Table of Contents

The Bank of England again kept the interest rate unchanged as a split emerged among rate setters over the impact of recent inflationary pressures.

Monetary Policy Committee members voted to keep the base rate at its current level of 5.25 per cent by a margin of seven to two, with Swati Dhingra and Dave Ramsden overruling when they urged the bank to cut 25 basis points to 5 percent.

Minutes from the MPC’s most recent meeting show that Dhingra and Ramsden, who have been more dovish than their colleagues this year, are less concerned than their peers about data on services inflation and wage growth that pushed back wage-cut expectations. market rates earlier this week.

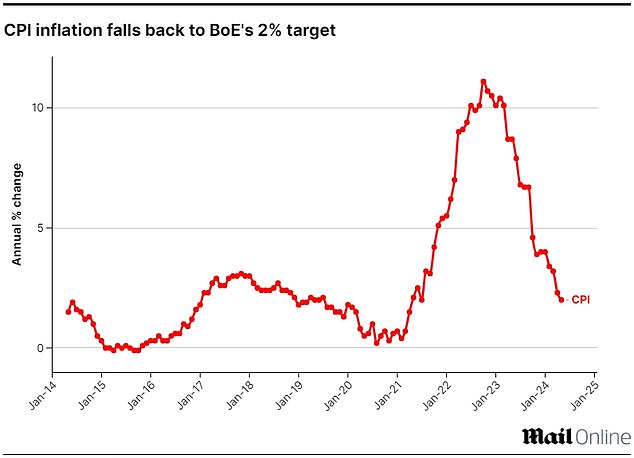

Data from the Office for National Statistics on Wednesday showed the headline inflation rate had finally returned to the bank’s 2 per cent target, but higher-than-expected services inflation and persistent labor market strength overshadowed the achievement.

Megadove: Swati Dhingra has consistently been the most moderate MPC member since joining in 2022

Who are the rebels?

External member and mega-dove Dhingra, who is also an associate professor of economics at the London School of Economics, has voted for the base rate to be lower than the consensus decision on 12 occasions since joining the MPC in September 2022. .

Dhingra voted for a cut to 5 percent in each of the last four meetings since February 1.

Ramsden, who is deputy governor for markets and banking at the Bank of England, has now voted in favor of a cut at two meetings in a row.

Since joining on September 17-22, his MPC record is 16 votes in favor of an increase, 27 votes in favor of keeping and four votes in favor of a reduction.

No other MPC member has voted for a cut since the base rate reached its current level.

| Andrew Bailey | Sara Breeden | Ben Broadbent | Swati Dhingra | Megan Greene | Jonathan Haskel | Catherine L Mann | Huw Pill | David Ramsden | |

|---|---|---|---|---|---|---|---|---|---|

| Voted to increase | 14 | 0 | sixteen | 2 | 4 | 18 | 18 | 14 | sixteen |

| Voted to keep | twenty-one | 6 | 109 | 9 | 4 | 26 | 5 | 9 | 37 |

| Voted to cut | 1 | 0 | 3 | 4 | 0 | 5 | 0 | 0 | 4 |

| No. of MPC meetings | 36 | 6 | 128 | fifteen | 8 | 49 | 23 | 23 | 57 |

Dave Ramsden has voted for a cut in two meetings in a row

What is the division?

The Bank of England said the MPC had expressed a “variety of views” on what evidence is needed to justify a rate cut “and the extent to which incremental information was leading them to materially update their assessment of the persistence of inflation.” “.

Members who voted to maintain the rate believe that the CPI’s return to its 2 percent target “is not necessarily indicative of the required sustained return to target.”

The Bank of England said: “Continued high levels of services inflation and bullish news supported the view that second-round effects would maintain persistent upward pressure on core inflation.

‘Wage growth continued to exceed model-based estimates. Domestic demand indicators were stronger than expected and risks to the activity outlook were skewed to the upside.

“For these members, more evidence of declining inflation persistence was needed before reducing the degree of monetary policy tightening.”

