Table of Contents

Barely a week goes by without the powerful and engaging phrase “early retirement” being mentioned on social media and news websites, and among bloggers and podcasters.

Escaping the rat race has always been appealing, but the appeal seems to be growing and becoming more intense.

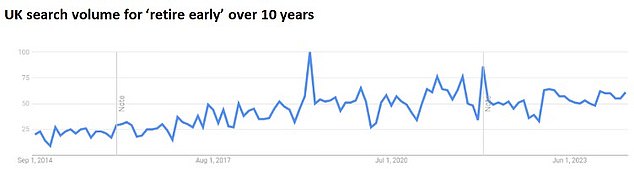

I checked Google Trends, just to see that the increase is real. And yes, the number of searches for “retire early” has tripled in a decade.

At the sharpest end of the “early retirement” movement is the FIRE department.

Time to relax? Escaping the rat race has always been attractive, but the appeal appears to be growing and becoming more intense, says Andrew Oxlade.

Coined by bloggers, the acronym emerged after the 2008 banking crisis and captured the aspiration of many young workers who wanted financial independence and early retirement.

They still do, Google data tells us.

The simplicity of the approach is attractive. You spend less than you earn and invest the excess. That’s a good concept. But as the years go by, savers increasingly follow it excessively.

FIRE acolytes advocate extreme frugality that allows them to save 70 percent of their income.

They should invest this aggressively, some in affordable investment accounts such as stocks and shares Isa, and hope to generate a replacement salary.

Some blogs even offer advice on how to create layoffs once you are in the right financial position.

Stories proliferate online of people who have “retired” when they were forty or younger.

But how many people have stopped to ask themselves why they are so desperate to retire?

Searches: UK search volumes for ‘retire early’ over the last decade

Beware of the ‘focus illusion’

The behavioral bias of the “focus illusion” helps induce that pause.

Nobel Prize-winning psychologist Daniel Kahneman and his colleagues developed the term shortly before the FIRE movement emerged.

In the financial manifestation of this brain bias, the importance of money in happiness is greatly exaggerated; The unwavering belief takes root that more money will make you happier.

The reality, according to Kahneman and company, is that higher incomes do little to improve life satisfaction, at least in rich countries, and can increase anxiety and stress.

These scholars have effectively academicized a familiar notion: that the grass is always greener on the other side.

Social media has most likely intensified those feelings. Seeing posts about people’s “better lives” makes us want more: more money, more nice things, a better life.

This is the cognitive bias that fuels the FIRE movement and it certainly thrives in the hottest sectors. It seems timely to raise this during Mental Health Awareness Week (May 13-19).

Even those who do not consider themselves FIRE acolytes are determined to retire early at any cost.

For some, the need to spend less and work more to finance a perceived future state of nirvana becomes overwhelming, perhaps obsessive.

In the United States there is talk of the rise of financial dysmorphia: a distorted view of our finances.

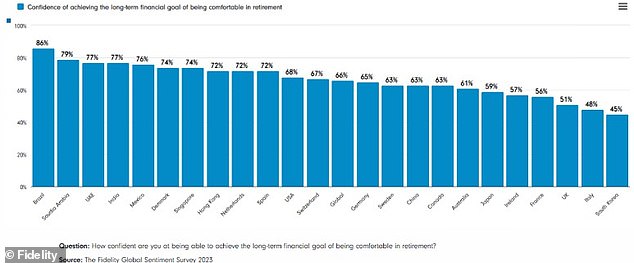

Survey: A graph showing how confident people around the world are in achieving a comfortable retirement

The double danger of ‘financial dysmorphia’

This dysmorphia can vary in any direction. For some, it is an obsessive saving. For others, it is saving too little and ignoring the consequences.

And yes, there is probably more of the latter than the former, particularly in the UK. But it’s hard to know.

Research by Fidelity found that only 51 per cent of British workers believed they had saved enough for a comfortable retirement, putting us near the bottom of the savings confidence tables.

In contrast, 68 percent of Americans believe they have hit the mark, as do 74 percent of Danes.

Opinions in these types of surveys are obviously a perception.

Knowing how much you need is difficult to calculate because there are many unknowns: how much you will spend in the future, how long you will live, etc.

In the era of final salary pensions, these headaches were resolved by actuaries hired by your employer. Today is your headache. (Read our guide to how pensions work to understand more.)

This makes us anxious. Have we saved too little?

Better do more. And more. A common response is to set goals: pay off the mortgage by 40, get a £500,000 pension, “it’s better to be on the safe side.”

This very precise guidance might work for some, but it carries the risk of harmful side effects.

If it descends into compulsion and obsession, then living for the now is completely replaced by living for the future. And maybe that will become a permanent state and the future will never come.

The stakes have never been higher, given demographic trends.

I wrote previously that there’s a good chance he’ll live to age 93 (a one-in-four chance), or even 97 (a one-in-10 chance).

The 100-year lifespan is a growing reality that requires us to reframe our approach to retirement. And it can be positive.

If we can work longer, financing our old age will be infinitely easier.

But many people don’t like their jobs, the schedules, or the commute.

One solution for younger generations is to plan their lives with options – directing some of their investments into flexible funds, such as Isas.

Then you give yourself the option to retrain in a new career when you’re 40 or 50, and maybe more than once, to find something you like.

Or you just want to take a break—a three-year mini-retirement to travel, so you have the stamina to keep working longer. This thoughtful post from a 25-year-old about how she thinks about this is worth a read.

Put out the FIRE: why ‘COOL DOWN’ is useful

Work can sustain engagement, keep us all on our toes, as well as continue social connections and even a sense of purpose.

The ideal job and employer would keep these beneficial attributes alive while giving you more time to pursue the things you love.

This is the antidote to the FIRE movement. I call it CHILL

This is the antidote to the FIRE movement. I call it CHILL: Professional happiness inspires longer lives.

Do not misunderstand. I understand 100 percent that we have a savings crisis. Too few people invest and too many people invest too little.

We need the least saved to embrace long-term investing and the potential it has to unlock a better future for them. But it is better to do it carefully and without pressing too much.

In addition to a savings crisis, we also have a mental health crisis, partly driven by financial dysmorphia.

The solution is more education; For example, these are Money’s financial calculators and pension calculator. Fidelity Retirement Calculators (if you don’t mind the plug for my employer) and those offered throughout the industry offer solid help.

Those willing to pay more may consider financial counseling if it is the only way to sleep at night.

Either way, you’ll never know exactly how much to save. Save what you can, what is sensible. And think about ways to extend your work life.

Join the great CHILL.

Andrew Oxlade is a director of Fidelity International.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.