Thousands more Californians will lose their home insurance this year as two more insurers leave the state.

Tokio Marine America Insurance Company and Trans Pacific Insurance Company filed notices with the California Department of Insurance saying they would stop offering coverage and umbrella policies to homeowners.

Both companies, owned by Japanese firm Tokio Marine Holdings, together insured 12,556 homeowners in the state, worth $11.3 million in premiums, according to company documents.

They are the latest in a series of insurers, including Farmers Direct and State Farm, that have limited or stopped doing business altogether in California, many citing the increasing risk of climate disasters.

As a result, more than half of Californians say they have been affected by rising property coverage premiums or had their insurer cancel them in the past year, a stark new reality. data of Redfin programs.

Tokio Marine America Insurance Company and Trans Pacific Insurance Company filed notices with the California Department of Insurance saying they would stop offering coverage and umbrella policies to homeowners.

A growing number of insurers have limited or stopped operating altogether in California; many of them cite the increasing risk of climate disasters (pictured: wildfires in Paradise, California, in 2018).

Insurers’ departure from the states reduces competition, while labor shortages and higher rates for home repairs are also driving up prices.

According to a survey by the real estate company, about 51 percent of homeowners in the Golden State say they have been affected by a worsening home insurance crisis.

In 2023, Farmers Direct Insurance announced it would leave the state entirely, while Allstate said it would no longer write new policies in California.

Earlier this year, State Farm, California’s largest insurance company, announced it would not renew policies for 72,000 households, after previously saying it would also not accept new applications for coverage.

The company cited increased risk of natural disasters, including wildfires, the effect of inflation on prices and rising reinsurance costs.

Tokio Marine America Insurance Company and Trans Pacific Insurance Company said they would begin sending non-renewal notices to customers starting July 1.

A spokesperson for Tokio Marine America told San Francisco Chronicle in a statement that it would continue to provide commercial insurance.

“Given the small segment of personal lines business we underwrite and rising costs, we cannot sustainably support personal lines coverages and do not plan to return,” they said.

Rates have skyrocketed for many California homeowners.

Jeff Waack, board treasurer of a condominium in West Hollywood, told DailyMail.com earlier this month how the building’s annual coverage has increased 400 percent this year, from about $23,000 to $116,000.

“This year our management company sent proposals to 12 different insurance companies and all of them refused to give us a policy,” he said.

West Hollywood is an urban area and is not at particular risk for wildfires, hurricanes or flooding, Jeff said.

Jeff Waack said he “almost fell off his chair” when he saw how much the insurance premium had increased this year for a condo building in West Hollywood.

Jeff said the West Hollywood building is not in an area at particular risk for wildfires, hurricanes or flooding.

He has lived in the building, which has 54 units, for decades, and says the last complaint he remembers was filed with the board 18 years ago.

As a last resort, the condo was forced to purchase coverage from a company not admitted in California, meaning it sells policies that are not backed by the state.

“I practically fell off my chair when I saw the price,” Jeff said. ‘It seems as if they randomly chose a number high enough to improve their results. They know that they have us on the brink of the abyss and that we have to try.

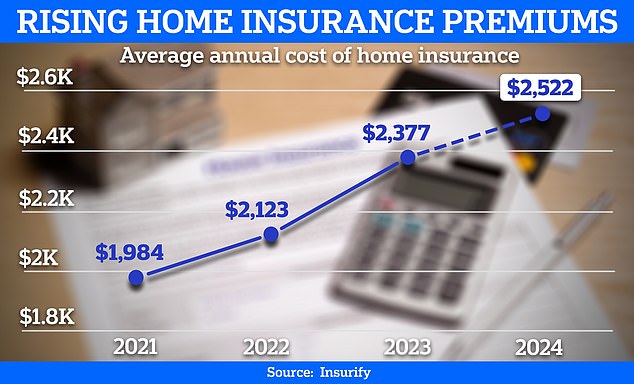

Across the United States, gloomy forecasts predict home insurance rates will hit a record high this year: The typical annual premium will rise 6 percent to $2,522 by the end of 2024.

While premiums are rising across the country, people living in some states are worse off than others.

The typical annual premium will rise to $2,522 by the end of 2024, according to predictions from insurance comparison platform Insurify.

Along with California, Florida’s home insurance crisis has intensified in recent years as costly natural disasters have made it difficult for insurers to remain profitable in the state.

According to Redfin, 11 insurers have liquidated amid increasing risk of floods and storms.

Hurricane Ian caused $109.5 billion in damage in 2022. This was the third costliest disaster to hit the United States and the most destructive in Florida history, according to the National Oceanic and Atmospheric Administration (NOAA).

About 70 percent of Florida homeowners said they had been hit by rising coverage costs or had been abandoned by their insurer, according to Redfin. survey.

This compares to 44.6 percent of homeowners nationwide.

And 11.9 percent of people in the Sunshine State planning to move next year cited rising insurance costs as a reason, about double the national share of 6.2 percent.