House prices rose for the second month in a row, according to the latest figures from the Office for National Statistics.

In April, the average house sold for £281,000, up 1.1 per cent on 12 months ago.

This was an increase of 0.9 per cent in the 12 months to March, marking the second consecutive month to record an annual increase after eight months of declines.

– Is a five-year fixed mortgage the best option now that interest rates remain high?

On the rise: Median house prices rose 1.1 percent in the 12 months to April 2024

Richard Harrison, head of mortgages at Atom Bank, believes this is a clear sign of improved levels of optimism among buyers.

“Prospective buyers are feeling more confident about moving forward with transactions,” Harrison said.

Nicky Stevenson, managing director of national property group Fine & Country, agrees.

She said: “The weather was blamed for the economy’s stagnation in April, but the rain did not dampen buyer sentiment, and house prices remained resilient.”

“After so many buyers paused their home-buying plans towards the end of 2023, stable interest rates and the prospect of a reduction this summer have been enough to inspire confidence, and many people have committed to taking the plunge.”

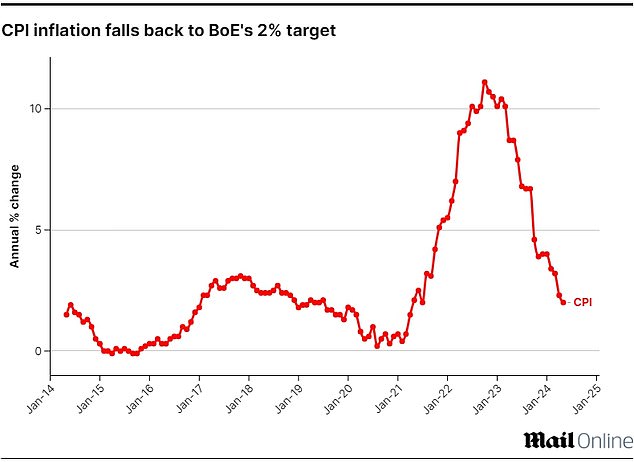

Today’s house price figures come accompanied by news that inflation has fallen back to the Bank of England’s 2 per cent target.

This means that the average price of goods and services is now 2 percent higher than last year.

The hope is that the Bank of England will soon consider cutting interest rates, which may result in lower mortgage rates.

Inflation Watch: Inflation has reached the Bank of England’s 2% target. This is the first time since July 2021 that inflation has reached this level

Nicky Stevenson adds: ‘Reports this morning reveal that the consumer price index measure is now in line with the government’s aim to control inflation.

‘As we expect the economic outlook to continue to improve, we are likely to see an increase in activity as the year progresses, especially with an interest rate cut by the Bank of England on the horizon.

“This would positively impact homebuyers, making mortgages more affordable, increasing consumers’ purchasing power and helping them obtain desired properties more easily.”

Nathan Emerson, chief executive of Propertymark, added: “With the tide turning decisively when it comes to inflation, the focus is now firmly on when the Bank of England feels confident enough to start lowering the rate.” base.

“Once this ride starts happening and when the political landscape calms down after the general election, we should see a stable market for the foreseeable future.”

Lags in house price data

The key problem with the ONS house price data is that it is based on sales price data from the Land Registry.

This means that their figures usually refer to sales agreed upon months in advance.

Jonathan Hopper, chief executive of Garrington Property Finders, said: ‘Today’s figures capture the glow of the surge in activity seen earlier in the year.

‘Many of the sales completed in April came from deals reached in January and February, when buyers were in force and the market was on a roll.

“So while the current data is more than a little sepia-toned, its resilience remains welcome.

“Nationally, this reveals that the market is stabilizing very well: the number of homes changing hands in April increased almost 10 percent compared to the same month last year.”

When looking at more immediate indicators about what is happening in the housing market in the here and now, it is easy to receive a mixed message.

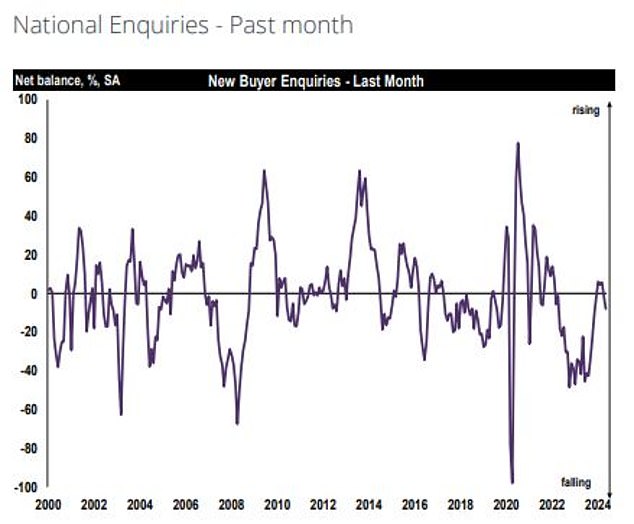

The property market has fallen again according to the latest survey carried out by the Royal Institution of Chartered Surveyors (Rics).

It said inquiries from new buyers fell further into negative territory last month, the lowest level since November.

This means that more Rics members reported fewer buyer inquiries in May than those who reported an increase in inquiries.

According to the Rics survey, new buyer inquiries saw a drop alongside a general weakening of reported momentum across the sales market.

However, according to Propertymark, its estate agent members reported 16 per cent more buyers registering with agents in April than in March.

Atom Bank’s Harrison added: “While there are mixed messages about the immediate market outlook, real estate agents are signing up at a faster rate than supply is increasing, and that is driving up prices.”

‘This is resulting in increased activity levels, with estate agents seeing the number of agreed sales rise to the highest level in two years.

Housing prices in the regions

While prices increase considerably year after year, they vary greatly between regions.

For example, house prices have increased by 4.5 per cent in the last 12 months in Scotland, while in Northern Ireland the average house has increased by 4 per cent.

Across all English regions, house price increases were greatest in the north west, where prices rose 3.8 per cent in the 12 months to April.

However, in London, prices are down 3.9 percent on average year on year.

The only other region where house prices have fallen in the 12 months to April is the South East, where average prices are 0.4 per cent lower.

“Huge regional disparities remain as the high cost of mortgage loans forces many buyers to focus their search on more affordable areas,” added Jonathan Hopper of Garrington Property Finders.

“That’s why average prices rose by 3.8 per cent in the north-west of England and fell by 3.9 per cent in London over the past year.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.