Foreclosures are increasing across the United States as Americans continue to struggle with rising interest rates and rising costs.

Last month, 37,679 properties had a foreclosure filing, according to recent figures from the real estate data provider. ATOM – 10 percent more than the previous month.

Foreclosure occurs when a homeowner can no longer make their monthly mortgage payments and, as a result, must lose ownership of their property. Foreclosure filings include notices of default, scheduled auctions, and bank liens.

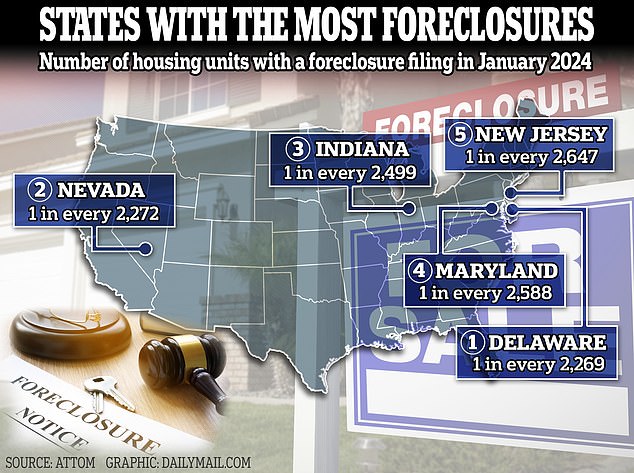

The numbers reveal a growing housing affordability crisis in the United States. But a disparity persists across the United States, with some states faring much worse than others.

Delaware recorded the highest number of applications last month, with one for every 2,269 housing units.

Home foreclosures are rising across the United States as Americans continue to struggle with rising interest rates and costs, with some states faring worse than others.

Nevada had the second-highest number of foreclosure filings in January: one in every 2,272 housing units.

Indiana had one in 2,499 housing units, Maryland had one in 2,588, and New Jersey had one in 2,647.

Foreclosures have been on the rise since late 2021, as banks make up for lost time after state and federal foreclosure bans expired.

Rising interest rates and inflation are impacting foreclosure filings, said ATTOM CEO Rob Barber.

Nevada’s position in the ranking is largely due to foreclosure filings in Las Vegas, where many people lost their jobs when tourism plummeted during pandemic shutdowns.

According to ATTOM, Las Vegas foreclosed on one in every 1,923 housing units in January.

“We saw a slight increase in foreclosure filings, which can be attributed in part to the typical progression of filings through the legal system after the holidays,” said Rob Barber, CEO of ATTOM.

“However, other external factors may be at play, such as rising interest rates, inflation, changes in employment and other market dynamics.”

Housing affordability across the country is the worst in decades, amid rising home prices, a lack of homes for sale and high mortgage rates.

Mortgage rates have risen again this year, after falling from highs near 8 percent last year.

Mortgage rates are rising again this year, after falling from highs near 8 percent last year.

According to the latest data from government-backed lender Freddie Mac, the average 30-year fixed-rate mortgage is now 6.90 percent, up from 6.77 percent last week.

Rates have soared due to the Federal Reserve’s aggressive interest rate raising campaign, which has pushed benchmark borrowing costs to a 22-year high. And persistent inflation has dashed investors’ hopes for immediate rate cuts in 2024.

This perfect storm has made keeping up with payments increasingly difficult for many Americans.

At the current rate, a typical homebuyer faces paying about $1,000 a month more than they did two years ago, when rates were around 3.08 percent.

In February 2022, a buyer purchasing a $400,000 home with a 5 percent deposit would face monthly payments of $1,619. At a rate of 6.90 percent, this increases to $2,502.

The mortgage crisis and the collapse of large bankrupt automakers drove millions of people from their homes in Detroit (pictured: abandoned properties in 2015)

Lenders also repossessed 3,954 properties in January, according to the ATTOM report, up 13 percent from the previous month.

It is the first monthly increase in completed foreclosures since July 2023.

Michigan saw the fastest increase in completed foreclosures: a whopping 200 percent. This was largely due to the high rates of foreclosure filings in Detroit.

One in every 1,799 housing units in The Motor City went into foreclosure last month.

During the mortgage crisis and the demise of major automakers, millions of residents left the city and houses on empty streets sold for $1.

While housing prices are rising, it appears the city is still playing catch-up.