Table of Contents

News of an Oasis comeback tour next summer was music to many ears.

Among those set to benefit is Premier Inn owner Whitbread, according to analysts at Bernstein, who expect the hotel company to cash in on demand as loyal fans snap up accommodation.

Its shares have fallen by more than a fifth this year as part of a broader industry sell-off triggered by weak demand in the United States and China.

However, analysts said Premier Inn remains a “high-quality product” although the rising pound and falling inflation should also help.

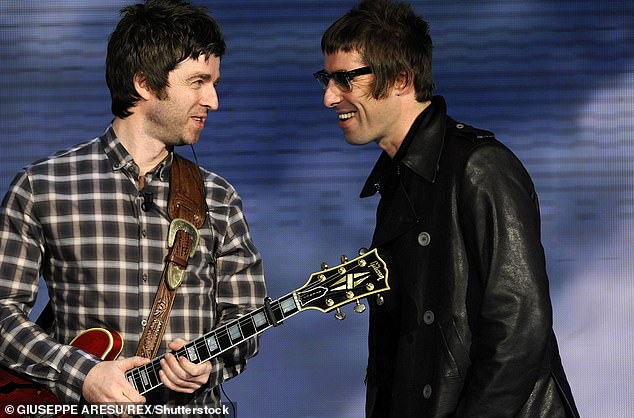

Return: Premier Inn owner Whitbread would benefit from the return of British rock band Oasis, fronted by brothers Noel, left, and Liam Gallagher.

Bernstein raised its rating from market perform to outperform and increased its target price to 3,300 pence from 3,140 pence. Whitbread rose 3.7 percent, or 105 pence, to 2,937 pence.

But there was less reason to cheer for PPHE Hotel. The owner of the Park Plaza, down 1.1% (15p) to 1,350p, reported that its average room rates fell 4.4% in the first half of 2024 following a sharp fall in leisure bookings seen over the same period last year.

The FTSE 100 rose 0.4 per cent, or 35.79 points, to 8,379.64 and the FTSE 250 fell 0.2 per cent, or 35.79 points, to 21,031.08.

Sainsbury’s has bought ten Homebase stores to convert them into supermarkets by the end of 2025 and hopes to start welcoming customers from next summer. It expects to create around 1,000 jobs and its share price rose 0.5%, or 1.4p, to 290.2p.

Greencore gained 1.5 percent, or 2.8 pence, to 183.6 pence after the sandwich maker expanded its share buyback programme by 10 million pounds.

At the same time, Grafton launched a £30 million buyback plan.

The owner of building materials supplier Selco also revealed that UK trading was under pressure as households cut spending and heavy rain hit sales during the spring.

Group sales fell 4.4 per cent to £1.14 billion, including a 5.9 per cent drop in the UK, in the six months to June 30, while profits fell by almost a quarter to £71.7 million. Grafton added 0.8 per cent, or 8p, to 1,059p.

Close Brothers was the biggest gainer among mid-cap stocks after RBC analysts raised their target price from 375p to 620p.

The lender added 8.1 percent, or 39.4 pence, to 527 pence. CAB Payments, which helps customers transfer money in emerging markets such as Bangladesh and Senegal, has partnered with Visa to make it easier to process smaller transfers, raising the exchange rate by 4.8 cents, or 5.2 pence, to 113.6 pence.

Energy services firm Huntington is to receive £46m over five years to support North Sea operators. The half-year results showed revenue rose 3 per cent to £375m and shares rose 0.8 per cent, or 3.5p, to 432.5p.

Tracsis, the technology company that analyses rail industry data, said revenues were flat at £81m in the year to the end of July as customers delayed spending decisions ahead of the election.

But it has won contracts with Network Rail and hopes to benefit from Great British Railways’ plans, news that lifted its share price by 0.8 per cent, or 5p, to 660p.

Shares in concrete specialist Somero Enterprises fell 3.6 per cent, or 11p, to 295p, hit by bad weather in North America and Australia. Sales fell 12 per cent to £39.4m in the first half, while profits plunged 32 per cent to £8m.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.