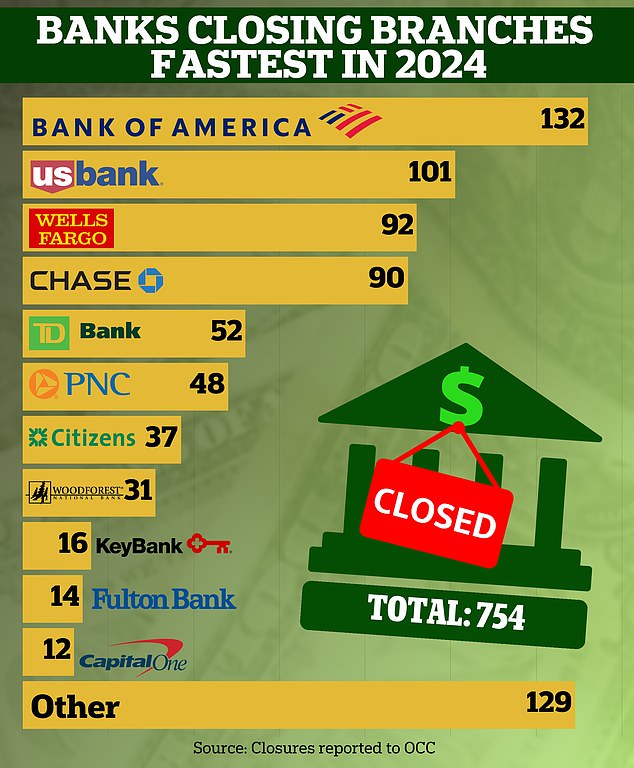

Bank of America has closed more branches than any other major bank in the first nine months of 2024.

The banking giant closed 132 branches between January and September, an analysis of official closure data by DailyMail.com shows.

This significantly outperformed its competitors, with US Bank being the second-most to close branches with 101 during the same period.

A Bank of America spokesperson told DailyMail.com that many closures involved consolidating two nearby branches into one.

But branch closures force locals who rely on in-person services to travel further to get to the nearest branch.

Bank of America closed the most branches of any US bank in the first nine months of the year

Banks must report all planned closings and openings to the Office of the Comptroller of the Currency (OCC), a federal banking regulator.

Every week he publishes a summary of these.

DailyMail.com analyzed them to compile details of total closures so far this year.

In total, more than 700 branches were closed, forcing thousands of people to travel further afield to access vital services.

If this pace of closures continues for the rest of this year, by the new year just over 1,000 branches will have closed across the country.

Meanwhile, independent research recently revealed that the last physical bank branch could close in the US by 2041.

Self Financial Experts He arrived at that figure by studying the rate of net closures nationwide, which has averaged 1,646 each year since 2018.

Bank of America defended the closures.

“Our network of financial centers is critical to our business and provides us with a strategic advantage,” a spokesperson said.

‘So far this year, we have opened more than 40 financial centers throughout the country.

‘We periodically adjust the location of our centers based on the pedestrian traffic that arrives at each location. Almost all of the closures in 2024 have been to combine two nearby centers into one or to move a financial center to a new location to better serve our customers.’

Research by GoBankingFees It was found that two in three seniors now prefer mobile or online banking to face-to-face banking.

Meanwhile, 23 percent of adults ages 18 to 24 visited a bank just once in the past year.

“Our latest research into the future of banking has shown that a growing number of Americans, across all generations, are opting for mobile banking over traditional banking,” Andrew Murray, senior researcher at the Bank, told Daily Mail.com. GOBankingRates.

US banks closed a total of 754 branches in the first nine months of the year

The banking giant closed 132 branches between January and the end of September 2024

“All of this demonstrates the clear trend that traditional banking is becoming much less common for Americans of all generations,” Murray said.

Even though most Americans now choose to do most of their banking online, customers still prefer to use physical branches for particular services.

It is also difficult for some older customers to operate services such as mobile banking.

Nearly two-thirds of Americans still use a physical branch to make cash deposits, while more than half use them to speak with an advisor in person, according to the report.

39 percent of respondents told Self Financial that they had more trust in banks with physical branches than those without.