Table of Contents

Bitcoin could be worth $100,000 in January as cryptocurrency investors pile in following Donald Trump’s landslide election victory.

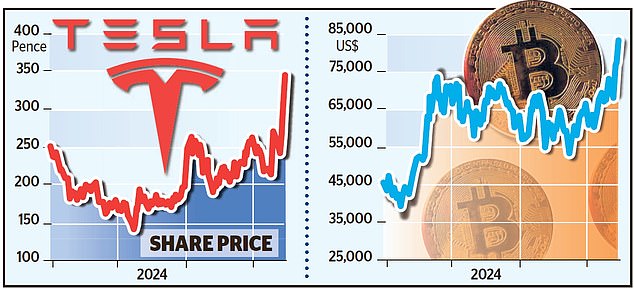

The digital currency hit an all-time high yesterday, surpassing $85,000 for the first time, as a wave of “Trump trades” broke out in global markets.

The U.S. dollar was also rising and shares of electric car maker Tesla, whose boss Elon Musk is a close ally of the incoming president, soared nearly 7 percent.

Driving Force: Shares of electric car maker Tesla, whose boss Elon Musk is a close ally of incoming President Donald Trump (pictured), soared nearly 10%.

Tesla has gained about 40 percent since last week’s US election and bitcoin is up 25 percent.

“People are eager to get in on the Trump trade sooner rather than later,” said Emmanuel Cau, head of European equity strategy at Barclays.

Bitcoin, the world’s most valuable cryptocurrency, has risen as investors bet Trump will be friendlier to the digital money sector than his predecessor Joe Biden.

Trump has previously insisted that he will make the United States “the crypto capital of the planet” and floated the idea of creating a strategic reserve of bitcoins for the government.

Additionally, the president-elect has pledged to fire Gary Gensler, the head of the US financial watchdog who has led a years-long crackdown on the industry.

Fadi Aboualfa, head of research at digital asset firm Copper.co, said it was “very possible” that Bitcoin would reach $100,000 before Trump’s inauguration on January 20.

Nigel Green, head of investment firm deVere, said: “This is the most significant tailwind we have seen for bitcoin since its inception.”

Trump’s victory has also given a boost to other major digital currencies: Ethereum is up 32 percent since last week’s election and dogecoin, a joke cryptocurrency previously promoted by Musk, is up 83 percent.

The rally was so strong that the cryptocurrency sector is now estimated to be worth £2.2 trillion, more than the market capitalization of the entire FTSE 100 of just over £2 trillion.

Along with the renewed rise in bitcoin prices, the US dollar hit its highest value in four months as traders bet on an economic boom backed by widely expected tax cuts and deregulation from the incoming Republican administration.

The party also took control of the Senate and is potentially on track to take the House of Representatives, giving it control of all major branches of government.

Stock markets have also rallied strongly on hopes of tax cuts and deregulation, with the S&P 500, the Dow Jones Industrial Average and the tech-heavy Nasdaq all at record highs.

Tesla shares are soaring on hopes that Musk, who spent tens of millions of dollars to support Trump’s re-election bid and appeared at his rallies during the election campaign, will be rewarded for his loyalty.

That could mean influence over decisions about the electric vehicle market, as well as regulation of areas such as cryptocurrencies and artificial intelligence (AI).

Tesla’s latest jump means Musk, 53, has added £27.6 billion to his fortune since the election, while the company’s market capitalization has soared to more than £777 billion (1 trillion of dollars).

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.