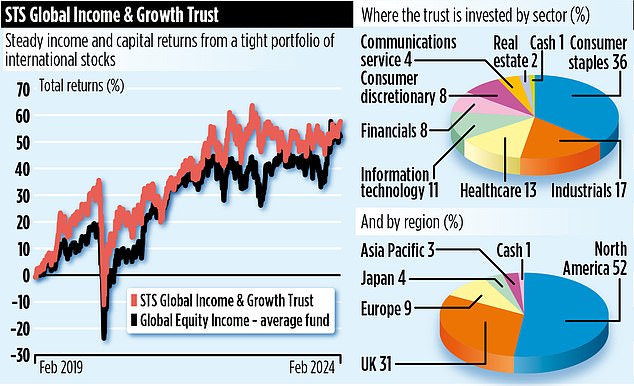

Investment trust STS Global Income & Growth has undergone a significant reboot since Troy Asset Management took over three years ago. Troy, an investment house that prioritizes capital preservation of clients’ wealth, has revamped the trust’s portfolio, divesting 95 per cent of the shares it inherited from Martin Currie, the previous trustees.

It has also reset the dividend dial so that shareholders now have every chance of enjoying income growth for the foreseeable future, while the trust was renamed the Securities Trust of Scotland last year to give investors a better idea of what it does.

The final part of the trust’s renewal will take place in the coming weeks when, subject to a shareholder vote, it will absorb the assets of fellow fund Troy Income & Growth. The merger should create a vehicle with assets of just under £400m. The reward for shareholders will be a reduction in the charges Troy imposes on the new combined trust.

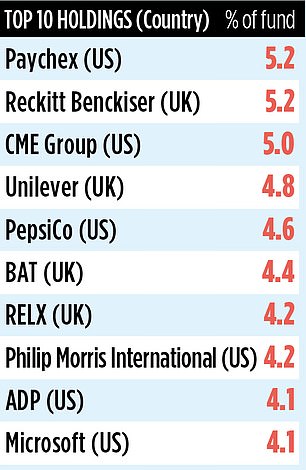

Although the shares STS inherits from Income & Growth will be listed primarily in the UK, there will be a lot of portfolio overlap: around 15 stocks (such as RELX, Unilever and Reckitt Benckiser) are common to both portfolios. It will also remain firmly a global income fund with a significant portion of its assets allocated to the United States and Canada.

James Harries, manager of STS, believes it will be business as usual. He says: ‘When we joined in November 2020, we wanted to establish STS as the high-quality, low-volatility trust in the global equity sector. I think we’ve done it.’

Performance figures support this claim. Over the past three discrete one-year investment periods, the trust has recorded returns of 2.3 (year to early February 2024), 4.8 (2023) and 12.5 per cent (2022).

Given the emphasis on capital preservation, Harries is meticulous about which stocks end up in STS’s portfolio. He avoids sectors such as energy and mining (too cyclical); automobiles and retailers (vulnerable to competitive disruptions); home builders and construction companies (too capital intensive).

By contrast, key areas of interest include select industrial stocks such as US semiconductor giant Texas Instruments, a company that has invested heavily in cutting-edge technology to ensure long-term cash flow growth.

It also has a stake in Canadian National Railway, which Harries believes will benefit from the push to boost freight transportation off the roads and onto the railways. Harries also likes some of the non-banking financial companies, such as wealth managers.

One of the top 10 holdings is the Chicago Mercantile Exchange (CME), which has benefited from growing interest among U.S. investors in financial instruments such as futures.

Once Income & Growth’s assets have been absorbed by STS, Harries is confident that the trust will find widespread appeal among investors keen to preserve their wealth while earning income from their investable assets.

“The fund will be invested in resilient companies,” he says. ‘It will deliver a dividend income equivalent to around three per cent a year and we will endeavor to increase it by around five per cent a year. Hopefully, we are building an attractive investment that will attract young and old.”

The trust’s market identification code is B09G3N2 and the symbol is STS. Total annual charges are 0.94 per cent, although they should fall when Income & Growth’s assets come under its umbrella.

Dividends are paid quarterly and the latest payment is 1.53 pence. The shares are currently trading at around £2.25.