Table of Contents

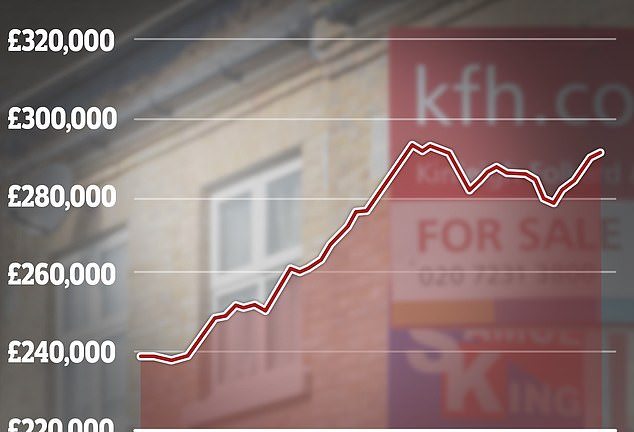

House prices rose 0.4 per cent in February according to the latest figures from Halifax, marking the fifth consecutive monthly increase.

This means the average house price has increased by 1.7 per cent compared to last year, with a typical house in the UK costing £291,699.

Last week, Nationwide reported a 0.7 per cent monthly rise in house prices.

Property prices rose 0.4% in February, according to the latest figures from Halifax, the fifth consecutive monthly increase.

The figures also show a continued rise in the number of people taking out mortgages to buy homes, thanks in part to a fall in interest rates in recent months.

Net mortgage approvals for home purchases rose from 51,500 in December to 55,200 in January, according to the latest data from the Bank of England.

It means mortgage approvals are at their highest level since October 2022.

Kim Kinnaird, director of Halifax Mortgages, said: “These figures continue to suggest a relatively stable start to 2024 and align with other promising signs of increased property activity, such as mortgage approvals.”

“The average house price is now only around £1,800 away from the peak seen in June 2022.”

House prices fell in some areas

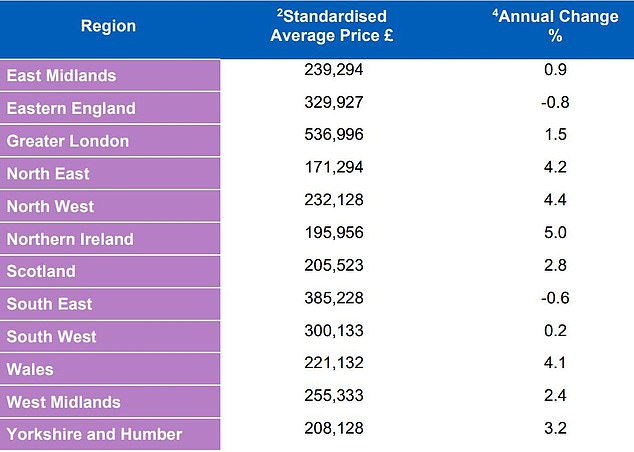

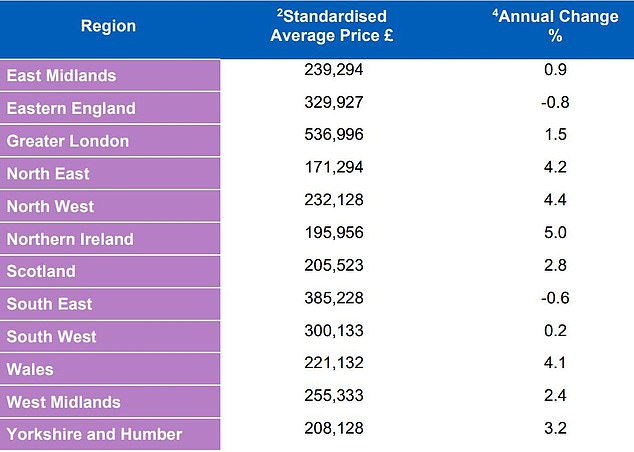

Although the average house price increased, in some areas of the UK prices still fell.

Properties in the east of England fell the most last month, with homes selling for an average of £329,927, a fall of 0.8 per cent compared to the same period in 2023.

Meanwhile, in Northern Ireland house prices rose 5 per cent year-on-year.

Houses in Northern Ireland now cost an average of £195,956, £9,359 more than at the same time in February 2023, according to Halifax.

The North West also saw year-on-year growth of 4.4 per cent. Prices in the North East rose 4.2 per cent and in Wales the average house rose 4.1 per cent compared to February last year.

Even within regions themselves, house prices can vary from area to area and city to city.

London continues to have the highest average house price of all regions, at £536,996.

Prices in the capital have increased by 1.5 per cent and it is the first positive annual growth seen since January 2023, according to Halifax.

Matt Thompson, head of sales at London estate agency Chestertons, said: ‘Buyers have become increasingly confident since the end of last year, when interest rates remained at 5.25 per cent and mortgage rates began to go down

“This sentiment continued into January and February 2024. Meanwhile, sellers have also become more optimistic about attracting the right buyer for their home, leading to a slight increase in the number of properties put up for sale. “.

The East of England saw the most downward pressure on house prices, while Northern Ireland prices rose 5% year-on-year.

What’s next for home prices?

Many commentators believe that the only way out is to raise house prices.

This is despite what has been widely seen as a disappointing budget for the housing market, with Jeremy Hunt revealing no new incentives for first-time buyers or any stamp duty reduction for downsizers.

Iain McKenzie, chief executive of The Guild of Property Professionals, said it was “disappointing” not to see new incentives for first-time buyers in the spring budget.

He said: “In the run-up to the announcement we had hoped to see a 99 per cent mortgage scheme or an updated version of the help to buy initiative, but we were left wanting more.”

