Table of Contents

- Payment systems regulator says refunds depend on who you do business with

- Scam volume rose 12%, but value fell 12% to £341m in 2023

- Most app scams are purchase scams, report says

If you have been a victim of fraud, you may or may not be able to get a refund depending on who you do business with, according to the payments regulator.

The Payment Systems Regulator (PSR) has said that “refunds still depend largely on who the bank is dealing with” when issuing a report on fraud in authorised push payments.

PPP fraud is when a victim is tricked into transferring funds to a different person or for purposes other than intended.

App scams: Payment regulator says chances of a refund depend on who you trade with

The PSR report covers scams targeting consumers and small businesses/charities with annual revenues of less than £1 million.

While the total value of scams fell by 12 per cent to £341m in 2023, the volume of scams rose by 12 per cent to 252,626 cases.

The PSR report found that the vast majority (70 percent) of APP scams were purchase scams in which the victim pays for a good or service they do not receive.

The total value of shopping scams rose from £67.3m in 2022 to £85.2m in 2023, while cases increased by 32 per cent to 176,685.

Advance payment scams and phishing scams were also common, each accounting for about 10 percent of all scam cases last year.

Are scams more common at your bank?

Metro Bank had the highest volume of scams sent: for every million transactions sent last year, 137 were fraudulent payments via APP.

Monzo and Nationwide follow closely behind with 131 and 129 respectively.

Clydesdale Virgin Money and Nationwide saw the biggest increases, with their remittance scam rates rising by 66 and 53 per cent respectively.

Santander recorded the largest decline, down 24 percent from 2022.

Metro Bank also topped the list for the average value of scams. For every £1 million worth of transactions sent last year, £266 was lost to app scams.

However, smaller “non-directed” payments companies are experiencing much higher levels of scams.

The PSR claims that smaller businesses receive “disproportionately” higher rates of PPP scams than larger banks.

The average scam rate (value of scams received per £1 million received) for smaller businesses is 18 times the average scam rate.

The ratio of scams compared to the number of transactions they receive is also high. In 2023, they accounted for 38 percent of APP scams by value, despite serving 17 percent of consumers.

Similarly, smaller businesses accounted for 53 percent of PPP scams received by volume, with just 8 percent of the market.

For every £1 million received into consumer accounts at Skrill, £18,550 was in app scams. This was followed by Zempler Bank with £4,523 and PayrNet with £2,814.

The report excludes any refunds made following a decision by the Financial Ombudsman.

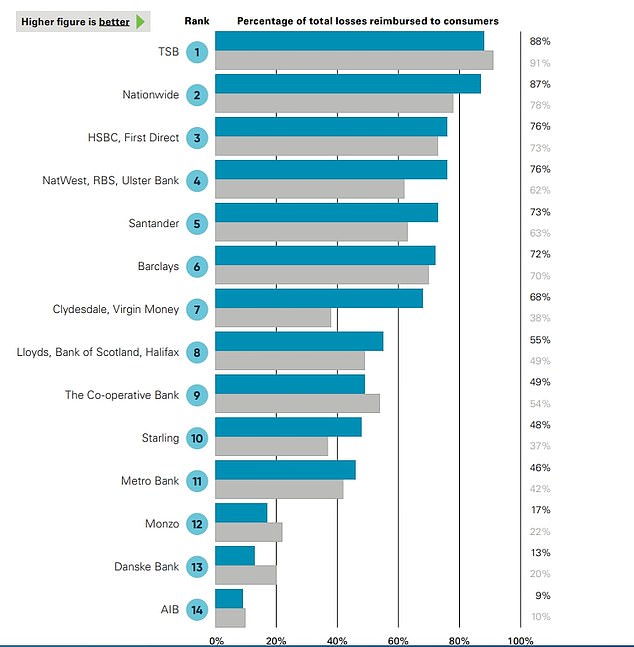

TSB refunded 88 per cent of the total value of money its customers lost to APP scams in 2023 – blue represents this year’s refund rate, grey is for 2022

Which banks are most likely to refund scam victims?

Currently, payment companies are not legally required to refund victims of APP scams, meaning refund rates vary between banks.

Most major banks are signatories to the Contingent Reimbursement Model (CRM), which is a voluntary code that sets out how companies should reimburse victims of PPP fraud.

In 2023, 67 percent of money lost to app scams was reimbursed, up from 61 percent in 2022.

PSR: ‘While this represents an improvement on 2022 refund levels, we understand that receiving a refund still depends largely on who your bank operates with.’

Banks that do not subscribe to CRM have an average repayment rate of 48 percent.

Nine of the 14 largest banking groups increased their repayment levels between 2022 and 2023.

TSB emerged victorious by refunding 88 per cent of the total value of money its customers lost to PPP scams last year.

It also refunded 95 percent and partially refunded 3 percent of the scam cases reported by customers.

They were closely followed by Nationwide (87 percent) and HSBC and Natwest (76 percent).

Allied Irish Bank (AIB) came in last with just 9 per cent of refunds, followed by Danske (13 per cent) and Monzo (17 per cent). All three banks also fully refunded less than 10 per cent of reported cases.

Overall, 80 percent of reported APP scams were refunded in full or in part.

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

5.21% cash Isa

5.21% cash Isa

Use code ISABOOST before July 31st to get a 0.11% boost

Transaction fee refund

Transaction fee refund

Get £200 back in trading commissions

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.