry Smith has defended his decision not to add Nvidia to Fundsmith Equity’s portfolio, despite the fund having underperformed the benchmark since January.

In a letter to shareholders, the industry veteran said the fund was up 9.3 percent in the first six months of the year but still underperformed the MSCI World Index, which returned nearly 13 percent.

“A 9 percent increase in value in a year would be in line with the long-term average for stocks, so 9 percent in half a year would normally be cause for celebration, except, of course, that it is lower than the index,” he said.

Not convinced: Stock picker Terry Smith defended not holding Nvidia as the outlook is “not that predictable”

Instead, returns have been concentrated in a few stocks, with nearly half of all S&P 500 returns coming from Amazon, Apple, Meta, Microsoft and Nvidia.

Fundsmith Equity owns three of the five stocks and has overweight positions in Meta and Microsoft, while saying its stake in Apple “remains small as we patiently wait for the share price to reflect the company’s current trading.”

A quarter of all returns came from Nvidia, which had a blistering start to the year after demand for its chips soared.

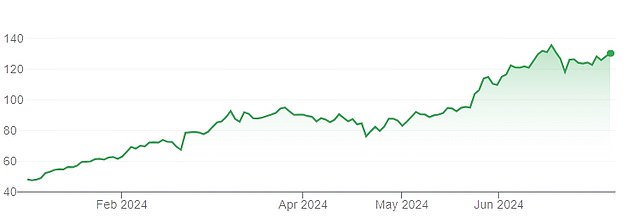

Despite a $577 billion write-down last month, Nvidia’s share price is up 166 percent so far this year.

Other funds have doubled down on Nvidia. The Blue Whale Growth fund, managed by Stephen Yiu, now has the chipmaker among its top 10 holdings.

Yiu recently told the Mail on Sunday: “We have long thought that Nvidia would become the most valuable company in the world… by overtaking Microsoft, it has now achieved that remarkable milestone.”

Smith isn’t so sure, telling investors: “We don’t own any Nvidia because we have yet to convince ourselves that its prospects are as predictable as we’re looking for.”

‘Without owning these stocks, and indeed all five in at least one index weighting, it was difficult to achieve outperformance.’

Nvidia shares are up more than 150% since the beginning of the year, despite a sell-off last month

Novo Nordisk was the top performer in Fundsmith’s portfolio, up 3.4 percent, followed by Meta, Microsoft and Alphabet, which contributed 2.7, 2 and 1 percent respectively.

Consumer brands L’Oreal, Nike and Brown Forman were among the biggest detractors.

Pet care company Idexx also suffered in the first half of the year, contributing a loss of 0.6 percent.

“The drop in pet owner visits to veterinarians after the pandemic splurge and problems in the Chinese economy explain most of the problems and leave us with little concern about the long-term outlook for most of these companies,” Smith said.

“In at least one case, the problem is probably not the business but the management.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you