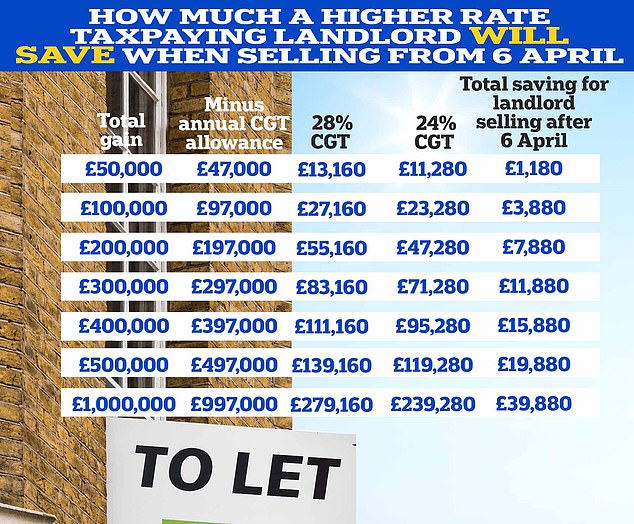

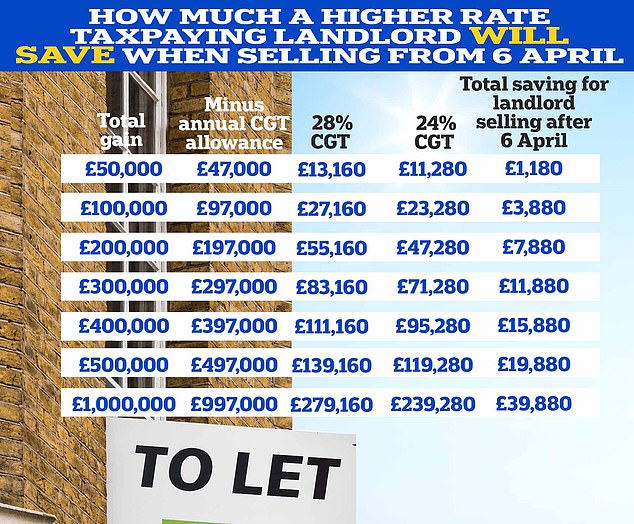

Hunt revealed that from April 6, the Government will reduce the CGT rate for higher rate taxpayers selling a second property from 28% to 24%.

Hunt announced that the capital gains tax (CGT) rate applicable to the sale of second homes will be reduced from 28 per cent to 24 per cent and abolished the tax benefits that come with furnished holiday lets.

Nicky Stevenson, managing director of national estate agent group Fine & Country, said: “It will be interesting to see whether the Chancellor’s announcement of capital gains tax relief in the Budget encourages reeling homeowners to sell their properties.”

“A flood of new listings would inject more energy into the housing market and could reignite demand from first-time buyers who have been struggling to afford a home in this high-interest rate environment.”

Anthony Codling, European head of housing and building materials at investment bank RBC Capital Markets, added: “Following yesterday’s lackluster budget, in our view and in the light of our own data sets, the underlying health of the UK housing market The UK is improving, so perhaps the lack of support for the housing market in yesterday’s budget is not as disappointing as we first thought.’

CGT is charged on the profits landlords and second homeowners make on a property that has increased in value when they sell it.

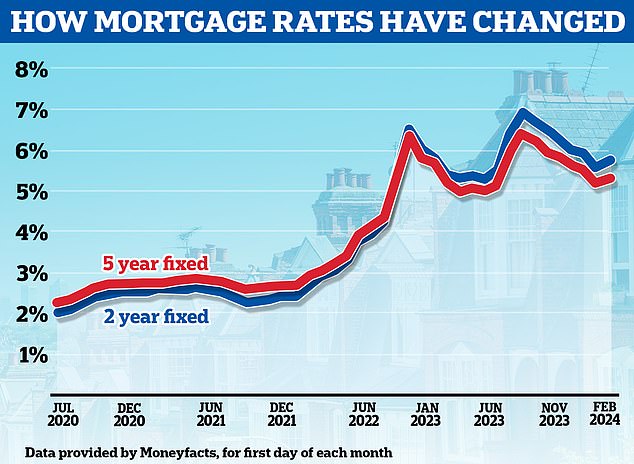

Ultimately, many believe that the future of house prices depends largely on the future of interest rates.

Andrew Montlake, managing director of London-based brokerage Coreco, said: “The housing market continues to show a strength that is disconcerting many slumping house price campaigners.”

‘A lot now depends on the next set of inflation figures, but the public is clamoring for a rate cut, rather than continuing to talk about possible increases.

‘What happens to mortgage rates will ultimately define the housing market this year.

“What we are seeing, however, is a growing number of potential buyers looking to do something this year rather than keep their lives on hold any longer.”

Beyond the peak? Mortgage rates rose again last month after retreating from summer highs.

However, Halifax’s Kim Kinnaird added a word of caution.

He said: “While it is encouraging that we have seen growth in recent months, what will happen next remains uncertain,” he says.

‘While lower mortgage rates, coupled with expectations of Bank of England interest rate cuts this year, should help buyer confidence in the short term, the downward trend in rates is showing signs of slowing down. fade off.

“Even with wages rising and inflation falling, raising a deposit and affording a sizeable mortgage remains a challenge, especially for those looking to join the property ladder, so it remains a possibility that there could be a slowdown in the real estate market this year.

Compare actual mortgage costs

Calculate mortgage costs and check which is the actual best deal taking into account rates and fees. You can use one portion to calculate the costs of a single mortgage or both to compare loans.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.