Table of Contents

The proportion of homes bought by homeowners has fallen to a 14-year low, according to new data, while mortgages granted to them have more than halved.

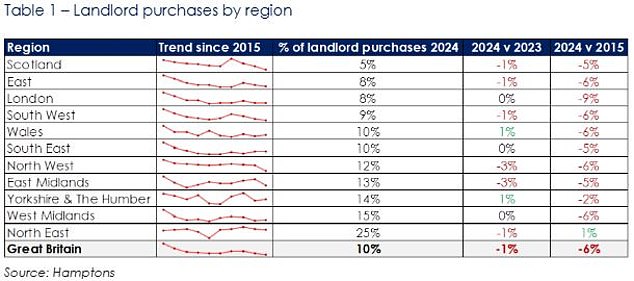

According to real estate agency Hamptons, only one in ten homes sold during the first half of this year went to an investor who bought them to rent out.

This is the lowest percentage since records began in 2010.

This is causing a shortage of supply for renters, with 42 percent fewer rental homes on the market last month than in June 2016.

Sales: Homeowners bought just 10% of all homes sold during the first half of this year, the lowest share seen since 2010 according to real estate agency Hamptons

The homeowner mortgage market also contracted for the first time this year, UK Finance figures show.

In the first three months of 2024, there were 59,000 fewer pending buy-to-let mortgages than in 2023, with the total falling from 2.039 million to 1.98 million.

Their data suggests that buy-to-let mortgages that are being paid off are not being replaced by new business.

The number of new mortgages granted fell from 25,280 in the last three months of 2022 to 12,422 in the first three months of 2024.

Aneisha Beveridge, Hamptons’ research director, said: “Rather than a sell-off by homeowners, the lack of available rental properties has been due to fewer investors entering the market.”

Why don’t homeowners buy houses?

Buy-to-let lost its appeal for some in 2016, when the Conservative government introduced a series of tax and regulatory changes.

This included a 3 per cent surcharge on stamp duty, which increased the bill for a £300,000 property purchase from £2,500 to £11,500, and the loss of the ability to offset mortgage interest payments against income tax.

Today, higher mortgage rates provide another reason to discourage homeowners from purchasing homes.

According to Moneyfacts, the average five-year fixed-rate mortgage to buy a rent-to-let property is currently 5.5 per cent. For someone buying a home with a £200,000 mortgage over a 25-year term and paying interest only, that means paying £917 a month.

At the end of 2021, rates below 3 percent were available.

Expert: Aneisha Beveridge, head of research at Hamptons, says landlord shortage is driving up rents

Is the Labour Government scaring homeowners?

Some homeowners may also have been spooked by the election and the plans of the new Labour government.

According to Hamptons, the proportion of investor purchases has been gradually declining throughout the year, hitting a low of 9.7 percent in June.

If current trends continue into the second half of the year, there are likely to be 113,630 new rental home purchases in 2024.

This would be equivalent to 75,900 fewer rental home purchases than in 2015, which represents a 40% drop.

Beveridge says: ‘Tax and regulatory changes introduced since 2016 have been the main culprits, but these disincentives to invest have been compounded more recently by higher interest rates and political uncertainty around the threat of further rent reforms.

‘Most investor buying this year has been driven by owners with large portfolios and plenty of cash who continue to expand their portfolios.’

By the end of the year, Hamptons estimates that private landlords will have sold 328,750 more rental homes than they have purchased since 2016.

This is despite the fact that the proportion of homes sold by one owner has been declining for the past three years.

Private owners accounted for 13 percent of all sellers so far this year, up from 14 percent in 2023 and 16 percent in 2022.

Based on current trends, Hamptons estimates that private landlords will sell 146,060 more homes this year, more than offsetting the 113,630 new rental home purchases projected.

Shortage: Landlords continue to sell more properties than they buy, reducing the number of homes available for rent.

Rents are rising

The shrinking supply of rental housing, coupled with rising demand, is driving up rents almost three times faster than inflation.

