Table of Contents

- IHT raised £2.1bn in Q2, £83m more than last year

Inheritance tax raised £2.1bn in the three months to June as frozen thresholds mean more people’s assets are caught in the net, official data shows.

HMRC figures show inheritance tax (IHT) receipts were £83m higher than at the same time in 2023.

The current nil-rate band of £325,000, which has not changed since 2009, will be frozen until at least 2028, meaning more households will have to pay as the value of their assets rises.

IHT revenues rise due to ‘massive wealth transfer’ and frozen thresholds

Laura Hayward, tax partner at Evelyn Partners, said: “With both property and financial market assets continuing to rise in value, there is no prospect of this long-standing trend abating – more estates and more assets in each taxable estate will be dragged above the frozen thresholds at which IHT applies.”

The Office for Budget Responsibility forecasts that the proportion of deaths triggering IHT payments will rise to 6.3 per cent by 2028/29, the highest level since the 1970s. The proportion was less than 3 per cent in 2009/10.

“Revenues from inheritance tax and its predecessors have risen over time in real terms, from around £2 billion in 1980/81 to £7.5 billion in 2023/24, and will reach almost £9 billion in 2028/29 (all amounts in 23/24 prices),” Hayward said.

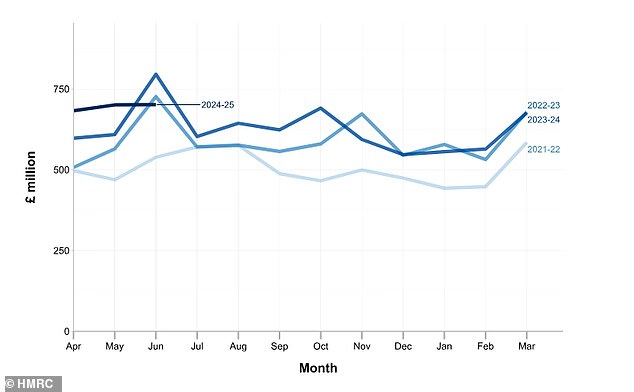

IHT revenues have been on an upward trajectory in recent years, as more household assets fall within the taxable amount.

HMRC says the higher revenues from March 2022 are due to higher volumes of wealth transfers following recent IHT-subject deaths, recent increases in asset values and the Government’s decision to maintain the threshold.

IHT revenues have been on an upward trajectory thanks to frozen thresholds

Hayward added: ‘Now that the baby boomer generation is approaching its sixties and seventies, some of that generation’s accumulated wealth is being passed on to its children and grandchildren, paying taxes along the way.

‘The ‘great transfer of wealth’ is also underway because many of the older generations are making lifetime gifts to their families.

‘With the wave of inheritances set to grow over the next 30 years to a transfer of £5.5 trillion, the temptation will be for successive governments to seize on it to plug gaps in the public finances.’

Labour has been silent on whether it could make changes to the current IHT system.

While he pledged not to raise income tax, VAT or national insurance contributions, he did not say whether he would increase IHT.

The only reference made in her manifesto relates to offshore and non-domiciled trusts, so all eyes will be on Chancellor Rachel Reeves’ autumn statement to see what, if any, changes will be made.

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

5.78% savings

5.78% savings

You have 365 days’ notice

Fiber broadband

Fiber broadband

BT £50 Reward Card: £30.99 for 24 months

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.