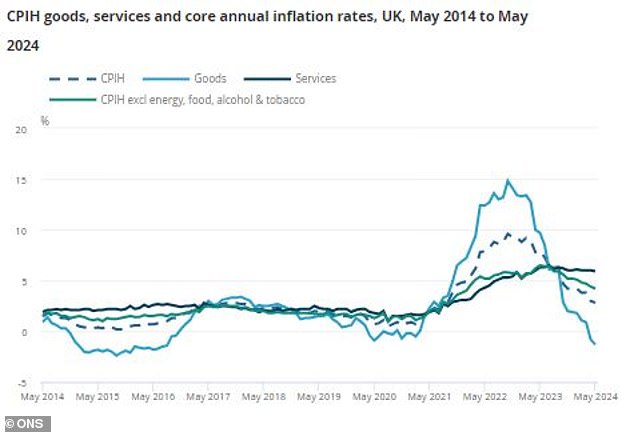

Goods price inflation has decreased significantly, but services inflation remains high

But Dhingra and Ramsden believe that positive news on service price inflation “does not significantly alter the disinflationary trajectory the economy is on”, while the increase in the national living wage in April due to wage growth should be considered. anomalous.

“Such factors (should not) drive inflation in the medium term,” he said.

‘For these members, the bank rate needed to be less restrictive now to allow for a smooth and gradual transition in policy stance and to take account of transmission delays.

“Given the weak demand outlook, the risks to inflation remaining sustainable within the medium-term target were to the downside.”

When will the Bank of England cut the base rate?

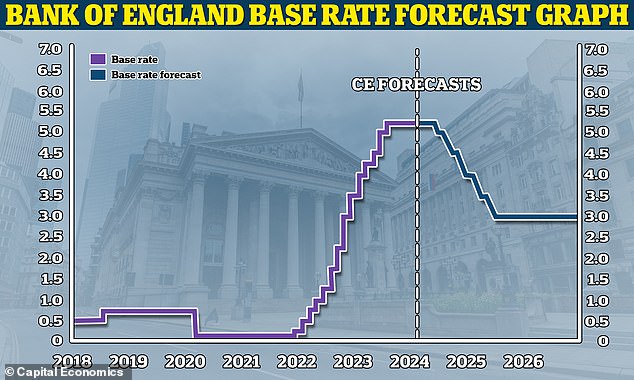

Short-term bond yields and sterling fell following the decision, suggesting markets are less confident that the Bank of England will leave the base rate unchanged again at its August MPC meeting.

Current prices suggest that the probability of an August rate cut has slowly increased from 40 to 60 percent currently, according to ING analysts.

Traders are more confident the bank will make cuts at its Sept. 19 and Nov. 7 meetings.

The general inflation rate has once again reached the target

The Bank of England said it is “prepared to adjust monetary policy as warranted by economic data to return inflation to the 2 percent target on a sustainable basis” and would therefore “continue to closely monitor signs of inflationary pressures.” and the resilience of the economy as a whole. .

“As part of the August forecasting round, Committee members would consider all available information and how this affected the assessment that the risks of persistent inflation were declining,” he added.

Julian Howard, chief multi-asset investment strategist at investment group GAM, said: “The path looks increasingly clear for some easing at the August meeting.”

‘Inflation has fallen to the target level of 2 percent, unlike the United States and, to some extent, Europe.

In particular, the UK’s energy bills are falling and, although its unique bill capping regime has seen more irregular price movements, actual prices for consumers are finally normalising.

‘However, some risks remain. The United Kingdom is in the middle of an election campaign and a possible landslide victory for the Labor Party could disrupt markets, particularly the currency.

Sir Keir Starmer has come under pressure in recent days over the issue of taxes and spending.

“While the headline inflation rate may have dipped encouragingly to 2 percent, the Bank will be keen to avoid a policy mistake where it cuts rates but then has to put the brakes on the fire or, worse, directly reverse easing due to forces beyond their control. control.’

When will interest rates fall?

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.