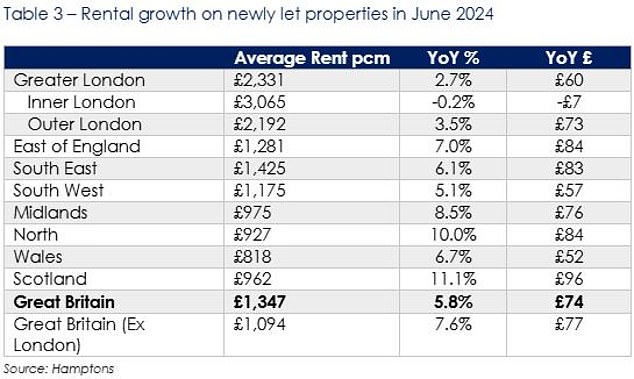

The average tenant who agreed a new lease in June paid £1,347 a month, 5.8 per cent more than the same period last year, according to Hamptons.

“Lack of supply is one of the main factors underpinning strong rental growth and this is unlikely to reverse any time soon,” adds Hamptons’ Aneisha Beveridge.

‘While some homes that would have previously been purchased by an investor have found their way into the hands of a first-time buyer, high mortgage rates and rising rents are likely to exclude many potential homeowners in the coming years, keeping them in the rental sector for longer.’

While there may be a shortage of landlords, some investment firms are trying to fill the void.

Pension funds and insurance companies are partnering with homebuilders and developers to build large-scale rental housing developments, known in the industry as “build-to-rent.”

The investors then hold onto the homes rather than selling them, essentially acting as corporate landlords.

These programmes have created new apartments and homes designed specifically for tenants located in a number of cities and towns across the UK.

However, rents are often higher than the market average due to the amenities they offer, such as gyms and common rooms.

According to the real estate company Savills, 106,000 rental homes have been built since June 2016, a figure far below that needed to fill the gap left by landlords.

Landlords prefer the North East of England

According to Hamptons, homeowner purchases have fallen in every region except the Northeast since 2015.

There, the share of homes purchased by an owner has increased slightly from 24 percent in 2015 to 25 percent in 2024.

London has seen the biggest decline in new home purchases.

The proportion of homes bought by owners in the capital has more than halved, from 17 percent in 2015 to a record low of 8 percent so far this year.

Lower rental yields in the capital are believed to have left landlords with less room to cover higher costs.

Scotland has the lowest level of investor buying, according to Hamptons analysis.

Rental investors have bought just 5 per cent of homes sold in Scotland so far this year, down from 10 per cent in 2015.

According to Rightmove, renters in Scotland currently face the fiercest competition for rental property.

During the Covid-19 pandemic, stricter rental rules were introduced in Scotland along with a new 6% stamp duty surcharge on second home purchases from the end of 2022.

Until recently, Scottish landlords were only able to increase rents on their existing leases by up to 3 per cent unless they received special permission.

However, the cap was lifted from March 31 and means rental costs will once again be under the control of landlords, 18 months after the first price freeze was introduced.

Despite rent controls, average advertised rents in Scotland have risen 11.1 percent year-on-year, according to Hamptons.

North-South split: Owner purchases have increased in the North East since 2015, while London has seen the biggest decline in new owner purchases

Owners seek high returns

Rental yield is the percentage return an investor can expect to earn on the purchase price of their property each year, before taxes and other costs are taken into account.

For example, a 5 per cent gross yield on a £200,000 property would equate to £10,000 per year in rental income.

High mortgage rates mean new buy-to-let investors are increasingly targeting higher-yielding areas to rack up sums.

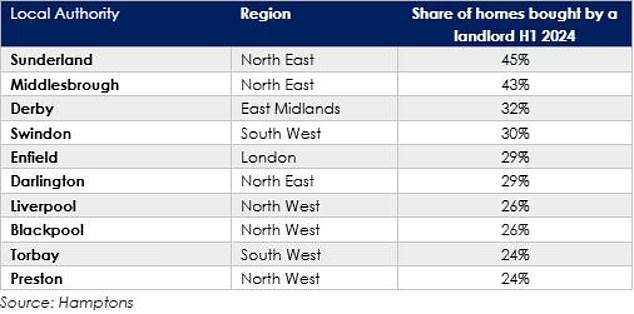

Six of the ten local authorities with the highest proportion of home purchases to let are in one of the three northern regions.

For example, in Sunderland, 45 per cent of homes were purchased by an investor during the first half of the year.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.