Donald Trump increased the national debt almost twice as much as Joe Biden during his presidential term, according to a new report analysis of your tax expenditure.

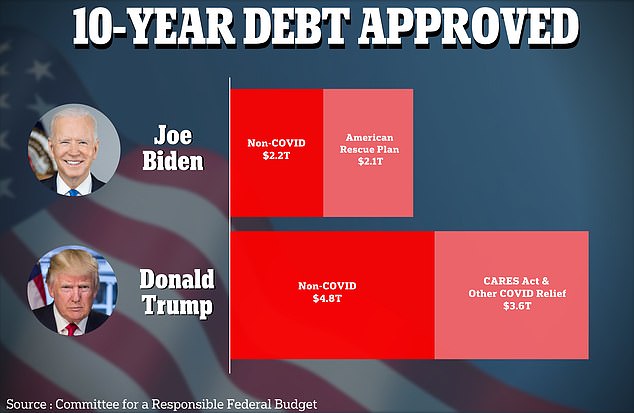

Former President Trump approved $8.4 trillion in new 10-year loans over his entire term, according to a nonpartisan public policy think tank.

Meanwhile, President Biden has given the green light to $4.3 trillion of the same type of loan with seven months left in his term.

Even excluding pandemic-era relief spending from the count, Trump still contributed more to the national debt while in office, according to the report.

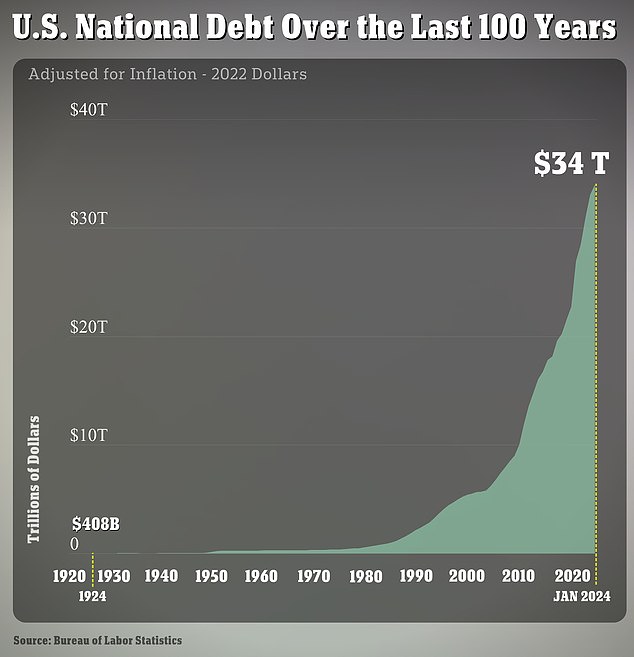

The winner of November’s presidential election faces a bleak fiscal outlook, with the national debt on track to reach a record share of the economy under the next administration.

Debt surpassed the $34 trillion mark earlier this year, and is set to surpass $56 trillion in 2034, according to projections earlier this month.

Former President Trump approved $8.4 trillion of new 10-year loans over his entire term

The report from the nonprofit Committee for a Responsible Federal Budget notes that both candidates bear some responsibility for adding substantial amounts of new borrowing in their first term.

However, it found that Trump’s spending was much higher, thanks in part to the major tax reform he introduced in 2017.

Aside from Covid relief, Trump added $4.8 trillion in loans over a ten-year period.

Their biggest additions to the debt were tax cuts, which added $1.9 trillion in additional borrowing, and bipartisan spending packages that added $2.1 trillion.

Trump added $3.6 trillion in Covid relief, analysis shows, including $1.9 trillion with the CARES Act introduced at the start of the pandemic in March 2020.

Meanwhile, Biden has added $2.2 trillion in non-Covid spending in the three years and five months since he took office.

This has been made up of 2022 and 2023 spending bills, which added $1.4 trillion, student debt relief programs, which added $620 billion in debt, and changes to SNAP and Medicaid benefits .

In terms of Covid relief, the President added $2.1 trillion in debt through his American Rescue Plan Act, which provided a large amount of funding to state and local governments, health care providers, and relief agencies. public health.

According to the analysis, about 77 percent of the 10-year debt approved by Trump came from bipartisan legislation, while 29 percent of the 10-year debt President Biden has approved so far came from bipartisan legislation.

“The next president will face enormous fiscal challenges,” said Maya MacGuineas, president of the fiscal watchdog. axios.

“However, both candidates have a track record of approving trillions in new loans, even leaving aside COVID-warranted loans, and neither has proposed a comprehensive, credible plan to rein in the debt,” he said.

“No president is fully responsible for the fiscal challenges that arise, but they need to use the pulpit to set the stage for making some difficult decisions.”

Warnings from economists and nonprofits about the impact of rising debt on the U.S. economy are growing louder as the election approaches.

Donald Trump increased the national debt almost twice as much as Joe Biden during his presidential term, according to a new analysis of his fiscal spending.

Public debt surpassed $34 trillion earlier this year.

The federal debt is at an all-time high and interest payments on this debt are now the fastest-growing part of the federal budget, according to the Congressional Budget Office.

Interest payments surpassed Medicaid last year and will surpass Defense and Medicare later this year. The first is health coverage for people with limited income and the second is mostly for people over 65 years of age.

This means that by the end of 2024, interest payments will be the second largest public expense. Only Social Security will involve a higher cost.

The Social Security trust fund is also headed toward depletion in 2033, when only 79 percent of scheduled benefits would be paid.

If Congress does not ensure that these programs have the resources to continue paying full benefits, this would mean that millions of Americans would see their monthly benefits cut.

Earlier this year, legendary hedge fund manager Paul Tudor Jones said a “debt bomb” is about to explode in the United States, due to “unsustainable” government borrowing.

The billionaire investor claimed that the economy appears strong, but beneath the surface it is actually “steroids” that are masking major problems.