- Commonwealth Bank abandons December rate cut call

The Commonwealth Bank is now advising borrowers to abandon hopes of a rate cut by Christmas despite a big drop in inflation.

Headline inflation – known as the consumer price index – fell to a three-year low of 2.8 percent in September.

This was a big drop from the June quarter’s annual pace of 3.8 per cent, based on one-off rebates of $300 for electricity and a sharp drop in petrol prices to $1.80 per litre.

CPI is now right between the Reserve Bank of Australia’s 2 to 3 per cent target for the first time since March 2020.

Since the pandemic, inflation has been highly volatile, falling below target during lockdowns, then soaring to three-decade highs as a result of supply constraints and pent-up demand for services.

This meant that headline inflation during the September quarter, including volatile price elements, was at the lowest level since the March 2021 quarter, when Melbourne was in lockdown.

But Commonwealth Bank Australian economics chief Gareth Aird has revised his forecast for the RBA to cut rates in February rather than December.

“The result is that we no longer expect the RBA to reduce the cash rate in December 2024,” he said.

The Commonwealth Bank is now advising borrowers to abandon hopes of a rate cut before Christmas despite a big drop in inflation.

“Instead, we expect a reduction of 25 basis points in February 2025.”

The Commonwealth Bank, Australia’s largest property lender, revised its forecast because core inflation – also known as trimmed average – was still too high: 3.5 per cent, down from 4 per cent.

This measure excludes volatile price items, such as gasoline, fruits and vegetables, and electricity discounts, to achieve an average increase in consumer prices.

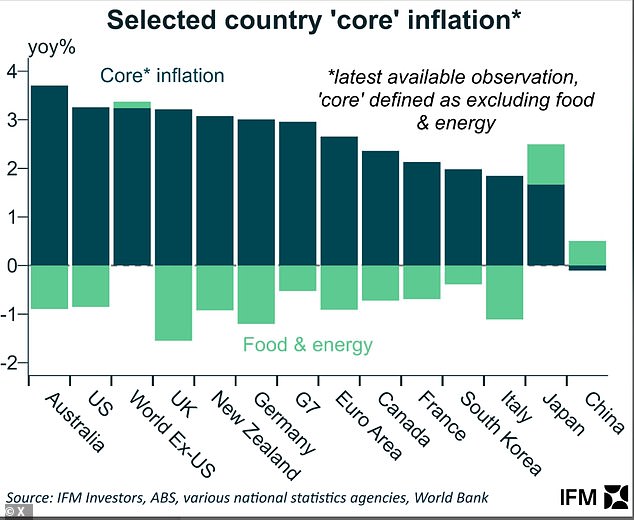

A chart from IFM Investors, released on Wednesday, also showed that Australia’s core inflation is higher than equivalent core inflation levels in the US, UK, New Zealand, Canada and the European Union, which this year they have cut interest rates.

Another underlying measure of Australian inflation, known as the weighted median, produced an even higher reading of 3.8 percent.

This also excludes volatile items to find an average increase in prices for more commonly sought-after goods and services.

Australian Commonwealth Bank chief economist Gareth Aird revised his forecast for the RBA to cut rates in February rather than December.

A chart from IFM Investors, released on Wednesday, also showed that Australia’s core inflation is higher than equivalent core inflation levels in the US, UK, New Zealand, Canada and the European Union, which this year they have cut interest rates.

Quarterly inflation data from the Australian Bureau of Statistics, released on Wednesday, also showed services inflation soared 4.6 percent in the year to September, while goods inflation rose 1.6 percent. 4 percent.

CBA has now joined the other big four banks (ANZ, Westpac and NAB) in predicting a quarter percentage point rate cut in February.

This would see the RBA cash rate fall to 4.1 per cent for the first time since November 2023, when rates rose for the 13th time since May 2022.

While headline inflation looks good, the lower figure was based on one-off factors such as the federal government’s $300 electricity rebate for 2024-25 and Queensland’s $1000 rebate on top of that.

The Reserve Bank is universally expected to leave interest rates unchanged on Tuesday next week, at a 12-year high of 4.35 per cent.

Governor Michele Bullock will announce her decision at 2.30pm Sydney time, half an hour before the Melbourne Cup.

While Australia focuses on a horse race, it will hold a press conference at 3:30 p.m.